Starting next week, I will begin publishing on Sun AM rather than Sat PM in order to avoid the option open int update problem. Earlier when I was using the SPY, it did not seem important, but recently using the SPX is giving better results and for some reason the Fri options data is not updated at CBOE until Sat night (probably going back to Fri only times), while the M/W are updated overnight. I have more free time on Sat, so I will continue to do most the of update Sat, but leave the options and conclusions to Sun.

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) climbed back above the mean with last weeks selloff, reaching the level of the July 2017 pullback which was followed by an SPX 85 pt rally lasting about 4 weeks before the next decline.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four months) also saw a weak bounce comparable to July 2017.

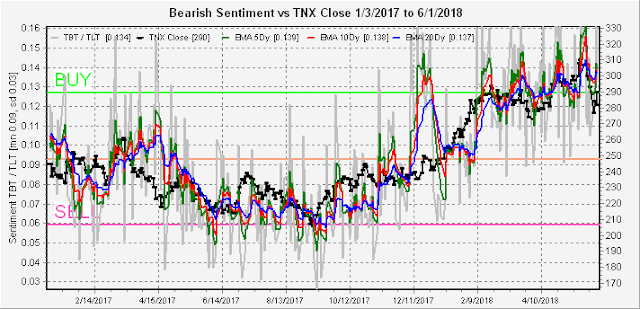

Bearish bond sentiment (TNX) remains at high levels as rates briefly fell to 2.8% before closing at 2.9%.

The gold miners (HUI) bearish sentiment has started to rise again as prices seem to be leveling off around the 180 level.

II. Dumb Money/Smart Money Indicators

The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 days/hours) as a very ST indicator briefly rose to a trendline weak BUY, but pulled back to neutral by the end of the week.

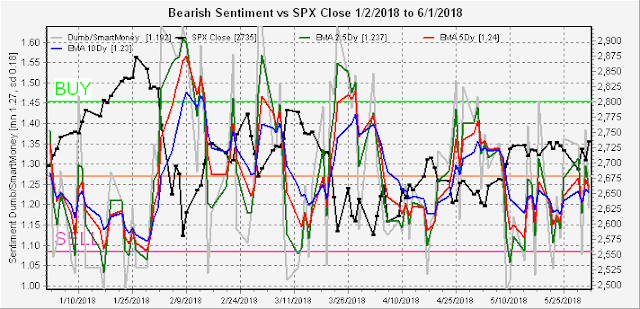

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 days/weeks) also briefly rose above neutral then fell back.

The INT term SPX Long Term/Short Term ETFs (outlook two to four weeks) was the big story of the week, as Mon price action resulted in a BUY trigger. This was a result of strong dumb money (2x) selling and modest smart money (3x) buying. Comparing sentiment to previous periods, similar to the Indicator Scoreboard, the results are most like July 2017 which saw a brief price spurt (SPX 85 pts) then a consolidation period before a sharper decline.

The INT term NDX Long Term/Short Term ETF Indicator (outlook two to four weeks) continued to rise early in the week with the NDX closing at 7084 just 100 pts from testing its ATH. This may be similar to Aug 2015 when the NDX mades its yearly high several months after the SPX.

III. Options Open Interest

The early week volatility did result in more puts being added which pushed last Fri expected close to SPX 2710-25, so the 2735 close was a sign of strength.

Most of the next two weeks show a range of SPX 2700-50 (Thurs options). For Mon the strongest resistance is at 2735 with strong support down at 2625. Pushing prices higher may be difficult, but overall sentiment does not show much reason for a decline either.

For Wed, support is at SPX 2675 and resistance is at 2740 and 2760, so a modest advance is more likely.

For Fri, the larger open int also shows more resistance starting at SPX 2725 and support at 2700. So some sort of pullback is likely at the end of the week.

For options exp Fri, strong resistance at SPX 2750 and modest support at 2700 are likely to contain prices.

For the June 29 EOM, resistance for the SPX starts at 2700 upward, so a pullback is likely to start by the end of June.

Conclusions. The whipsaw expected last week was much quicker than expected but was able to drive up bearish sentiment enough to improve the outlook for the SPX 2750-75 target topping area. Both Indicator Scoreboard and SPX LT/ST ETF sentiment show strong comparisons to July 2017 that point to a target of SPX 2760+ with a consolidation over the month of June. June EOM options open int does show the possibility of late month weakness.

Weekly Trade Alert. Specific targets were not triggered last week, but the momentum short trade on a break of SPX 2700 Tues was good for 20+ pts. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment