I. Sentiment Indicators

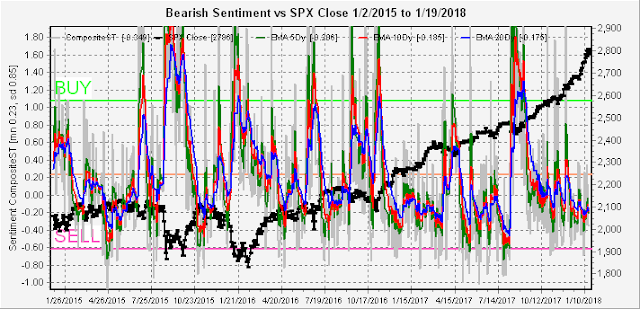

The overall Indicator Scoreboard continues to show extremely low levels of bearishness.

While the Short Term Indicator (VXX $ volume and Smart Beta P/C) had a very small uptick in bearishness due to divergences in the two components.

The VXX $ volume saw a sharp uptick comparable to the Jul 2017 SPX 50 pt decline, supporting higher prices short term.

The Smart Beta P/C (Equity Calls/ETF Puts), however, saw a sharp drop as individuals seemed to be piling into Equity Calls, which is usually a sign of excess frothiness. So overall, higher prices are likely but with higher risk.

The SPX short term ETFs SPXU/UPRO also saw a sharp run up in bearish sentiment, matching the early Dec pullback of SPX 40 pts that was followed by a rally of 180 pts.

The NDX short term ETFs SQQQ/TQQQ sentiment has also spiked higher reaching the BUY level. It is very possible that a topping process similar to mid 2015 forms where the SPX traded in a 5% range for several months (2000-2100), even as the NDX continued higher into Jul due to the higher level of bearishness.

Bond sentiment (TNX) was virtually unchanged even as rates broke above the 2.6% area with 2.7-2.8% seen as the first area that could be a drag on the SPX.

The gold miners (HUI) seem to have run into strong resistance at HUI 200 and GDX 24 with little support from sentiment which is also unchanged. Target updates in the options OI section.

II. Options Open Interest

This week I will take a look at Feb's monthly options for VIX and GDX as well as weekly and monthly for SPY (close 280.4, SPX 2810). Looking at the SPY for Wed, we a "most likely" at 278.5, but delta hedging over 280 can push prices higher with strong support at 276.

For Fri, SPY "most likely" drops to 277.5 with delta hedging over 280 and strong resistance at 284-85.

For EOM Jan, the most noticeable feature is huge support at SPY 273-74, beyond that we also have delta hedging from 278 to 281, and "most likely" at 277.

Looking at Feb monthly for SPY, over 280 then next resistance is 286, below 280 could pust down to the "most likely" at 277 and the relatively large number of calls below 277 could push down to 273.

For the Feb VIX, strong put support at 12 and call resistance at 15 is likely to keep the VIX in s tight range with a "most likely" at 12.5. A move over 15 could run up to 21 with delta hedging. Last week started at 10.4, ran up to 12.8, then fell back to 11.3, so this implies more volatility than seen recently.

For Feb GDX, we have support at 23 and resistance at 25, "most Likely" is 23.5. The most noticeable feature is lack of support/resistance outside this range that could mean a large move is possible in either direction.

Conclusions. Last Tue's sharp reversal and 40 pt SPX drop from a high at 2808 was apparently viewed as an important top by many as shown by sentiment using VXX $Vol, SPXU/UPRO, and SQQQ/TQQQ that indicate a short term rally is likely to EOM Jan. Likely targets are SPX 2840-50. SmartBeta PC, VIX Call Indicator (last week), and VIX options OI point to a possible volatile period ahead (EOM with FOMC?) thru Feb. Note: chart on BA last 18 mns looks like Bitcoin at top.

Investment Diary, update 2017.10.28, Indicator Primer

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2017 SentimentSignals.blogspot.com

Magnumax Fish such as sardines trout and mackerel can be the perfect sources of fatty chemicals. Nuts and various other seeds are perfect sources of fats too. Steroids likewise cause a person to be more aggressive it can damage the liver and sometimes even can cause problems with other important bodily processes. http://jackedmuscleextremeadvice.com/magnumax/

ReplyDelete