Everyone looks at put/call ratios occasionally, but the CBOE publishes data on other ratios than the widely followed CPC (combined) and CPCI (index). Two of my favorites are the SPX and VIX P/Cs. After the 2007-08 bear market, there was a huge growth in volatility products to hedge risk, and this included puts and calls on the VIX. CBOE includes VIX calls in the calls for both CPC and CPCI, likewise for puts, so to eliminate the distortions, I use modified CPC and SPX for CPCI.

To get back to the main subject, a large volume of calls on the VIX is a bet on increased volatility. Friday for instance the VIX P/C was 0.14 with 700k calls or 30% of the 2.4m reported for the CPC and almost 60% of the calls in the CPCI. The reported CPCI, for instance, was .81, but without the VIX calls the number jumps to 1.80. The SPX P/C was 1.79.

So what does this mean for an investor? Long-term the VIX P/C averages about .50. VIX call buyers tend to be "smart money" investors, such as hedge funds and pension funds, looking for a way to hedge risk.For instance, for the five days from Dec 29, 2015 to Jan 5, 2016 the VIX P/C averaged .25 and the next two weeks the SPX dropped from 2017 to 1812. Before that in mid-Aug 2015, the five day average dropped to .30 before the Aug crash. Friday, Feb 5, the 4-day avg dropped to .2 and the 5-day to .30. What are VIX call buyers afraid of?

The following shows a VIX P/C sentiment chart with the current 5-day EMA at .30.

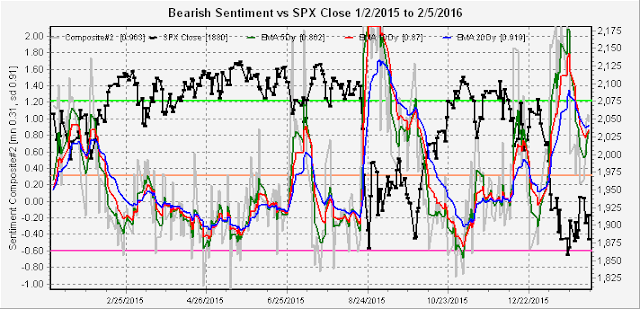

The next two charts show updates for the composites, #1 (P/C, VXX $ Vol, Skew) and #2 (P/C, VXX $ Vol, VXV/VIX).

Composite #1 remained steadfastly bearish (low sentiment) from Sept thru mid-Jan, mostly due to the Skew which remained in the mid-140s, only recently dropping below 120. This composite is now bullish. Composite #2, below, is also bullish, but not as mush so as after the Aug crash and retest.

Overall, sentiment seems to be pointing to some type of short-term washout using the VIX P/C, followed by a sizable rally of several months, but no new highs.

No comments:

Post a Comment