Looking at some historical background, this is the second trade war between China and the West. The first trade war, known as the Opium Wars 1 and 2. Britain started trade with China in the 1600s, mainly the purchase of tea, porcelain, and silk. Over the years China ran up a huge trade surplus that finally led to a shortage of silver in Britain, so the East India Company devised a plan to import opium from India to sell in China. This corrected the trade imbalance but created a country of opium addicts and in the mid-1700s China declared the sale and smoking of opium illegal. After little progress, in 1830 the Chinese emperor confiscated 1,200 tons of opium from British ships and blocked foreign trade. The British in retaliation declared war, sending their navy to crush Chinese resistance and force agreement to very unfavorable trade terms. In the second war, Britain was joined by the US, Russia and France with similar results. No wonder China is building up a military presence in the China seas. This was around the time that the US fought a war with Mexico, seizing Texas and California (the two most populous states), perhaps if things had turned out differently, Mexico would be having problems with US immigrants. Of course, we owe lax regulation of big pharma for our current opioid crisis.

Today I am going to add some historical charts for sentiment comparison to the 2015 for several of the indicators.

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) rose sharply with last weeks pullback by a similar amount to the May pullback, but also similar to the early stages of the Aug 2017 volatility.

Looking back to the 2015 period for some clues, starting with the Aug flash crash compared to the Jan-Feb 2018 crash, there is a lot of similarity between now and early Nov 2015 where a failure of the Aug 2015 low retest to make new highs several months later was followed by a sharp downturn of 4-5%. From what I remember, in 2015 everyone was expecting the SPX to continue on to 2300-400, similar to today's calls for 3000+.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four months) saw a much smaller bounce, indicating that a much larger decline is likely needed to duplicate the huge jump in bearish sentiment seen in Aug 2017.

Bearish bond sentiment (TNX) is well off its highs as rates have stabilized around 2.9% for now, providing a neutral background for stocks..

Returning to the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment spiked briefly then fell again as prices rebounded Friday.

II. Dumb Money/Smart Money Indicators

Continuing with the longer term (INT) sentiment picture. The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 days/hours) remains near the INT SELL level within a downward sloping trend since Jan, now slightly exceeding the level of July 2017.

The option-based Dumb Money/Smart Money Indicator also saw a sharp bounce matching the Indicator Scoreboard that could mean a weak bounce (SPX 50+ pts from low) or a continuation downward in prices until a BUY is reached.

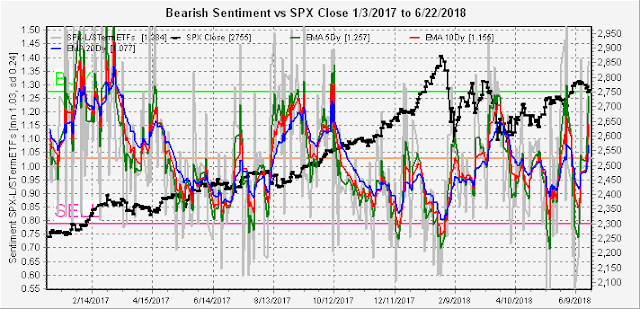

The INT term SPX Long Term/Short Term ETFs (outlook two to four weeks) rose sharply last week reaching the level of the May low that may mean a bounce or could follow the pattern of July 2017 with new lows.

The INT term NDX Long Term/Short Term ETF Indicator (outlook two to four weeks) saw bearish sentiment continue higher last week buoyed by Dumb Money (2x) selling and Smart Money (3x) buying.

III. Technical Indicators, Other

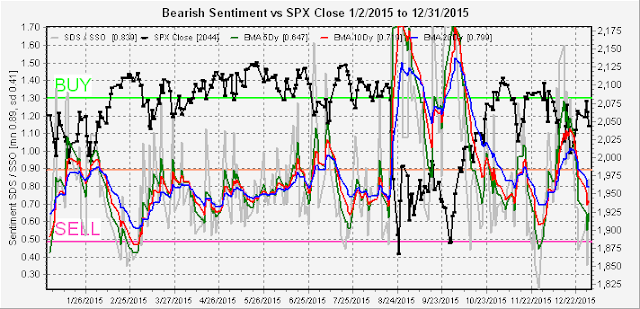

This week I want to take a closer look at some of the SPX ETF indicators comparing 2015 to 2017-18. Starting with the SDS/SSO ETF (2x) sentiment in 2015, you can see that the SELL level was reached several months before the May top with a secondary low a month before the Aug crash. Following the crash, a SELL was not reached until a month after the rebound top in early Nov with a secondary low right before the Jan decline.

Moving to 2017-18, a SELL was reached in Oct with a secondary low in Dec, both well before the Jan top and similar to 2015. Currently, sentiment is well away from a SELL, but is at the same level as the Nov 2015 top. This has kept me from becoming immediately bearish, but if the 2015 analog continues, a larger decline than expected may currently unfold (SPX 2675-2700), followed by a sharp rally that fails (SPX 2770-80) but drops bearish sentiment to a SELL.

Looking at the SPXU/UPRO ETF (3x) sentiment for 2015, we see a similar pattern, but the 2x Dumb Money seems to be the better contrary indicator.

For 2017-18, again we see a sentiment SELL well before the Jan high with secondary sentiment lows in Dec. Current sentiment is also near the Nov 2015 level.

IV. Options Open Interest

Using the Thur closing data. Mon has very small open int size with small put support up to SPX 2770 and large resistance at 2790 and 2800 similar to last Fri. I wonder if someone is expecting "unexpected news" such as the dropping of the FBI investigation into the Trump/Russia connection. Resistance can be used for a "pop and drop" with little put support until 2725.

For Wed, support and resistance show an expected close at SPX 2765, but there is little support below 2750 until 2700.

For Fri, open int is large with overlapping positions between 2750-80 that largely cancel out. Larger resistance is at 2790 with support at 2725. For the week the relevant range looks to be SPX 2725-90.

Last week I forgot to mention the Wed monthly VIX options open int (wrong title), but it showed the possibility of a move to 15 with Tue high at 14.68.

Jul 18 monthly is about the same.

Conclusions. Trumps second salvo at China in the new trade war may have aborted the run to SPX 2800+. The links to the previous trade war may give some background supporting China's reluctance to comply, and I doubt if will be as easy to win as Trump expects. A "pop and drop" is still possible but may only reach SPX 2790-2800. More worrisome are the comparisons to 2015 where several of the INT indicators look analogous to Nov 2015 that point to a possible drop to 2700 or lower to be followed by one last abortive run toward 2800.

Weekly Trade Alert. No specific targets for this week. A drop toward SPX 2675 would be a ST BUY, while 2790 would be a SELL. Trading range 2730-80 possible. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment