Last week the SPX followed followed my guidelines almost perfectly - until the last hour of trading on Fri. Last week's SPX option OI showed the potential for a strong rally Mon with large put support at 3940 and the day started out strongly with a rise into mid-aft to 3955 before closing at support at 3941. With an expected range for the next two weeks of 3850-3950 based on the large EOM call OI at 3900, the SPX began to pullback, falling to a low Thur AM at 3854 and began to rally. Reaching 3945 by mid-Fri. a pullback began to 3915 before an explosive rally began, up 40 SPX pts the last hour.

What happened? I remembered reading earlier in the week about a potential gamma-related short squeeze due to falling VIX discussed by Nomura's C.McElligott at ZH. It's a little bit over my head, so don't be surprised if you don't understand all of it. Then again late Fri, they came out with another report predicting a large rally on Mon 29th targeting the SPX 4000 area, and likely what we saw was front-running and/or short covering by their clients before it was released to the public on ZH premium. In case you haven't noticed, both ZH and MW have starting using "premium" releases, but a quick google of the title will show links to free versions. The second part of their forecast is the "crash up, crash down" similar to their mid-Feb forecast. I am willing to move my range up to SPX 3900-4000, but I still think it is still too early for a "crash".

This week in Tech/Other see an update of the aa mining composite put-call indicator and a possible volatity indicator.

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment increased slightly last week, but remains near its lows.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C [ETF Puts/Equity Calls], outlook two to four months) bearish sentiment also increased slightly last week, but remains near its lows.

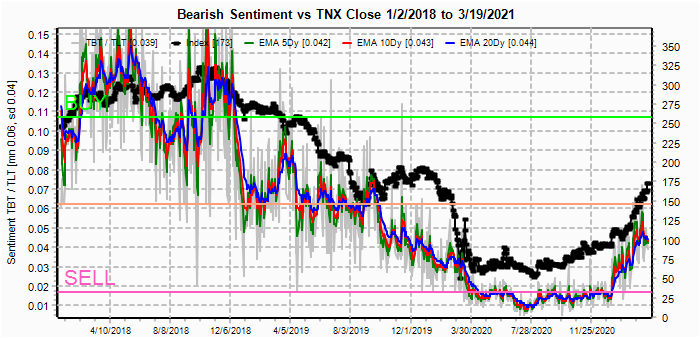

Bonds (TNX). Bearish sentiment in bonds has fallen significantly even though rates remain near recent highs, indicating that the highs are not likely to hold INT.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment was relatively unchanged.

II. Dumb Money/Smart Money Indicators

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) bearish sentiment fell sharply last week as options call speculators look at every dip in prices as a BTFD oppty. Not good LT.

And the sister options Hedge Ratio bearish sentiment fell slightly last week providing weak support for the market.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Apr 1, markets are closed for Good Fri Apr 2. Also, this week includes a look at the GDX for Apr exp.

With Fri close at SPX 3975, options OI for Mon is mixed with moderate put support at 3900 and call resistance at 4k. Put support at 3950 may allow a move to 4k, but a break below could fall to 3925.

Wed EOM has somewhat larger OI where SPX strangle collar at 3900 appears broken and call resistance at 4K is likely to provide strong resistance. SPX 3950 or lower is possible.

With SPX somewhat ambiguous for Wed, I decided to take a look at the SPY ETF OI where SPY at 396 (1/10 SPX less div payout diff) has large call resistance at 395 that will likely put downward pressure on prices.

For Thur there is only light OI, but it is indicating lower prices for the SPX toward 3925-50.

For Mon Apr 5, my biggest argument against a "crash" following Fri jobs report as speculated by Nomura is the higher put support at SPX 3900, although a pullback below 3975 looks likely.

For EOM Apr 30, it's too early to draw strong conclusions, but the most obvious symptom is that unlike prior months which showed OTM put support, now we see a switch to OTM call resistance (a likely cause of VIX dropping) as call option buyers are becoming overconfident.

Using the GDX as a gold miner proxy closing at 32.7, put support at 31.5 and 32.5 may provide a slight upward bias with call resistance at 33.6 and 34.5.

Currently the TLT is 136.7 with the TNX at 1.66%, as forecasted rates seem to be consolidating between 1.6 and 1.75%.

IV. Technical / Other

This week I want to take a look at a couple of the data mining indicators - the Composite Put-Call indicator (Equity+ETF+SPX) and a volatility indicator. First the Composite Put-Call indicator, I'm sure that many doubted the positive implications when I first showed this several weeks ago, nut so far it has proven accurate and has only now dropped to neutral, several weeks away from a Sell.

This is the equivalent using the composite with EMAs.

This is the ST composite with EMAs. We appear to be at the same level as late Dec 2020, 1 month before the Jan top.

This is a volatility indicator using the VIX Buy & Sell (SKEW + VXV/VIX) and VIX Put/Call.

This is the ST volatility indicator with EMAs. Here, we are the same level as the Jan top, but not close to the level before the larger declines in Sept and Oct 2020.

Conclusions. Bearish sentiment continues to nosedive in the options marketbut enough hedging seems to exist to support the markets ST. The overall outlook of a rounded top that may stretch over several more months still seems more likely than the melt up-melt down scenario, but identifying an exact top remains elusive.

Weekly Trade Alert. Prices may continue higher on Mon, but a breakout over SPX 4k seems unlikely. Fri late rally could be due to Nomura's forecast of a ST gamma squeeze that targets SPX 4k, but a pullback toward 3900 may follow. Updates @mrktsignals.

Investment Diary, Indicator Primer,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2021 SentimentSignals.blogspot.com