Over the holidays, I downloaded several indicator components from stockcharts.com going back to 2001 in order to see how sentiment indicators would work in bear markets. Many of the variables I use were either non-existent or had insignificant volume prior to 2009, including volatility products and leveraged ETFs. However, I was able to reconstruct the Trifecta Model copied from the Humble Students blog. This model consists of the VIX term structure (VXV/VIX), SPX overbought/oversold indicator (SPXA50R/SPXA150R), and TRIN. I replaced the TRIN with a measure of market strength I've been using for over a year, the SPX bullish percent divided by the equity put/call ratio (BPSPX/CPCE).

The following chart shows the performance of the Students Trifecta from Apr 2007 to Apr 2009.

Early 2007 showed very low bearish sentiment until the July-Aug selloff that increased bearish sentiment to an extreme > 1 SD over the mean. However, by the time the market had rallied to a new high in Oct, bearishness had fallen to a low extreme, marking a market top. This was followed by a selloff of about 18% into mid-Jan 2008 that generated much lower lows in stock prices but lower highs in bearishness. After rallying into early Feb, over the next several weeks the market traded sideways to down, until a sharp rally occurred in Mar-Apr. This time bearish sentiment reached an even lower extreme than the Oct 2007 high. Of course, during this time President Bush was claiming that the economy was the strongest he had seen, Ben Bernanke appeared on TV claiming the the sub-prime problem was well-contained, and market pundits were predicting DJIA 20,000 by the end of 2008.

But then we had the October crash were the SPX fell 30% from 1200 to 800 and bearish sentiment reached a severe extreme over 2 SD from the mean. But never fear, a year-end rally of 20% convinced everyone that the worst was over and bearish sentiment fell to the level of the Oct 2007 high, only to be followed by a plunge into March 2009.

The next chart shows the period from 2011-12, the Euro (Greece) crisis. Here, the Students Trifecta performed fairly well, but not as well as 2007-09, probably due to the fact that the source of the crisis was overseas and not as well anticipated.

So where does that leave us today looking at the period from the second half of 2014? Oddly, the Aug selloff with very extreme bearish sentiment, followed by an Oct rally that produces low bearish extreme sentiment, followed by a Dec-Jan selloff that produces less extreme beariush sentiment seems to be repeating the 2007-08 fractal. I would become extremely worried if a Mar-Apr rally produces lower bearish sentiment than we saw in Oct-Nov of 2015.

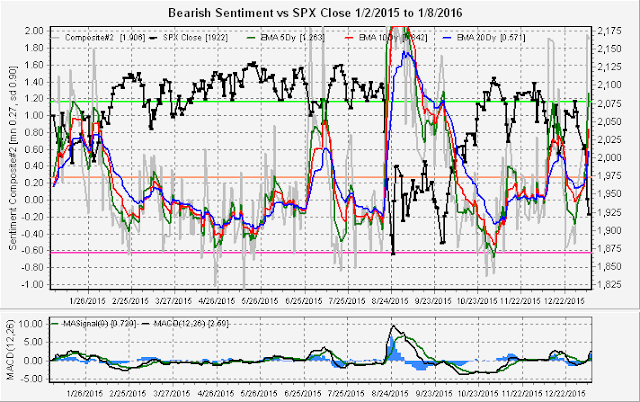

How does the Student Trifecta model compare to other sentiment models? Below is the Composite#2 (Put/Call, VXX $ Volume, and VXV/VIX). As I have noted before there is a high correlation between many of the sentiment models as are these, although the Composite#2 may be better at picking tops.

What exactly does the BPSPX/CPCE show? When used alone this is a confirming, not a contrary indicator as high levels indicate underlying market strength. This also tends to be a leading indicator and gave several months notice before the Aug decline. The levels today are almost a mirror image of the first half of 2014, extreme high to extreme low, indicating lack of internal strength.