The good news is that the SPX 2800 level held, but for how long? There has been steady deterioration in the $SKEW (an indicator of complacency) that is reminiscent of late 2018 as well as 2007-08 (more in Tech/Other).

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment decreased sharply, but no further lows are expected until a drop below neutral.

The INT view of the Short Term Indicator (VXX+VXXB $ volume and Smart Beta P/C, outlook two to four months) bearish sentiment has declined to below neutral, so more volatility is expected.

Bonds (TNX). Interest rates continued to fall with fear of a trade war with China overshadowing low bearish sentiment.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is in a slow decline matching the price declines. Some progress towards the GDX 21 level, as indicated by last weeks options OI, was seen, but could not hold.

II. Dumb Money/Smart Money Indicators

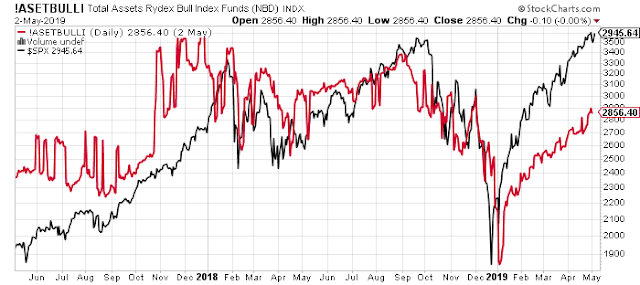

For this week and possibly for the next several months, I am going to replace the DM/SM ETF indicators with other indicators.

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) reached the level normally associated with a BUY, but does not seem to be having much of an effect in a "trade news" driven market.

The INT term SPX Short Term (3x/SM) ETFs (outlook two to four weeks) bearish sentiment may give some hope to the bulls short term as sentiment reached the levels of the Apr 2018 retest.

The INT term NDX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment has also reached an extreme matching the Feb 2018 crash and Apr 2018 retest. Together with the SPX ETF indicator some consolidation, or a possible move back toward SPX 2900 seems likely before any significant downside..

III. Options Open Interest

Using Thur close, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. This week I will look out thru May 31. Also, This week includes a look at the TLT thru Jun.

With Fri close at SPX 2826, Mon & Wed are so light OI that effects may be minimal, but a move towards SPX 2850-60 is possible.

Wed SPX puts show very small support between 2840-75, while larger support is at 2800, and call resistance is minimal.

For Fri, with large OI, looks like a copy of last Fri, where a range of SPX 2825-75 is likely to contain prices and 2850 is most likely.

The TLT 20 year bond fund is used as a proxy for interest rates. For the last several years when the TNX was 112 when the TNX was 3.2% (11/2018), the TLT was 124 when the TNX was 2.5% (12/2017), and the TLT was 140 when the TNX was 1.5% (08/2016).

Currently the TLT is 127.8 with the TNX at 2.32%. The puylook for TLT is little changed from two weeks ago, as strong put support at 120 and declining call resistance over 125.

IV. Technical / Other

A long term look at the $SKEW as a measure of complacency is again showing a disturbing trend that resembles the 2007-08 top. The sharp decline from the Oct SPX highs was a warning, and this may indicate longer term troubles.

Although I still not in the "crash and burn" camp, sentiment behavior over the last week (pullback in bearishness) has me leaning more towards the stair step type of decline with an expected time frame of about a year. This fits the topping pattern of a double top or giant "M" where the down leg is usually about half the time of the up leg. The downside price target is the late 2016 level of SPX 2100-200.

Conclusions. Overall this a news and not a sentiment driven market, specifically the ongoing verbal fisticuffs between the US and China. In many ways, China is following the same path of military and economic expansion followed by Japan in the 1920s and 1930s which led to its dominance of the Far East including much of China. Perhaps this is why appeasement is not acceptable to the US, in order to prevent a similar situation to WW2 in the Far East. That being said, the stock market is likely to be fighting a war of attrition that is likely to go 10 to 12 rounds, rather than a 1 to 3 round knockout.

Weekly Trade Alert. Options OI shows little gains are likely by the EOM, but high bearish sentiment may surprise with a move back to SPX 2900 in June before significant additional downside. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2019.04.27 Stock Buybacks, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2019 SentimentSignals.blogspot.com