Several weeks ago when I pointed out the possible significance of a false timing signal from the so called "January effect", I expected somewhat more volatility that a fifty point SPX trading range for six weeks. Now the 1% breakout last week has the bulls convinced that Nirvana is just around the corner. This is most evident in the bonds (TNX) and gold stocks (HUI) where sentiment is nearing a SELL even though there has not even been a breakout.

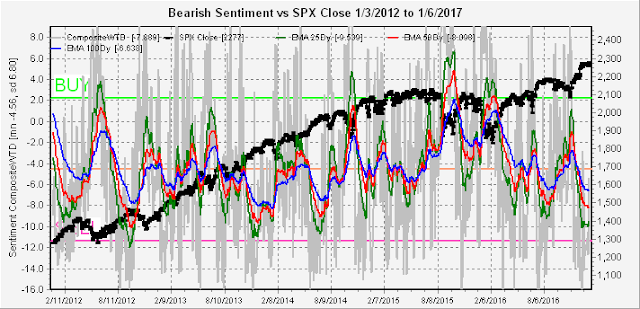

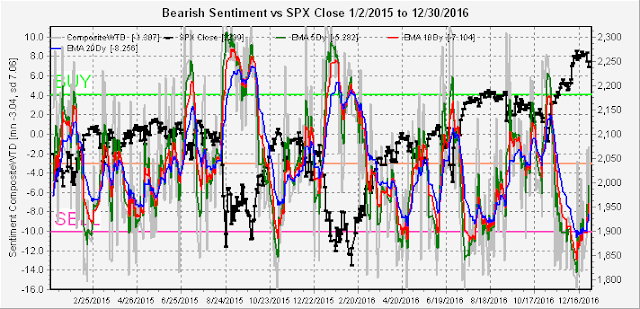

For stocks (SPX), the story is much the same with low bearish sentiment remaining and no apparent reason for things not to continue so. My reasoning remains that higher rates will be the key to bring down the house of cards for a broad range of asset classes.

Now looking at the indicators, the overall Indicator Scoreboard has now fallen back to the SELL level, indicating that at least a short term pullback is likely to start next week, but does not rule out a continuation top similar to the first half of 2015 or mid 2016.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) has also turned lower but has still failed to reach the extremes seen before the Aug 2015 and Jan 2016 for the very short term.

If I seem to be somewhat more conservatively bearish, I will show two of the MISC indicators that do not seem to be indicating a short term top yet. The first is the TRIN (essentially a measure of net adv issues to net volume) which usually shows lower supporting volume or higher ratios as seen in Aug 2015 or late 2016.

The second indicator is the VIX P/C, where lower levels are typically seen before a significant selloff.

Moving on to bonds (TNX), investors seem to be flocking into the bond ETFs as rates have stabilized around 2.5%. Interest rates have been somewhat weaker than I expected to date, but a breakout to the upside still seems more likely.

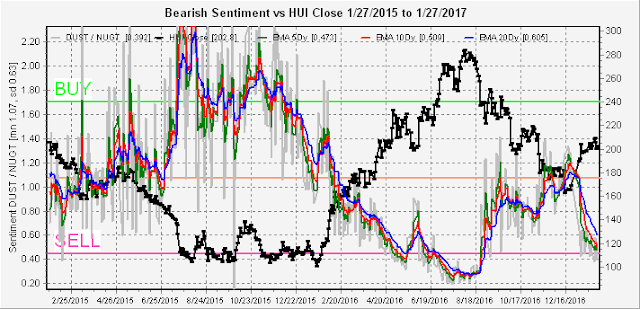

Finally, the gold stocks (HUI) shows an even sharper drop in bearish sentiment even as the HUI has stalled out around the 200 level. Compared to bonds gold stocks seem to be betting on higher growth and more inflation, while bonds seem to be expecting lower growth and less inflation.

Conclusion. The end of January has produced a positive result as expected, but some of the indicators are not as extreme as expected for a major top. I will be watching bonds (TNX) very closely as a breakout over the 2.6% level may be required for a major selloff to start.

Weekly Trade Alert. I did call off all trades last week via @mrktsignals due to pre-market levels and EOM timing considerations. This week there are no clear shorting levels, so I will probably stand pat with any changes posted on Twitter.

Sunday, January 29, 2017

Sunday, January 22, 2017

Game Time

The SPX continued its sideways dance last week with the NDX streaming ahead on the back of Netflix, while the DJIA faltered somewhat. As most of you this Sunday afternoon, most of my attention is focused on football. So this weekends post will be brief with little change in outlook from last week.

Looking at the overall Indicator Scoreboard, bearishness remains at low levels after reaching a momentum extreme low. An advance toward the mean is not unlikely before a correction begins.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) is in a similar position.

Looking at the SPX 3x ETFs SPXU/UPRO shows that bearishness is becoming more compressed to the SELL side, leaving little hope for those expecting a breakout rally at this time.

The strongest index, the NDX, show bearish sentiment about as low as it can get using the 3x ETFs.

Sentiment for bonds (TNX) using TBT/TLT showed a surprising drop in bearish sentiment even as rates rallied back to the 2.5% level. Not what you want to see if you are a bond bull.

The gold miners (HUI) continue to bet on the reflation trade at the same time as the HUI stalls out at the same level as the early 2015 rally top. Sentiment for bonds and gold indicate the advance in rates with continued pressure on gold is just ahead.

Conclusion. Not much change from last week. All signs are pointing to tops in January for a variety of assets, as I continue to believe that higher rates are the biggest concern going forward for most of 2017.

Weekly Trade Alert. We did not get the expected move last week for the SPX to 2285-90. So I am moving my timing top to the EOM. Short at 2285-90 with a stop at 2300. Updates will be posted @mrktsignals if a trade is recommended or any change in outlook is necessary.

Looking at the overall Indicator Scoreboard, bearishness remains at low levels after reaching a momentum extreme low. An advance toward the mean is not unlikely before a correction begins.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) is in a similar position.

Looking at the SPX 3x ETFs SPXU/UPRO shows that bearishness is becoming more compressed to the SELL side, leaving little hope for those expecting a breakout rally at this time.

The strongest index, the NDX, show bearish sentiment about as low as it can get using the 3x ETFs.

Sentiment for bonds (TNX) using TBT/TLT showed a surprising drop in bearish sentiment even as rates rallied back to the 2.5% level. Not what you want to see if you are a bond bull.

The gold miners (HUI) continue to bet on the reflation trade at the same time as the HUI stalls out at the same level as the early 2015 rally top. Sentiment for bonds and gold indicate the advance in rates with continued pressure on gold is just ahead.

Conclusion. Not much change from last week. All signs are pointing to tops in January for a variety of assets, as I continue to believe that higher rates are the biggest concern going forward for most of 2017.

Weekly Trade Alert. We did not get the expected move last week for the SPX to 2285-90. So I am moving my timing top to the EOM. Short at 2285-90 with a stop at 2300. Updates will be posted @mrktsignals if a trade is recommended or any change in outlook is necessary.

Sunday, January 15, 2017

Bull Market or Just Bull

The market measured by the SPX has managed to gain a total of five points over the last month from 2278 when my Short Term Indicator joined the overall Indicator Scoreboard on December 11 pointing to an intermediate term top. Last week I pointed that January would probably be manipulated in order to show a positive "January effect", so far so good. One indicator that acts like the Hindenburg omen is a surge in the volume of VIX calls over 500k per day. In 2015, there two such days in November and 5 in mid-December, the past two months saw two in December and four last week. There is no specific timing involved, but a top is likely between options expiration and the EOM, then a significant decline to SPX 2100 or lower. The trading range last week saw little change in sentiment except gold stocks.

The overall Indicator Scoreboard saw a very small uptick in bearish sentiment, but no change in overall posture.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) is in a similar trending up, but bearish position.

Price and sentiment are relatively unchanged for bonds (TNX).

Sentiment for the gold miners (HUI) has dropped to an almost bearish low extreme although still a similar pattern to the early 2015 period.

Conclusion. Although I still think we may have the "reflation rally" that everyone has been looking for the last three years, economic patterns show a clear lag between policy inception and effectiveness. Typically a 6 to 12 month period is necessary to develop policy then another 12 to 18 months to see the full effect. This means a low could be see by mid 2018 and a high by 2020. If you think the stock market sees all, just remember the housing crisis.

Weekly Trade Alert. A significant top is likely soon. Look for the SPX to pop to 2285-90 next week with a short at 2285 and a stop at 2300. Updates will be posted @mrktsignals if a trade is recommended or any change in outlook is necessary.

The overall Indicator Scoreboard saw a very small uptick in bearish sentiment, but no change in overall posture.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) is in a similar trending up, but bearish position.

Price and sentiment are relatively unchanged for bonds (TNX).

Sentiment for the gold miners (HUI) has dropped to an almost bearish low extreme although still a similar pattern to the early 2015 period.

Conclusion. Although I still think we may have the "reflation rally" that everyone has been looking for the last three years, economic patterns show a clear lag between policy inception and effectiveness. Typically a 6 to 12 month period is necessary to develop policy then another 12 to 18 months to see the full effect. This means a low could be see by mid 2018 and a high by 2020. If you think the stock market sees all, just remember the housing crisis.

Weekly Trade Alert. A significant top is likely soon. Look for the SPX to pop to 2285-90 next week with a short at 2285 and a stop at 2300. Updates will be posted @mrktsignals if a trade is recommended or any change in outlook is necessary.

Sunday, January 8, 2017

Twenty Thousand Leagues Under the Sea

Jules Verne saw the significance of the number 20,000 as the journey to the depths of the deepest seas, will it also turn out to be the top of the DJIA? Admittedly the stock market is struggling at that level, failing only a fraction below at the high of last week. I was somewhat surprised at the lack of volume which did not indicate an immediate distribution top. Bonds and gold both saw strong moves last week in the typical early January pickup of the most beaten down sectors from the previous year.

Moving on to the indicators. The Short Term Indicator (VXX $ volume and Smart Beta P/C) saw a slight rise in bearish sentiment due to a pickup in VXX $ Volume as shorting seems to have appeared near the 20k mark, but not enough to change the negative outlook for prices.

The overall Indicator Scoreboard remains nailed to the SELL level on longer sentiment term levels. As I was curious to see if there were any other periods that may indicate other than a negative result for the markets, and decided to look back long term as far back as my database would allow (starting July 2010).

The only period since 2012 was late 2013 - early 2014, so I can't really say it is impossible, but it is improbable.

Comparing the above to the long term indicator for the SPX using the ETFs SDS/SSO shows that the SDS/SSO was a better long term indicator, remaining bullish until just before the late 2014 pullbacks. We are now at the lowest bearish sentiment level in the last four years using this measure.

Looking at some of the other ETFs. The sharp run up in gold mining stocks saw an equally sharp drop in bearish sentiment. Apparently the gold bugs are looking for a repeat of the start to 2016, but sentiment indicates that a repeat of the start to 2015 is more likely where similar levels for prices and sentiment led to disappointing results.

For bonds, an equally sharp drop in rates (TNX) was not met by much change in sentiment. This combined with the disappointing retail sales results announced last week has me rethinking rapidity of the expected rise in rates. Although the result (negative) is the same for stocks (SPX), this could indicate a less robust economy with weak earnings growth combined with rates high enough to discourage stock buybacks,

Conclusion. Based on a variety of observations, including a lack of volume and some pickup in shorting, I expect next week to be mildly positive with a dance around the DJIA 20K area. Ideally, a close above 20K Friday could result in a high volume top the following Monday. Earnings results with begin after the close that Monday.

Weekly Trade Alert. Last week missed DJIA 20K by 0.5 points, but it did not look like a good short. I will be playing it by ear next week, but expect no trades. Updates will be posted @mrktsignals if a trade is recommended or any change in outlook is necessary.

Sunday, January 1, 2017

Ringing in the New Year

First let me wish everyone a happy and prosperous New Year.

Next I want to outline what I see as the ideal scenario for the first quarter. Sentiment has a major influence on the markets direction, and is often a result of false signals from market actions. For instance, last January was one of the worst in many years, and based on the so called "January effect", many concluded a new bear market was beginning. Instead, the market rallied 25% from the lows by December. As I have pointed out earlier, sentiment is now indicating a down year for 2017, but I am expecting a positive January effect to again give a false signal. This would require an up market the first week and at month end. So after a positive start, a decline of 3-5% by mid-month to about SPX 2200, then a month end rally that may have one or more indexes at ATH high would be ideal.

The biggest potential problem for the first quarter will be strong job reports (~200K) and other economic reports that may cause the Fed to raise rates again in March. The Initial Claims that usually moves inversely with jobs is hovering at the lowest level in 35 years, indicating potential for wage inflation. If true, Feb and March will likely see a rise in bond interest rates and the SPX dropping down to retrace the post-election rally (2080) by the end of March.

Moving on to the sentiment indicators, a nice drop of about SPX 40 points followed the Short Term Indicator (VXX $ volume and Smart Beta P/C) SELL. As a result there was a small rise in bearish sentiment, but not enough to indicate a change in direction.

The overall Indicator Scoreboard has only seen a small rise in bearish sentiment.

Bonds and gold both had a brief but strong rally last week probably due relief of tax loss selling with bond (TNX) sentiment moving back to neutral. The gold stocks (HUI) outlook seems more ominous with short term sentiment dropping well below the mean in a pattern similar to Apr to May 2015.

The NDX remains the most bearish of the indices with sentiment hovering near the lows.

Finally, the banking index BKX with FAZ/FAS has seen a very sharp drop in bearish sentiment as the BKX has rallied 50% in the last 6 months. However, given the long period of accumulation (BUY zone), the index is in a similar position as the HUI in May of 2016 where the initial drop to the SELL zone was meet by a lengthy period of distribution similar to the BKX from March thru July.

Conclusion. Sentiment wise, of all the indices the BKX is probably the least bad and is likely to outperform over the next few months, while the NDX and HIU are the worst. It's hard to say at this time whether the market continues downward as sentiment indicates or presents the "false signal" I outlined above. These two to four week selloffs, followed by 4 to six month rallies are starting to remind me of a 2014 Sci-Fi movie, Edge of Tomorrow with Tom Cruise, where time looped back every time he died.

Weekly Trade Alert. I hope some you were able to short at SPX last week as my entry was meet, but I was too hesitant on the Monday ramp. My New Year's resolution is to work on my trading skills. Same as last week if strong start to year, short on the SPX on a retest of the highs next week 2270-75 with a stop at 2290. Updates @mrktsignals if necessary.

Next I want to outline what I see as the ideal scenario for the first quarter. Sentiment has a major influence on the markets direction, and is often a result of false signals from market actions. For instance, last January was one of the worst in many years, and based on the so called "January effect", many concluded a new bear market was beginning. Instead, the market rallied 25% from the lows by December. As I have pointed out earlier, sentiment is now indicating a down year for 2017, but I am expecting a positive January effect to again give a false signal. This would require an up market the first week and at month end. So after a positive start, a decline of 3-5% by mid-month to about SPX 2200, then a month end rally that may have one or more indexes at ATH high would be ideal.

The biggest potential problem for the first quarter will be strong job reports (~200K) and other economic reports that may cause the Fed to raise rates again in March. The Initial Claims that usually moves inversely with jobs is hovering at the lowest level in 35 years, indicating potential for wage inflation. If true, Feb and March will likely see a rise in bond interest rates and the SPX dropping down to retrace the post-election rally (2080) by the end of March.

Moving on to the sentiment indicators, a nice drop of about SPX 40 points followed the Short Term Indicator (VXX $ volume and Smart Beta P/C) SELL. As a result there was a small rise in bearish sentiment, but not enough to indicate a change in direction.

The overall Indicator Scoreboard has only seen a small rise in bearish sentiment.

Bonds and gold both had a brief but strong rally last week probably due relief of tax loss selling with bond (TNX) sentiment moving back to neutral. The gold stocks (HUI) outlook seems more ominous with short term sentiment dropping well below the mean in a pattern similar to Apr to May 2015.

The NDX remains the most bearish of the indices with sentiment hovering near the lows.

Finally, the banking index BKX with FAZ/FAS has seen a very sharp drop in bearish sentiment as the BKX has rallied 50% in the last 6 months. However, given the long period of accumulation (BUY zone), the index is in a similar position as the HUI in May of 2016 where the initial drop to the SELL zone was meet by a lengthy period of distribution similar to the BKX from March thru July.

Conclusion. Sentiment wise, of all the indices the BKX is probably the least bad and is likely to outperform over the next few months, while the NDX and HIU are the worst. It's hard to say at this time whether the market continues downward as sentiment indicates or presents the "false signal" I outlined above. These two to four week selloffs, followed by 4 to six month rallies are starting to remind me of a 2014 Sci-Fi movie, Edge of Tomorrow with Tom Cruise, where time looped back every time he died.

Weekly Trade Alert. I hope some you were able to short at SPX last week as my entry was meet, but I was too hesitant on the Monday ramp. My New Year's resolution is to work on my trading skills. Same as last week if strong start to year, short on the SPX on a retest of the highs next week 2270-75 with a stop at 2290. Updates @mrktsignals if necessary.

Subscribe to:

Comments (Atom)