Last week I was looking for a posiive bias due to the continued moderae hedging and ST indicator with a possible retest of the ATH, but was obviously not bullish enough as the SPX rallied from 4440 to 4510. Oddly 80% of the gains came the first two hours of trade Mon and Fri. The LT target of 4550-4600 may come sooner than expected.

More divergences are appearing between price and sentiment as the hedge spread has now begun to roll over and is now just above neutral. The ST Composite has moved to below neutral. Last weeks jump in the SKEW to over 160 puts the INT VIX Buy & Sell component into a positive (lower volatility) mode. This weeks Tech/Other section looks at the latest Composite Put-Call Revised indicator has joined the other INT/LT indicators indicating a Sell at a more extreme than seen at the Mar 2020 top, while the ST/INT VIX call indicator shows no signs of an expected pickup in volatility.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the VXX $ volume.

This indicator is showing very low bearish sentiment similar to Jan-Feb 2020 top, indicating that an important INT top is near.

The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the VXX $ Vol/SPX Trend. Weights are 80%/20%.This indicator is slightly below neutral and likely means choppy trading ahead.

The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.Since the mid-July pullback, this indicator has remained mostly positive thru much of the SPX 300+ pt rally, but is now approaching levels where more than a 2+% pullback over two days is likely.

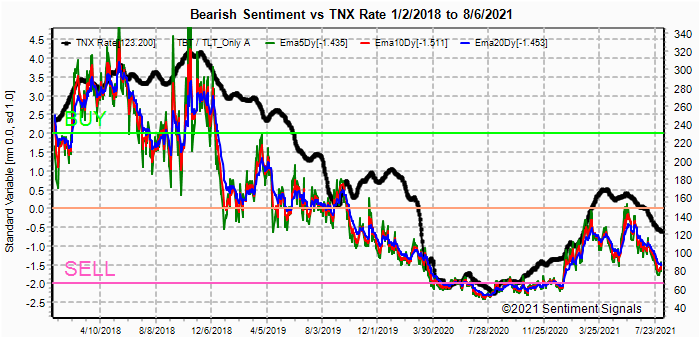

EMAs indicate that sentiment extremes are very ST (grn), while LT extremes (blu) are likely before a more significant pullback. Bonds (TNX). Bearish sentiment in bonds remains in a tight range. consistent with int rates. For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.

Last week warned of a bounce of as much as 10% off of the strong support level of 240 and last week saw a 6% rally. The uptick in bearish sentiment could mean stronger gains, possibly due to Avi's Thur warning of drop in GDX to 21 (about the same as my LT goal of HUI 140 or less).

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Similar to the INT/LT Composite, this indicator shows sentiment much like the Jan-Feb 2020 period, but if as some are suggesting a Supercycle V top is near, sentiment could get more extreme.

And the sister options Hedge Spread bearish sentiment as a ST/INT indicator (outlook 1-3 mns) is showing that the market is losing much of its support from options hedging that buoyed prices the last six weeks.III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Sept 3. Also, this week includes a look at the GDX for Dec exp.

With Fri close at SPX 4509, options OI for Mon is fairly large, most being OTM puts whuch may explain the jump in SKEW Fri to over 160. There is a positive bias up to 4475 but the large # of calls at 4500+will likely cause a drop towards the 4475 level..

Tue (EOM) has somewhat larger call OI where SPX could be pressured down to the 4435-50 area.

Wed has smaller OI where SPX put support starts at 4450 and only minor call resistance exists up to 4525. Early week declines may be reversed to ATH to start month.

For Fri strong call resistance at SPX 4500 and similar to Mon-Wed may see a reversal to the 4475 level.

IV. Technical / Other

This week I wanted to take a brief look at the INT/LT Combined Put-Call Revised indicator (Equity + ETF + SPX), as well as the ST/INT VIX Call indicator using options call FOMO formula (comparison to mrkt strength using NYDEC/NYADV).

The Combined P-C Revised spread is now showing greater low bearish extremes than

seen before the Mar 2020 crash, indicating that an important INT/LT top is

likely as early as Sept-Oct.

Looking at the VIX call indicator as a SM predictor of increased volatility using the FOMO comparison shows a somewhat positive bias, while the DM predictor SKEW has jumped back to highs in the 160s..

Conclusions. Further upside is possible towards the SPX 4550-600 area is possible over the coming weeks, but gains are likely to be harder to come by. Increasing divergences between INT/LT negative indicators and ST/INT neutral/positive indicators continue to increase the uncertainty of discerning ST market direction.

Weekly Trade Alert. Possible limited weakness to start the week toward SPX 4450 before early Sept strength mid-week and a fade toward 4475 to end the week. Updates @mrktsignals.

Investment Diary, Indicator Primer,

update 2021.07.xx Data Mining Indicators - Update, Summer 2021 (in progress),

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2021 SentimentSignals.blogspot.com