<title>Pretty Much as Expected

Pretty Much as Expected

The sale of my house went well but was hectic as expected taking up much of my

time the last few weeks which included finding a new home in a somewhat more rustic

area at less than half the price. My outlook early Sept in my last post with the

SPX at ATHs near 4540 was for a correction of 3-5% into late Sept - early Oct, and

the bottom was the first week in Oct at -6%.

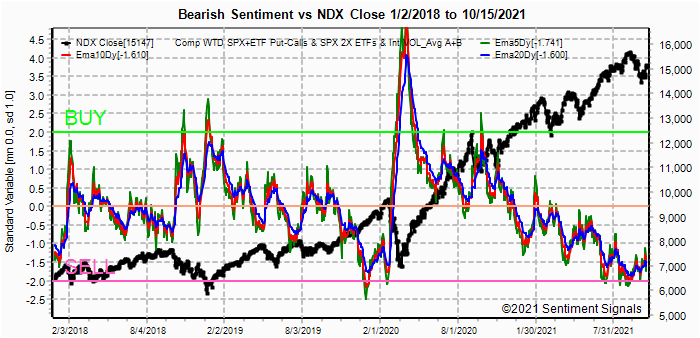

Surprisingly, the increase in bearish sentiment was fairly mild, especially in

the options FOMO indicators and the SPX ETFs. For this reason, I see little support

for some of the aggressive bullish targets of some in the SPX 4900+ range, but we

may see limited ATHs of 4650 by the EOY. One of the reasons that I expected limited

downside in Sept-Oct was the VIX Buy&Sell components (see Tech/Other), but recent

changes indicte the next correction may be larger (10%+).

ST/INT indicators are showing that the current rally is running out of gas, and

that a 50-60% retracement of the recent move from SPX 4270 (4350-80) is likely over

the next two-three weeks. The trend since May had been a late-early month rally

followed by an options exp week pullback which is usually accumulation (bullish INT),

while the current trend maybe reversing with rallies into opt exp (distribution,

bearish INT).

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate

components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT

ratio (40%), and 3rd a volatility indicator (30%) which combines the options

volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the VXX $ volume.

This composite is showing very little increase in bearish sentiment with the

recent SPX decline with a setup similar to the Feb 2020 top.

The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio

indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the VXX $ Vol/SPX Trend. Weights

are 80%/20%.

This component gave a strong Sell at the early Sept top, and a Buy somewhat

early in the mid-Sept decline, and is now nearing another Sell.

The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%)

and includes ST Composite (12%) and three options FOMO indicators using SPX (12%),

ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO

is shown when strong call volume is combined with strong NY ADV/DEC. See

Investment Diary

addition for full discussion.

This indicator also gave at strong Sell at the early Sept top and has since only

shown a weak increase in bearish sentiment. Of note is the new low for the SPX FOMO component.

The EMA version shows that weakness is is expected ST.

Bonds (TNX). Bearish sentiment in bonds has shown little change and is

neutral at best.

For the INT outlook with LT still negative, the gold miners (HUI) bearish

sentiment is presented in a new format using the data mining software to add

the inverse TNX rate to the ETF ratio.

The HUI briefly broke thru the 240 support level, but has since rallied to upper

support. A more significant decline is likely to coincide with expected

weakness in SPX starting early 2022.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT

term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs

increases the duration (term).

Only small increase in bearish sentiment on the recent pullback is a warning of

more significant trouble ahead.

And the sister options Hedge Spread bearish sentiment as a ST/INT indicator

(outlook 1-3 mns) is showing that hedgingnis the major form of support for the

market ST/INT. There is a good chance that hedging will pullback sharply

when favorable seasonality is in full swiing, setting up the potentil for a

sharp pullback to follow similar to late 2015.

Taking a look at the ETF ratio of the INT term SPX INT (2X) ETFs (outlook 2 to 4 mns)

as bearish sentiment, much weaker bearish sentiment is present now than before

the Feb 2020 top.

The INT term NDX ST 3x ETFs (outlook 2 to 4 mns) bearish sentiment has increased

more strongly than the SPX and may explain the current strength in prices with

the rise in int rates.

III. Options Open Interest

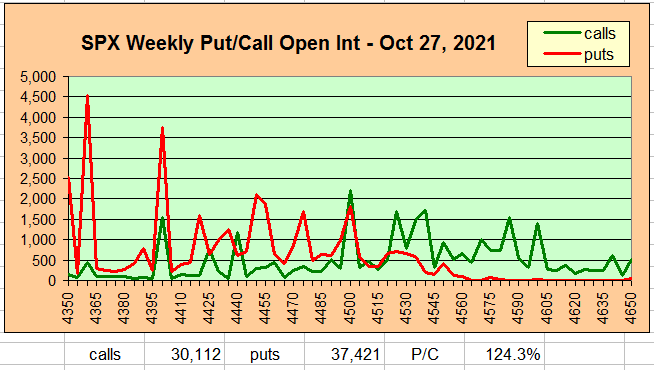

Using Thur closing OI, remember that further out time frames are more likely

to change over time, and that closing prices are more likely to be effected.

Delta hedging may occur as reinforcement, negative when put support is broken

or positive when call resistance is exceeded. This week I will look

out thru Oct 22 Also, this week includes a look at the GDX and TLT for Nov exp.

With Fri close at SPX 4470, options OI for Mon is small, but low P/C over 4400

indicates that a positive open could reverse by the close.

Wed has somewhat smaller OI where SPX call resistance is stronger over 4400,

indicating a decline to that area is possible.

For Fri stronger put support up to 4400 should contain or reverse early week

weakness.

Using the GDX as a gold miner proxy closing at 32.5, put support at 32 and call

resistance at 33 may limit movement.

Currently the TLT is 145 with the TNX at 1.58%, high P/C and no call resistance

until 148 could mean some weakness in int rates and higher TLT prices.

IV. Technical / Other

During the Aug-early Sept on of the longer term sentiment measures whih did not seem to

line up with the outlook of many for a 10%+ decline in the SPX was the VIX Buy&Sell

component difference (SKEW and VIX term structure), but the recent trends have now

reversed and now show increasing risk.

Another LT indicator, the NYSE ADV/DEC volume has not yet shown the MA drops

below 1.5 seen prior to the declines since 2018, but may be following the

2007-08 pattern with a delayed dropoff.

Conclusions. .

Weekly Trade Alert. . Updates

@mrktsignals.

Investment Diary,

Indicator Primer,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021 (in progress),

update 2020.02.07

Data Mining Indicators,

update 2019.04.27

Stock Buybacks,

update 2018.03.28

Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2021 SentimentSignals.blogspot.com

The sale of my house went well but was hectic as expected taking up much of my

time the last few weeks which included finding a new home in a somewhat more rustic

area at less than half the price. My outlook early Sept in my last post with the

SPX at ATHs near 4540 was for a correction of 3-5% into late Sept - early Oct, and

the bottom was the first week in Oct at -6%.

Surprisingly, the increase in bearish sentiment was fairly mild, especially in

the options FOMO indicators and the SPX ETFs. For this reason, I see little support

for some of the aggressive bullish targets of some in the SPX 4900+ range, but we

may see limited ATHs of 4650 by the EOY. One of the reasons that I expected limited

downside in Sept-Oct was the VIX Buy&Sell components (see Tech/Other), but recent

changes indicte the next correction may be larger (10%+).

ST/INT indicators are showing that the current rally is running out of gas, and

that a 50-60% retracement of the recent move from SPX 4270 (4350-80) is likely over

the next two-three weeks. The trend since May had been a late-early month rally

followed by an options exp week pullback which is usually accumulation (bullish INT),

while the current trend maybe reversing with rallies into opt exp (distribution,

bearish INT).

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate

components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT

ratio (40%), and 3rd a volatility indicator (30%) which combines the options

volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the VXX $ volume.

This composite is showing very little increase in bearish sentiment with the

recent SPX decline with a setup similar to the Feb 2020 top.

The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio

indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the VXX $ Vol/SPX Trend. Weights

are 80%/20%.

This component gave a strong Sell at the early Sept top, and a Buy somewhat

early in the mid-Sept decline, and is now nearing another Sell.

The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%)

and includes ST Composite (12%) and three options FOMO indicators using SPX (12%),

ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO

is shown when strong call volume is combined with strong NY ADV/DEC. See

Investment Diary

addition for full discussion.

This indicator also gave at strong Sell at the early Sept top and has since only

shown a weak increase in bearish sentiment. Of note is the new low for the SPX FOMO component.

The EMA version shows that weakness is is expected ST.

Bonds (TNX). Bearish sentiment in bonds has shown little change and is

neutral at best.

For the INT outlook with LT still negative, the gold miners (HUI) bearish

sentiment is presented in a new format using the data mining software to add

the inverse TNX rate to the ETF ratio.

The HUI briefly broke thru the 240 support level, but has since rallied to upper

support. A more significant decline is likely to coincide with expected

weakness in SPX starting early 2022.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT

term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs

increases the duration (term).

Only small increase in bearish sentiment on the recent pullback is a warning of

more significant trouble ahead.

And the sister options Hedge Spread bearish sentiment as a ST/INT indicator

(outlook 1-3 mns) is showing that hedgingnis the major form of support for the

market ST/INT. There is a good chance that hedging will pullback sharply

when favorable seasonality is in full swiing, setting up the potentil for a

sharp pullback to follow similar to late 2015.

Taking a look at the ETF ratio of the INT term SPX INT (2X) ETFs (outlook 2 to 4 mns)

as bearish sentiment, much weaker bearish sentiment is present now than before

the Feb 2020 top.

The INT term NDX ST 3x ETFs (outlook 2 to 4 mns) bearish sentiment has increased

more strongly than the SPX and may explain the current strength in prices with

the rise in int rates.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely

to change over time, and that closing prices are more likely to be effected.

Delta hedging may occur as reinforcement, negative when put support is broken

or positive when call resistance is exceeded. This week I will look

out thru Oct 22 Also, this week includes a look at the GDX and TLT for Nov exp.

With Fri close at SPX 4470, options OI for Mon is small, but low P/C over 4400

indicates that a positive open could reverse by the close.

Wed has somewhat smaller OI where SPX call resistance is stronger over 4400,

indicating a decline to that area is possible.

For Fri stronger put support up to 4400 should contain or reverse early week

weakness.

Using the GDX as a gold miner proxy closing at 32.5, put support at 32 and call

resistance at 33 may limit movement.

Currently the TLT is 145 with the TNX at 1.58%, high P/C and no call resistance

until 148 could mean some weakness in int rates and higher TLT prices.

IV. Technical / Other

During the Aug-early Sept on of the longer term sentiment measures whih did not seem to

line up with the outlook of many for a 10%+ decline in the SPX was the VIX Buy&Sell

component difference (SKEW and VIX term structure), but the recent trends have now

reversed and now show increasing risk.

Another LT indicator, the NYSE ADV/DEC volume has not yet shown the MA drops

below 1.5 seen prior to the declines since 2018, but may be following the

2007-08 pattern with a delayed dropoff.

Conclusions. The actions of the past few weeks were not totally unexpected as rampant bullish sentiment was warning that some negative surprises were ahead. The biggest surprise may be the lack of bearish sentiment that resulted from the somewhat larger decline than expected. For the past several months I have been looking for a pattern of rallies in optn expirations as a sign of distribution and last week may be that sign, and a continuation of this pattern in Nov and Dec may finally be a setup for a Sept-Oct 2018 type top. If so, we could start with a 15-18% decline in Q1 2022 (below SPX 4000) that could continue into the first half of 2023 and result in a 35-40% decline. I have a sneaky felling that the proximate cause could be trouble in the Dems party, either as a result of mid-term elections/Bidens health issues/or both.

Weekly Trade Alert. Some weakness and choppy trading is expected over the next 2-3 weeks, resulting in a 50-60% retrace of the move off recent lows of SPX 4280. Updates

@mrktsignals.

Investment Diary,

Indicator Primer,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021 (in progress),

update 2020.02.07

Data Mining Indicators,

update 2019.04.27

Stock Buybacks,

update 2018.03.28

Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2021 SentimentSignals.blogspot.com