On Nov 24, I showed that leveraged long/short ETF pairs could be used to measure sentiment for the S&P 500 with similar results to other sentiment measures and therefore might produce similar results for other investments. The bottom two-year chart for CNN's Fear & Greed Index can be used for comparison.

Today I want to add the sentiment results for another type of investment, the gold miners HUI, using the DUST/NUGT ETF pair. The chart below shows the results from Jan 1, 2013 thru Nov 25:

The chart looks very similar to the SPX charts turned upside down. Here, persistent low levels of bearishness have led to continued lower prices for most of the period, except for an few spikes. Something changed, however, starting in June. Since then, a persistent spike in bearish sentiment has accompanied the trading range at lower prices, almost a mirror image of the mid-2014 topping pattern in prices.

Based strictly on the comparison to the sentiment readings from the last two rallies of about 30% from year-end lows in 2013 and 2014, the rally from this year's low should be about twice as much or 50-60% sometime the first half of 2016. This should not be used to time the exact bottom, but I am expecting a low in Dec-Jan based on collapsing demand for gold from China.

Sunday, November 29, 2015

Tuesday, November 24, 2015

Using "synthetic" put/call ratios, Nov 24, 2015

Having completed most of the sentiment tool creation for the S&P, I was curious about developing other sentiment tools that could be applied to a variety of investments.

One idea was the use of "synthetic" put/call ratios created with leveraged long/short ETF pairs. To test this idea for the S&P I tried both the 2X SDS/SSO pair and the 3X SPXU/UPRO pair. The results were somewhat better than I expected, with comparable results to other sentiment measures. Here is the result for the SPXU/UPRO pair using dollar volume from the period Jan 2013 thru Nov 2015. (Updated Nov 29)

Here you can see that as sentiment remained highly bearish throughout 2013, the SPX rose 30%. Then as bearish sentiment fell to lower levels in mid 2014, the returns for the last 18 months were about 10% and flat for 2015.

The following chart for the SDS/SSO is very similar

The current sentiment position does not say anything good about future returns. Tuesday, Goldman came out a report forecasting the SPX at 2100 at the end of 2016, sentiment certainly agrees.

http://www.marketwatch.com/story/the-sp-500-is-going-nowhere-fast-in-2016-goldman-says-2015-11-24

Next up, HUI with DUST/NUGT.

One idea was the use of "synthetic" put/call ratios created with leveraged long/short ETF pairs. To test this idea for the S&P I tried both the 2X SDS/SSO pair and the 3X SPXU/UPRO pair. The results were somewhat better than I expected, with comparable results to other sentiment measures. Here is the result for the SPXU/UPRO pair using dollar volume from the period Jan 2013 thru Nov 2015. (Updated Nov 29)

Here you can see that as sentiment remained highly bearish throughout 2013, the SPX rose 30%. Then as bearish sentiment fell to lower levels in mid 2014, the returns for the last 18 months were about 10% and flat for 2015.

The following chart for the SDS/SSO is very similar

The current sentiment position does not say anything good about future returns. Tuesday, Goldman came out a report forecasting the SPX at 2100 at the end of 2016, sentiment certainly agrees.

http://www.marketwatch.com/story/the-sp-500-is-going-nowhere-fast-in-2016-goldman-says-2015-11-24

Next up, HUI with DUST/NUGT.

Saturday, November 14, 2015

Sentiment Update, Nearing Oversold Bounce, Nov 14, 2015

My condolences to all Parisians. The groundwork for a drop to SPX 1970 early next week was laid out Friday based on the VIX term structure timing model (https://caldaro.wordpress.com/2015/11/12/thursday-update-504/#comment-226919). Looking over some of the charts, this level also corresponds to the DJIA at 16750 which is the bottom of a line connecting the Aug and Oct lows.

Many indicators including the NYSE A-D line, NYMO, and NYUD point to an approaching tradeable bottom. My sentiment composite reading is still in neutral although the put/call ratio component is reaching an extreme that suggests a fast and furious short-covering rally (100+ SPX pts) before a more serious decline. The rally is likely to top by Thanksgiving.

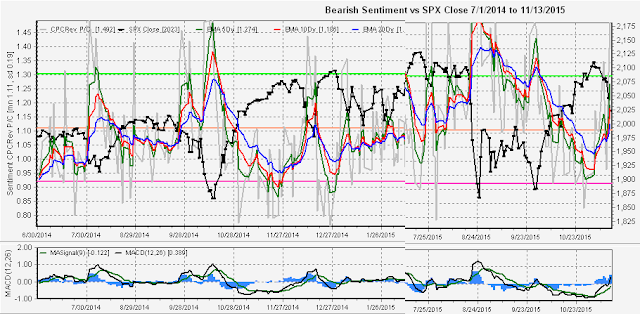

CPC P/C revised by subtracting vix puts and calls (yes CBOE includes vix calls/puts with equity calls/puts in CPC and CPCI).

Saturday, November 7, 2015

Sentiment Update, Zooming in on the VXX Volume, Nov 7, 2015

Previously on Nov 3, I indicated that my sentiment composite#1 had given a sell signal, but that I was hesitant to make an "official" call due to the high VXX volume. The composites are heavily weighted by put/call ratios which tend to be early in bottoming and actually increase many times prior to a top due to "smart" money correctly positioning for a decline.

So today I want to show a chart of the VXX volume indicator and what it would take to generate a sell. Note that this was the only indicator that I watch that gave warning before the August crash.

Using the different EMAs, I expect the 5 day (green) to reach at least the .6 level (currently .73) and preferably the .5 level. The longer term 20 day (blue) has been very slow to come down, and currently at .85 should drop down to about .65. Comparing the 20 day to the position before the Sep and Dec 2014 tops, this could be two to four weeks away.

In conclusion, this certainly supports a move to new highs with the potential targets given as SPX 2150-70. Timing bands for a top extend from Opt Exp to Thanksgiving, with maximum risk seen in Dec-Jan (China). The decline last week of 30 SPX points was almost identical to declines prior to rally tops in July and Sept of 2014.

So today I want to show a chart of the VXX volume indicator and what it would take to generate a sell. Note that this was the only indicator that I watch that gave warning before the August crash.

Using the different EMAs, I expect the 5 day (green) to reach at least the .6 level (currently .73) and preferably the .5 level. The longer term 20 day (blue) has been very slow to come down, and currently at .85 should drop down to about .65. Comparing the 20 day to the position before the Sep and Dec 2014 tops, this could be two to four weeks away.

In conclusion, this certainly supports a move to new highs with the potential targets given as SPX 2150-70. Timing bands for a top extend from Opt Exp to Thanksgiving, with maximum risk seen in Dec-Jan (China). The decline last week of 30 SPX points was almost identical to declines prior to rally tops in July and Sept of 2014.

Posted November 3, 2015

My sentiment model gave a sell signal yesterday at the close with the the composite 10 dy ema reaching the -1 stddev at -.66 (actual -.70).

Previously, I posted that I was expecting a short but sharp decline similar to Dec 2014, but the overall sentiment pattern now more closely resembles that of the Sept 2014 top which would mean a more serious decline of 10% or more. Note that the longer term sentiment 20 dy ema is now lower that it was in Sept 2014. The sell signal may be 1 to 2 weeks early as in 2014, however.

So I hesitate to issue an official sell at this moment, particularly since one of my favorite short-term indicators – the daily VXX volume indicator, has not shown sell levels. This acts similar to the H.O indicator and occurs in clusters, not always important, but sometimes …

Last occurrence 08/18 with 4 occurrences between 08/10 and 08/18 with result –10% decline in 2 wks, previous multi-signals and result, 2015/04 with –2% decline over 2 mns, 2014/08 with –10% decline in 6 wks.

My current outlook is a continued upward chop for one-two weeks with possible new highs in the SPX 2150-70 range aka Oct 2007 top, then a sharp selloff aka Dec 2007-Jan 2008.

Previously, I posted that I was expecting a short but sharp decline similar to Dec 2014, but the overall sentiment pattern now more closely resembles that of the Sept 2014 top which would mean a more serious decline of 10% or more. Note that the longer term sentiment 20 dy ema is now lower that it was in Sept 2014. The sell signal may be 1 to 2 weeks early as in 2014, however.

So I hesitate to issue an official sell at this moment, particularly since one of my favorite short-term indicators – the daily VXX volume indicator, has not shown sell levels. This acts similar to the H.O indicator and occurs in clusters, not always important, but sometimes …

Last occurrence 08/18 with 4 occurrences between 08/10 and 08/18 with result –10% decline in 2 wks, previous multi-signals and result, 2015/04 with –2% decline over 2 mns, 2014/08 with –10% decline in 6 wks.

My current outlook is a continued upward chop for one-two weeks with possible new highs in the SPX 2150-70 range aka Oct 2007 top, then a sharp selloff aka Dec 2007-Jan 2008.

Original post from October 17, 2015

I have not been posting for about 10 weeks after I decided to concentrate on switching my sentiment analysis from Excel to a database system using Delphi/Pascal.

Now, I'd like to share some of the results. I started earlier this year collecting info on about 10 indicators including various put/call, vxx volume and skew data. Looking over the results in the new system, none of the indicators worked consistently alone so I decided to combine several as standardized variables to produce a composite. So I will show the results in two charts.

The first chart is a backtest from Feb to mid-Aug 2015 in a low volatility period. Sentiment composite (gray) is left axis, SPX close prices (black) is on right. More important are the EMAs of composite with 5 day (green), 10 day (red) and 20 day (blue). The horizontal lines are + and - 1 stddev from mean (sample varies from pop mean of 0 from 7/2010). + 1 std dev (lime) is oversold extreme (buy), - 1 std dev (pink) is overbought extreme (sell). During this period three sells were generated when the 5 day ema reached - 1 std dev, and two buy signals were generated at the + 1 std dev line. Somewhat better on the sells, so I will probably be looking for a better buy composite.

The second chart is longer term from mid-2014 with the 1st chart period cut out to compare the last half of 2014 to today. Here the two rallies in 2014 after volatility spikes flattened out when the 5 day ema (green) reached - 1 std dev, then continued upward in a choppy fashion until the 10 day ema (red) reaches - 1 std dev and finally stalls out and begins a decline. The current indicators are at an almost identical position to 11/25/2014, two weeks before the Dec top and a 100 pt SPX decline. This is more interesting considering the fractal from Mar-Oct 2014 where 2015 is leading by 6 weeks. July top preceded Sept 2014 top by 6 weeks, late Aug crash preceded Oct 2014 crash by 6 weeks, and last week in Oct precedes Dec 2014 top by six weeks. So a choppy market into FOMC top Oct 27/28 may be good time to short.

Now, I'd like to share some of the results. I started earlier this year collecting info on about 10 indicators including various put/call, vxx volume and skew data. Looking over the results in the new system, none of the indicators worked consistently alone so I decided to combine several as standardized variables to produce a composite. So I will show the results in two charts.

The first chart is a backtest from Feb to mid-Aug 2015 in a low volatility period. Sentiment composite (gray) is left axis, SPX close prices (black) is on right. More important are the EMAs of composite with 5 day (green), 10 day (red) and 20 day (blue). The horizontal lines are + and - 1 stddev from mean (sample varies from pop mean of 0 from 7/2010). + 1 std dev (lime) is oversold extreme (buy), - 1 std dev (pink) is overbought extreme (sell). During this period three sells were generated when the 5 day ema reached - 1 std dev, and two buy signals were generated at the + 1 std dev line. Somewhat better on the sells, so I will probably be looking for a better buy composite.

The second chart is longer term from mid-2014 with the 1st chart period cut out to compare the last half of 2014 to today. Here the two rallies in 2014 after volatility spikes flattened out when the 5 day ema (green) reached - 1 std dev, then continued upward in a choppy fashion until the 10 day ema (red) reaches - 1 std dev and finally stalls out and begins a decline. The current indicators are at an almost identical position to 11/25/2014, two weeks before the Dec top and a 100 pt SPX decline. This is more interesting considering the fractal from Mar-Oct 2014 where 2015 is leading by 6 weeks. July top preceded Sept 2014 top by 6 weeks, late Aug crash preceded Oct 2014 crash by 6 weeks, and last week in Oct precedes Dec 2014 top by six weeks. So a choppy market into FOMC top Oct 27/28 may be good time to short.

Subscribe to:

Comments (Atom)