Wishing everyone a happy and covid-free holiday season and a prosperous new year. This weeks report will be somewhat shorter than normal as well as the time frames, looking only at the past year as the year draws to a close.

The first thing that jumps out when looking at the SPX is that prices seem to be following the rounded top scenario, similar to mid-2015, as mentioned as a possibility several weeks ago. Many are looking at this as an ending diagonal with an imminent breakdown, likely targeting the 3500 area. Springheel Jack discusses this option from an EW view. SPX options OI still shows this as a possibility by Dec 31, but time is running out.

The Tech/Other section takes a look at the Tech Indicator Composite and the VIX Buy/Sell Indicator, now approaching an INT VIX Buy/SPX Sell.

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment over the past six months looks like an elongated version of of the Jan-Feb topping process, inching higher last week.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C [ETF Puts/Equity Calls], outlook two to four months) bearish sentiment may have bottomed early Dec similar to Jan.

Bonds (TNX). Bearish sentiment in bonds from a ST perspective have been following the moves in rates closely.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is somewhat more confusing as the peak was at price lows in Mar but at price highs in Aug. Current levels are close to neutral.

II. Dumb Money/Smart Money Indicators

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) bearish sentiment for both option indicators also look like a longer version of the Jan-Feb topping period, last week dropping down to the level seen prior to the mid-Dec drop down to the SPX 3630s.

.

And the sister options Hedge Ratio bearish sentiment is also hovering at levels seen at the Feb highs.

III. Options Open Interest

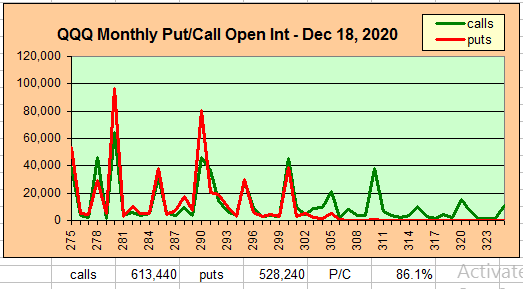

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Dec 31. Also, this week includes a look at the TLT for Jan exp.

Mon SPX drop of 100 pts at the open was probably a strong factor, but there have been a lot of ST puts added with Thur P/C going from 102% a week ago to 202% This w/ about 40k calls and 130k puts added during the week. As a result, this weeks P/C may be understated. I will try to update during the week.

With Fri close at SPX 3703, options OI for Mon shows moderate call resistance at 3725 and 3750 with put support starting at 3665. Possible downside bias.

Wed has similar OI where SPX put support starts at 3650 and call resistance at 3700 and 3725.

For Thur EOM, now showing large put support at SPX 3500 and smaller between 3600-50 (likely will change during week) with call resistance at 3675 and 3700. The potential still exist for a sharp drop to the low 3500s due to negative delta hedging.

Using the GDX as a gold miner proxy closing at 36 is down slightly for the week from 36.5 after dropping to 35.

Currently the TLT is 157.3 with the TNX at 0.93%, and is unchanged for the week after dropping to 155.5 and may be pushed up to 158 with positive delta hedging.

IV. Technical / Other

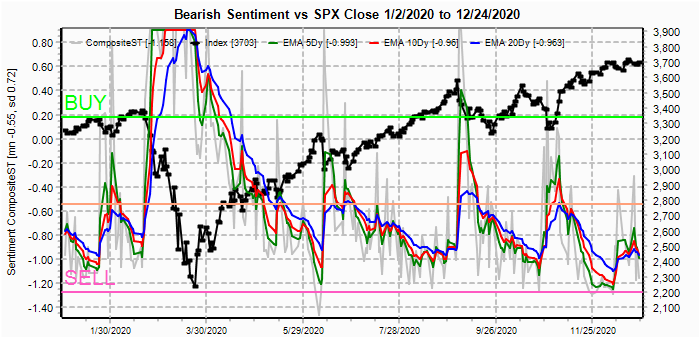

The technical indicator Composite (NYMO+TRIN+NYAD+NYUD) is somewhat interesting, for one we have now reached the neutral level after an extreme low similar to Jan (see Nov 21 for LT), and two the last four lows have alternated between marking the exact top for June and Oct, while leading by about a month with lows in mid-Aug and early Dec. Does this mean a decline starting mid-Jan?

The VIX Buy/Sell Indicator (VXV/VIX & SKEW) is more of an INT indicator, specifically to forecast a rise in the VIX, and at -1 SD is at the same level as Jan and May 2018, although -1.5 is considered an official Sell. The last Sell in Aug, prior to the Sept & Oct declines only resulted in an 8% decline in the SPX. but the VIX did reach 40, the same level as in Dec 2018.

Conclusions. A significant top is approaching, the only question is when. The last three years (prior posts) have shown megaphone patterns in both sentiment and prices where sharp declines have resulted in extreme high bearish sentiment, only to be followed by more extreme rallies and extreme low bearish sentiment. This must end some time, perhaps this was just the result of Trump's policy of creative destruction where his policy of creating havoc forced the Fed to be more active.

Next year, I see a significant change with a more stable administration, but likely the beginning of a 1.5 to 2 year bear market with increasing risk in the second half of 2021, possibly due to higher taxes and more regulation, especially for large techs.

Weekly Trade Alert. Time appears to be running out for EOM options gamma event to test the low SPX 3500s, but the VIX Buy/Sell indicator is telling us that this is more of pay me now or pay me more later situation. Also, the rounded top implies limited upside and downside, probably inuo mid-Jan. Updates @mrktsignals.

Investment Diary, Indicator Primer,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators