Most of my outside projects are nearing completion, so I will be able to devote more time to analyzing sentiment trends. Of note last week, the bearish levels of the Short Term Indicator components (VXX $ Volume and Smart Beta P/C) soared, while the overall P/C ratios were more subdued (declining VIX P/C). Also, the SKEW has been accurately forecasting market moves rising to the mid 130s before a decline and dropping to the mid 120s before rallies, with Friday's close at 125 being short term bullish. I will also be looking at some of the ETF ratios including the SPXU/UPRO and DUST/NUGT.

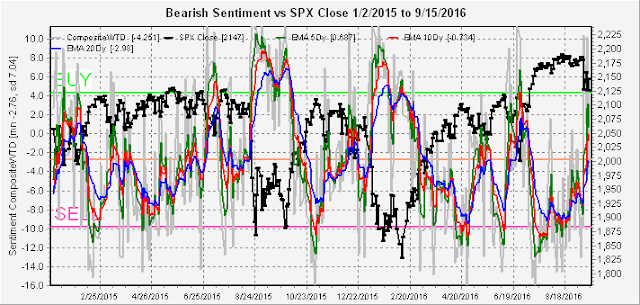

The overall Indicator Scoreboard continues to mimic the first half of 2015. Rising from a more extreme low, this indicator is approaching levels of the March 2015 decline and has increased almost as much as the early July 2015 decline.

The Short Term Indicator has risen more sharply with the medium term EMAs approaching the early July 2015 level. This indicates that a rally to test the ATH at SPX 2194 is likely to start next week.

Several times,I have referred to the SPXU/UPRO ratio as an excellent short term indicator and this time it seems to agree with the Short Term Indicator by showing behavior that mimics the July 2015 period. This points to the possibility of a fast and furious rally that is likely to fail.

For the last of the market indicators, the VIX P/C continues decline as expected, now approaching the equivalent of April 2015.

Finally, the gold miners ETF ratio DUST/NUGT. As it turns out, by waiting a couple of weeks, the effects of the double split worked themselves out so no smoothing was needed. This is definitely looking like a topping formation with a clear reverse mirror image to the last half of 2015.

Conclusion. It still continues to look like that by the end of the year gold miners, bonds and the general stock market will be in decline. For the general market the most likely period seems to be November for the final high which for now my guess is in an SPX range of 2185 to 2215.

Weekly Trade Alert. A rally is likely to start by mid-week. I doubt the FOMC will raise rates before the election, but even so, any decline is likely to be brief and shallow. Ideally, I want to go long at 2115 with a stop at 2100 and a target of 2185.

No comments:

Post a Comment