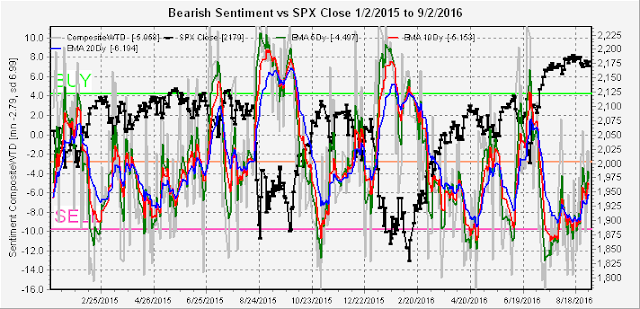

As expected, the Initial Unemployment Claims correctly forecast a weaker jobs report on Friday than last month with a resulting bounce from the 2160 area I expected. From a trading perspective, however, most of the week looked like distribution with early morning selloffs followed by slow rallies throughout the day, so I did not play the rally. Not much change in the indicators with mostly neutral readings. With football season beginning, I would compare this to halftime with the bulls ahead in the score, the only question is whether the second half will see a change in momentum.

The overall Indicator Scoreboard is little changed from last week.

The Short term Indicator has also flattened out with a slightly negative bias.

The VIX P/C is also little changed, hovering near the mean.

Conclusion. There is little reason for excitement, as the indicators continue to grind sideways in a pattern most similar to the first half of 2015. Still working on the DUST/NUGT splits, so no results until next week.

Weekly Trade Alert. The daily trading patterns last week kept me from going long at SPX 2160, but I doubt that the current rally exceeds 2185 for long and is likely to revisit the 2160 area soon. No trades for now.

No comments:

Post a Comment