Last week started much as expected with the SPX rising toward the 4450 area by Wed (4443 act)., and following the M/W/F options OI targets. Oddly, Tu/Th were both negative with Thur particularly violent following the NVDA EPS outlook which took the after hours SPX (FX) to 4474 which meet the minimum target of a 50%+ retrace (4471) of the Aug decline (4607-4335). EW analysts almost unanimously started clamoring for 5 waves down to SPX 4250 to confirm a larger move down, but Fri late recovery to SPX 4406, from a Powell's hawkish speech at Jackson Hole and selloff to the SPX 4350s, may have voided that outlook. Bonds remain a major concern as Mon saw the TNX spike to 4.36% to take out the Oct 2022 high of 4.33% before reversing to 4.2%. The possible "handle" of the TNX cup and handle remains questionable with bond sentiment (TBT/TLT) remaining near the strong Sell.

Bearish sentiment increased slightly overall even as price rose overall with a strong Buy remaining ST for the Hedge Spread indicator. COT data shows a strong increase in bearish sentiment for the DJIA (YM) rising from a neutral level to +.75 SD, just short of a weak Buy. Last week I indicated that for one scenario to the SPX 4550+ area, I expected an expanding wedge in price and time, so to clarify, a 2-3 week decline early Aug (a) would lead to a 4-6 week rally into mid-late Sept (b) then a 8-12 week decline Oct-Dec (c).

The SPX option components for the INT/LT Composite indicator have been removed this week due to previous problems with the volume of 0DTE options.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. Starting Aug 26, 2023 SPX options are removed due to extreme 0DTE volume distortions. New weights are ETF put-call indicator (30%), SPX 2X ETF INT ratio (40%), and a volatility indicator (30%) which combines the options volatility spread of the ST SPX (VIX) to the ST VIX (VVIX) (20%) with the UVXY $ volume (10%).

Update Alt. Bearish sentiment since the beginning of Aug has risen from a weak Sell to above neutral.

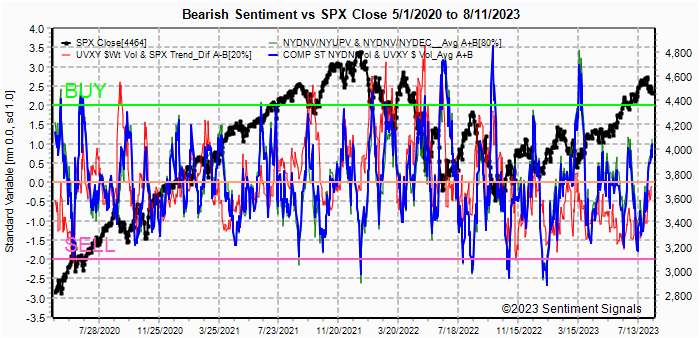

Update Alt EMA. Bearish sentiment looks a lot like Jan-Feb 2021 where a minor correction unfolded, but prices continued to rise for about a year. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/SPX Trend. Weights are 80%/20%.Update. Bearish sentiment rose modestly Thur-Fri with the increased volatility.

Update EMA. Bearish sentiment rose last week, but remains below the weak Buy. This may be following the path after May 2021 where prices rose slowly until sentiment picked up. The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. Bearish sentiment remains around the neutral level.

Bonds (TNX). Bearish sentiment remains in the weak Sell area which continues to surprise. In 2017-18 rates rose from 1.3% to 3.3% and bearishness was extremely strong before the 2019-2020 rate decline, but now after a 4% rise from .5%, everyone is bullish. For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.Update. Bearish sentiment in ETFs saw a sharp spike last week, but prices remain subdued due to high int rates and continued weakness in China (SSEC).

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Bearish sentiment bounced off a strong Sell, but may also be following the Jan-Feb 2021 path of a complex correction.

With the sister options Hedge Spread as a ST/INT indicator (outlook 1-3 mns), bearish sentiment moved back to a strong Buy ST (grn) and should help prices move higher and provide support from intraday weakness as last weeks Thru-Fri declines. A new composite SPX options indicator uses both the volume adj (1/B-A) and P/C equivalent spread (A-B) to compensate for the discrepancy between the two. This replaces the old SPX options indicator for the SPX ETFs + options below and the INT/LT composite. No chartFor the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the INT term composite (outlook 2 to 4 mns), bearish sentiment remains weak, but may be bottoming as in May 2021.

For the NDX combining the hybrid ETF options plus NDX 3X ETF sentiment with the interest rate effect, (outlook 2 to 4 mns) bearish sentiment shows similar extremes between ETF and options as in late 2020 which resulted in a choppy market until options sentiment rose. Note QQQ options are optimal, but are N/A and are included in ETF options.

Bearish sentiment increased slightly with the Thur-Fri volatility, and remains above neutral.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Sept 1. A text overlay is used for extreme OI to improve readability, P/C is not changed. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross.

With Fri close at SPX 4406, options OI for Mon is moderate with little OI bias between 4375-4450, but deep ITM puts ($OI) may provide an upward bias toward 4425.

Wed has smaller OI where SPX outlook is about the same as Mon.

For Thur EOM strong OI has a positive bias to SPX 4450+.

For Fri Jobs report moderate OI has very strong put support at SPX 4400 and below, and moderate support up to 4450, while call resistance starts at 4475 and is strongest at 4500. A likely target may be around 4475.

IV. Technical / Other

The following uses barcharts.com as a source and discusses S&P futures (ES) as a third venue of stock sentiment in addition to options and ETFs. The non-commercial/commercial spread represents a LT bearish sentiment (dumb money/smart money) indicator. As explained in investopedia, commercial investors (red) are institutions and are smart money, while non-commercials (green) are speculators such as hedge funds and are dumb money. Here is the current barchart graph for the S&P 500 (top) and trader positions (1st bot) with positives as net longs and negatives as net shorts. Bearish sentiment is represented by the spread and is positive if red > green (Buy) and negative if green > red (Sell). ES sentiment is neutral at > +.5 SD and now about the same as Sept 2020, YM (DJIA) increased sharply to +.75 SD, Dow theory may keep DJIA up thru Sept-Oct, watch for Sell at -1 to -2 SD.

Click dropdown list to select from the following options:

Tech / Other History2023

2022

Other Indicators

Conclusions. Sentiment is only slightly more bearish than last

week, except for the DJIA futures that may mean a return to relative strength

for the cyclicals vs techs. SPX options OI is indicating a possible

reverse of last week with a neutral Mon/Wed outlook and a Thru/Fri outlook for

gains to the mid 4450-4500 area. Fri with unemployment data shows very

large bearish sentiment and seems most likely to surprise to the upside.

Weekly Trade Alert. Prices may drift around early in the week, but

strength may return late in the week to about SPX 4475 by Fri close. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

Tech/Other Refs,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2023 SentimentSignals.blogspot.com