There is not much change in the short term sentiment view this week, so I want to take a broader view of several of the ETF sentiment charts since the same theme seems to be prevalent in each.

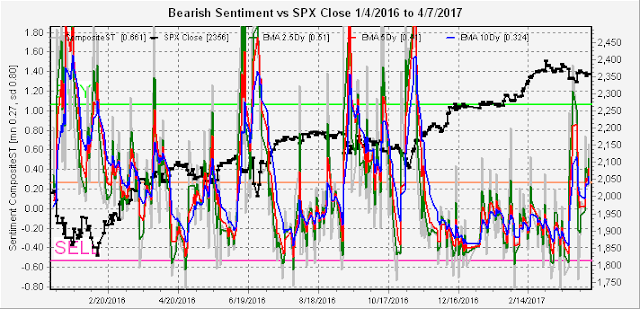

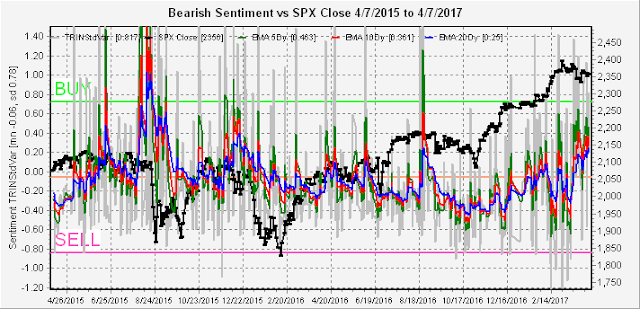

First to cover normal stock sentiment I will use the intermediate Indicator Scoreboard (overall composite), Short Term Indicator (VXX $ volume and Smart Beta P/C), and TRIN.

The Indicator Scoreboard shows continued rising bearish sentiment after reaching an official SELL, similar to the June and November readings in 2015 as antsy bears load up on puts while trying to pick market tops. Previously this has resulted in a sharp short covering rally after a BUY is generated causing sentiment to fall back to the -8.0 level before a serious decline.

The Short Term Indicator remains near neutral with no clear direction indicated.

The TRIN continues to inch upward showing declining volume support as measured by net advances/net advancing volume similar to the June and December 2015 periods.

The ETF section covers the SPX, NDX, BKX, TNX and HUI. First the SPX with SPXU/UPRO is clearly the lowest bearish sentiment of the last several years.

The NDX with SQQQ?TQQQ is similar and even more extreme than the SPX. The correlation that comes to mind is 1999-2000 with the tech blow off prior to the Bush II Presidency.

The BKX with FAZ/FAS is a new measure for the banking sector which at least price wise is showing the H&S pattern as the RUT measure show last week. The main difference is that the BKX is much more influential for the DJIA and SPX.

Next, the bond sentiment using TNX with TBT/TLT is showing rising bearish sentiment even as interest rates fall. Overall, the contrary position is that the inflation/growth expectations seen in the stock and gold markets may be unwarranted with a two year inverse H&S pointing to a possible drop to 2.0% or lower.

Finally, for gold stocks (HUI) with DUST/NUGT bearish sentiment remains weak.

Conclusion, Whether true or not, sentiment all seems to point to strong expectations of inflation and higher growth. The most unexpected outcome may be the stagflation equivalent of the 1970s with low growth and rising interest rates as the FED tries to "normalize" policy.

Weekly Trade Alert. None. A drop to the SPX 2300-30 area seems to be the most likely to set up a short covering BUY that would be consistent with prior tops. Updates if necessary at @mrktsignals.

No comments:

Post a Comment