Last week, I showed two topping patterns from 2015, here, June-July and Nov-Dec, but I forgot to discuss the later which appears to be what happened. June-July saw an extended bottom with lower retest setting up sentiment for a larger rally, while Nov-Dec saw a spike low followed by a sharp, but weaker rally, that lead to a higher retest. Sentiment last week seemed to support the second scenario with rapidly falling bearishness until Friday. EOQ window dressing obviously was a big factor for the rally and Friday everyone assumed that a failure would follow as P/C ratios soared, intraday here, driving up the VIX. VXX volume was weak throughout the day but increased by 50% the last hour and after hours.

The net result was an increase in bearishness using the Short Term Indicator (VXX $ volume and Smart Beta P/C) that delayed the SELL that seemed likely earlier in the week. So its hard to tell if we follow the Nov-Dec period with a higher retest to SPX 2330+ then rally, or maintain some upward momentum until a SELL is generated.

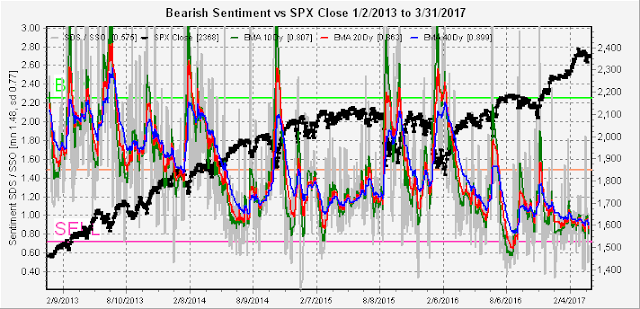

Longer term sentiment patterns going back to 2013 for the SPX using the SSO/SDS ETFs, however, still lead me to believe that a topping pattern of some magnitude is forming.

Intermediate Term Indicators

The overall Indicator Scoreboard for the SPX has continued to stair step upwards in a pattern similar to the 2015 tops as well as mid 2016, but the recent pullback has moved sentiment back to neutral.

One index that may be giving an indication of the future is the RUT, now up more than 50% from its early 2016 lows, where a large head and shoulders pattern may be forming.

Bearish bond sentiment (TNX) continues to inch upwards with the expectation of higher growth and inflation, but the contrarian position is that the Republican low tax/high growth agenda may face continued problems.

Finally, bearish sentiment for gold stocks (HUI) is little changed with the HUI hovering around the 200 level.

Conclusion. The price targets given last week of SPX 2325 to the downside and 2380 worked out well, but my ignoring the EOQ effect and the Nov-Dec 2015 possibility kept me out of the market. The recent uptick in bearishness Friday supports a trading range for the next few weeks. Potential problems for the tax cut bill will probably be shown by the debt ceiling debate as tax cuts and increased infrastructure spending can only occur with large increases in government debt.

Weekly Trade Alert. None expected. Updates as required at @mrktsignals.

No comments:

Post a Comment