Last week was expected to start out with strength to the upside to 3950+ (act Mon 3982) with weakness into mid-week (Tue 3875) and strength into the EOW (Fri 4158), so an A on that one, Overall, the expectation was for a rally of SPX 200-300 pts from the low (3810) with the caveat that 10%+ was possible with less Fed hawkishness, a change in China lockdowns/tariffs or Russis/Ukraine. It certainly did not take long for the Fed to change as Tue one of the Fed heads floated the idea of ending the rate hikes by Sept, and after this was confirmed on the Wed release of Fed minutes at 2PM by Fri close the SPX rallied 5% from 3930 to 4158 (close to my EOM target). Since the Fed knows economic data several weeks before public releases, the rapid change of heart may be due to weak economic data ahead. There is a minor Bradley turn June 8 that may be a bottom or top. Fri jobs data may be weak, but could be interpreted as more dovish support from the Fed and the following Fri, CPI may still be a problem.

My INT outlook has not really changed for a rally into a Sept-Oct top which now looks to be a "buy the rumor, sell the news" event as the Fed is expected to pause rate hikes just as the full QT is scheduled to start (I think someone already predicted that). We are starting to see signs of economic slowdowns and profit margin squeezes as shown by the 20% price drops of WMT and TGT the previous week on profit outlooks, and a July swoon on EPS releases is likely before a final melt up. Inflation is likely to slow from 8+% to 4.5-5.0% by the Fall, but remain high enough to cause a new rate hike cycle by EOY just as in 2018.

Some have noted a sharp breath thrust last week as the beginning of a sharp move upward. I like to look at the McClellan Osc. Last week it was at 105 which provided strong support from 2010-20, but also gave several false Buys during the late 2008-09 bear market.This weeks Tech/Other section takes a look at the VIX Call indicator that is now showing a Sell as well as a LT options indicator that is showing a lot of similarity to 2000-2002.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

Update EMA. Sentiment is dropping slowly but remains near a Buy at 1.5 SD.

The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/SPX Trend. Weights are 80%/20%.Update. Sentiment dropped sharply last week from the Buy level similar to the rally into the June 2020 top, but not yet at the Sell level.

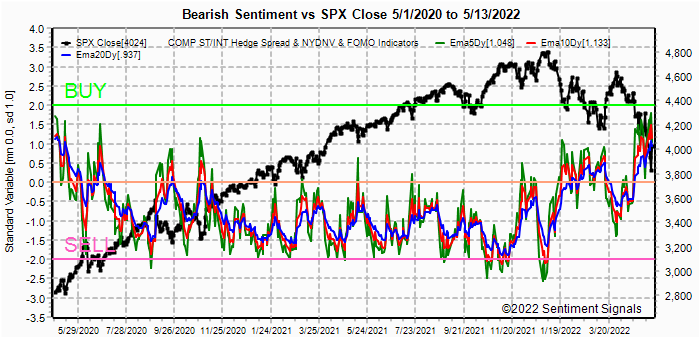

Update EMA. LT(blue) likely to reach 1-1.5 SD before significant downside. The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update. Strongest SPX option FOMO since Sept 2018, but composite remains above neutral.

Update EMA. Similar sentiment decline as seen into the June 2020 top with LT (blue) likely to reach -.5 SD before real trouble. Bonds (TNX). Bearish sentiment in bonds continues to rise with TNX slightly lower than expt at 2.74%, could drop as low as 2.5%. For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.

Update. Bearish sentiment continues to follow bonds higher and should support a trading range 240-280.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Bearish sentiment fell sharply ST, but LT remains near a Buy level.

With the sister options Hedge Spread bearish sentiment as a ST/INT indicator (outlook 1-3 mns), using the 2018-22 as a base, hedging has decreased but remains strong. Taking a look at the ETF ratio of the INT term SPX INT (2X) ETFs (outlook 2 to 4 mns) as bearish sentiment, ST (gr) rose even as the SPX rallied. Using the TNX plus ETF sentiment shown for the HUI as the NDX sentiment with the interest rate effect. The INT term NDX ST 3x ETFs + TNX (outlook 2 to 4 mns) bearish sentiment using the faster EMAs also shows a modest decline, but remains well above a Buy.III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru June 3 & EOM. A text overlay is used for extreme OI to improve readability, P/C is not changed. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross plus $ volume.

With Fri close at SPX 4158, options OI for Tue/EOM is large, but with many straddled price levels. The high OI P/C shows a positive bias, but the $OI has a negative bias (BE 3950), so a range of 4150-4200 is expt.

Wed has small OI with low SPX OI and $OI and some retracement 4125-75 is expt.

For Fri (May jobs data) modest OI has a moderate positive OI P/C and negative $OI. As long as SPX is over 4100 a range of 4125-75 is likely, below 4100 shows little support to 4000. For June EOM strong put support at SPX 4285 is likely to pull prices toward 4300+ by EOM June..

IV. Technical / Other

For the ST, the VIX Call indicator has now gone full circle from a Buy two weeks ago to Sell in a very short time span similar to June and Nov 2020 which saw sharp pullbacks of 50-100 pts over a couple of days but remained in an uptrend.

For the LT, this week I want to look at one of the bear market indicators from Stockcharts which goes back to 1998. In this case I chose the combined option put/call ratio CPC divided by the SKEW (out of the money premiums). Here you can see that for most of 2018-19 the ratio did a good job of indicating the relative importance of tops and bottoms, but in late 2020-21 wqs skewed downward. The next chart shows recent distortion was a result of low CPCE (equity P/C).

The Equity P/C was much lower in the post-Covid period due to more tech demand from at-home usage driving prices and profits beyond the norm.

The breakdown of CPC did not begin until 2004, but the abnormally low CPC during the dotcom bubble of 1998-99 was likely due to low CPCE as well and similarities to 2020-21 are high. It is interesting that unlike 1998-99 and 2020-21, 2007-08 saw high CPC before the 2008-09 crash that may support the adage that "in a bear market, the bears are right"; if so this may explain the strong bearish position in SPX and NDX ETFs in expecting a less volatile, but longer lasting bear market as seen in 2000-02 compared to 2008-09. In a final note, the current level of the CPC/SKEW is just above that seen in the first leg down in Mar 2001 (one of the DeMark Buys from last week), but also about the same as Oct 1998.

Conclusions. INT/LT sentiment remains consistent with a multi-month rally, likely into the Fall. ST/INT sentiment indicates that several weeks of upside is likely, but will likely be followed by a sizable pullback. probably with Q2 EPS in July. Very ST the VIX Call indicator is now showing a Sell, following a Buy two weeks ago, but the Buy was followed by a lower low in week 1 before a strong rally. Combine this with a minor Bradley turn date June 8 and the SPX may remain higher (4125-4200) next week before a possible 100-200 pt pullback (low 4000s possible), then a rally into EOM.

Weekly Trade Alert. Some negative news is likely this week on the employment front and may see a drop in SPX to low 4100s with the Wed ADP preview, then rally back to upper 4100s on Fri NFP report as "bad news is good news". Updates @mrktsignals.

Investment Diary, Indicator Primer, Tech/Other Refs,

update 2021.07.xx Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2022 SentimentSignals.blogspot.com