My condolences to all Parisians. The groundwork for a drop to SPX 1970 early next week was laid out Friday based on the VIX term structure timing model (https://caldaro.wordpress.com/2015/11/12/thursday-update-504/#comment-226919). Looking over some of the charts, this level also corresponds to the DJIA at 16750 which is the bottom of a line connecting the Aug and Oct lows.

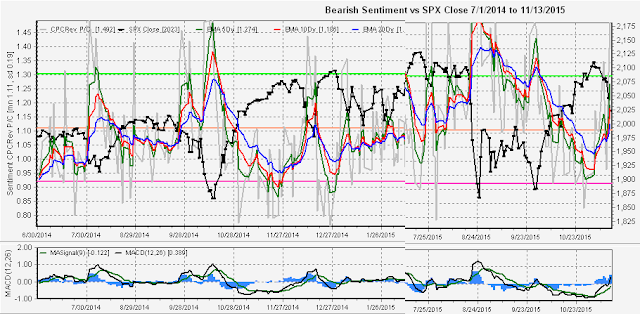

Many indicators including the NYSE A-D line, NYMO, and NYUD point to an approaching tradeable bottom. My sentiment composite reading is still in neutral although the put/call ratio component is reaching an extreme that suggests a fast and furious short-covering rally (100+ SPX pts) before a more serious decline. The rally is likely to top by Thanksgiving.

CPC P/C revised by subtracting vix puts and calls (yes CBOE includes vix calls/puts with equity calls/puts in CPC and CPCI).

No comments:

Post a Comment