Moving on to the indicators. The Short Term Indicator (VXX $ volume and Smart Beta P/C) saw a slight rise in bearish sentiment due to a pickup in VXX $ Volume as shorting seems to have appeared near the 20k mark, but not enough to change the negative outlook for prices.

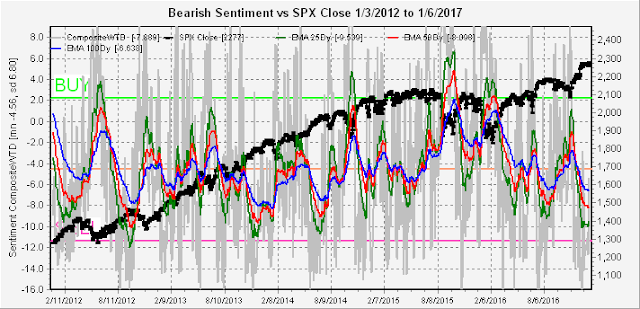

The overall Indicator Scoreboard remains nailed to the SELL level on longer sentiment term levels. As I was curious to see if there were any other periods that may indicate other than a negative result for the markets, and decided to look back long term as far back as my database would allow (starting July 2010).

The only period since 2012 was late 2013 - early 2014, so I can't really say it is impossible, but it is improbable.

Comparing the above to the long term indicator for the SPX using the ETFs SDS/SSO shows that the SDS/SSO was a better long term indicator, remaining bullish until just before the late 2014 pullbacks. We are now at the lowest bearish sentiment level in the last four years using this measure.

Looking at some of the other ETFs. The sharp run up in gold mining stocks saw an equally sharp drop in bearish sentiment. Apparently the gold bugs are looking for a repeat of the start to 2016, but sentiment indicates that a repeat of the start to 2015 is more likely where similar levels for prices and sentiment led to disappointing results.

For bonds, an equally sharp drop in rates (TNX) was not met by much change in sentiment. This combined with the disappointing retail sales results announced last week has me rethinking rapidity of the expected rise in rates. Although the result (negative) is the same for stocks (SPX), this could indicate a less robust economy with weak earnings growth combined with rates high enough to discourage stock buybacks,

Conclusion. Based on a variety of observations, including a lack of volume and some pickup in shorting, I expect next week to be mildly positive with a dance around the DJIA 20K area. Ideally, a close above 20K Friday could result in a high volume top the following Monday. Earnings results with begin after the close that Monday.

Weekly Trade Alert. Last week missed DJIA 20K by 0.5 points, but it did not look like a good short. I will be playing it by ear next week, but expect no trades. Updates will be posted @mrktsignals if a trade is recommended or any change in outlook is necessary.

No comments:

Post a Comment