Today's update will be very brief due to the holiday.

As promised I wanted to show a comparison to this weeks sentiment indicators compared to the last rally top on Nov 3, 2015.

Comparing the Nov 3 rally top to then week ending Mar 18 was identical in overall score with 0 indicators up, 9 down and 7 neutral for a rating of -7. However, many of the negatives in Nov were more extreme, more important is that after only a 2% decline last week, the score dropped to only a -5. Looking at the put/call ratios shows very low bearishness for both ETF and SPX P/C, while the Equity P/C reached a high enough level to become bullish, as well as turn the overall CPC to a neutral. Changes in the put/call measure support an end of quarter rally next week mostly in the beaten down stocks (Equity P/C) with less support for the large caps (ETF and SPX P/C).

As for the title "When Bad Is Good", I am referring to the extreme overbought condition of some of the indicators that can actually be a sign of strength - at least short term. Similar to the Zweig breadth thrust off the Aug 2015 lows that convinced many that a bull market rally to ATH was around the corner, we now have extreme readings in the NYMO and the cumulative NYSI that did not occur in either the 2000-02 or the 2008-09 bear markets. A strong rally in the DJIA late 2000 into 2001 could be view as similar but weaker.

Another indicator the VXV/VIX, whose 20 day SMA normally oscillates between 1.00 and 1.20, reached a level of 1.22 last week. This last occurred at the Dec 2014 and Mar 2015 tops on the markets way to ATHs last May. The extreme overbought conditions may keep the market afloat for another two or three months as in 2015, but there is no doubt that Cinderella's coach will turn into a pumpkin sooner or later.

Sunday, March 27, 2016

Saturday, March 19, 2016

A Top is Very Near

On March 5 using the Students Trifecta Model (VXV/VIX, SPXA50R/SPXA150R, and TRIN/BPSPX), as representative of the overall sentiment picture ...

I pointed out that

"Bearish sentiment has now declined to about the same level for the SPX as in Oct 2015 when the SPX was about at 2010. At that point we were about three weeks from the Nov top at 2116, So it is possible on sentiment comparisons that we reach SPX 2100, but it is more likely that a top is reached in the 2050-2080 range." With 2080 the ideal target.

Now, two weeks later, we appear to be only days away from a top with 2080 still the ideal target.

I pointed out that

"Bearish sentiment has now declined to about the same level for the SPX as in Oct 2015 when the SPX was about at 2010. At that point we were about three weeks from the Nov top at 2116, So it is possible on sentiment comparisons that we reach SPX 2100, but it is more likely that a top is reached in the 2050-2080 range." With 2080 the ideal target.

Now, two weeks later, we appear to be only days away from a top with 2080 still the ideal target.

In addition the individual indicators have turned overwhelmingly bearish, the overall reading has gone from +6 net positive on Feb 12 to -10 net negative as of Mar 18, and all three of the composites have turned negative as well.

However, we are likely to see a two month distribution or topping process similar to Nov and Dec of 2015, roughly between 1980 and 2080, before further downside. The volatility measures VIX put/call and VXX $ volume will likely be the last measures to turn bearish.

Edit: March 22, The reading for SDS/SSO should have been neutral, changing the overall score to a net of -9. This will be corrected for future reports. Comparison to Nov 3. 2015 top next weekend.

Edit: March 22, The reading for SDS/SSO should have been neutral, changing the overall score to a net of -9. This will be corrected for future reports. Comparison to Nov 3. 2015 top next weekend.

Sunday, March 6, 2016

Indicator Scorecard as of March 4, 2016

Not sure of the value, but I wanted to start tracking individual indicator performance. Rating is a little subjective since I look at past performance to evaluate. Down (dn), up, and neutral (nt) indicate market bias. Measures are for bearish sentiment so a high value may be considered low bearish sentiment and vice versa.

Saturday, March 5, 2016

Sentiment is Becoming Less Bullish

This weekend I will be reviewing the Students Trifecta Model (VXV/VIX, SPXA50R/SPXA150R, and TRIN/BPSPX), including instructions on how to create charts for the components using Stockcharts.com, as well as a number of the short/long ETF pairs (ie, "synthetic" put/call ratios).

The current Students Trifecta is representative of the overall sentiment picture as shown below. Bearish sentiment has now declined to about the same level for the SPX as in Oct 2015 when the SPX was about at 2010. At that point we were about three weeks from the Nov top at 2116, So it is possible on sentiment comparisons that we reach SPX 2100. but it is more likely that a top is reached in the 2050-2080 range. The SPX 2080 target has nice symmetry for a bear market scenario since it is the 78% retracement for wave A down, and if C = A then the next target lower is 1760, my target for a "summer swoon".

Looking at the individual components, two are available intraday (VXV/VIX and TRIN/BPSPX) for those that want to check sentiment readings during market hours. All three components are tracking the Oct 2015 rally very closely, so hopefully will warn of a top when similar readings are reached. When using Stockcharts.com, each variable is preceded by a "$" with the divide "/" replaced by the ":". For example, the VIX term structure VXV/VIX is input as $VXV:$VIX.

For all charts under chart attributes I use dashed lines for daily data and check log scale, under indicators I use Price, $SPX and behind price. For the VIX term structure, I use a 1 year period/daily and under overlays use a 10 day SMA and horizontal lines at 1 and 1.2, where the top is usually when the 10 MA nears 1.2. For the TRIN/BPSPX, I use a 6 month/daily period with a 20 day SMA and this produces a nice sentiment chart with lows at tops and highs at bottoms. For the overbought/oversold indicator (SPXA50R/SPXA150R), I use a 1 year/daily period with a 20 day SMA and horizontal lines at .65 and .95. One last note before saving the chart link, below the chart click Permalink, Reload with link to create the final link.

The amazing thing about these indicators is how closely they are tracking the Oct 2015 rally with each at comparable positions to about 70% completed or about SPX 2080 for a top.

Finally, I want to show updated ETF-based sentiment for the SPX, NDX, RUT and HUI.

Using the SPXU/UPRO to measure sentiment for the SPX, you can see that sentiment is comparable to Oct 2015 when the SPX was at 2010 similar to the Students Trifecta.

Using the SQQQ/TQQQ for the NDX, we can see higher bearish sentiment for the NDX than the SPX, so the NDX is expected to outperform for the remainder of the rally.

Using the TZA/TNA for the RUT, we see that bearish sentiment is below average, indicating weaker expected performance compared to the SPX.

Finally for the HUI using DUST/NUGT, we see that sentiment has reached lower extremes, but is likely to remain in a trading range from 150 to 200 for the next few months similar to the first half of 2015.

The current Students Trifecta is representative of the overall sentiment picture as shown below. Bearish sentiment has now declined to about the same level for the SPX as in Oct 2015 when the SPX was about at 2010. At that point we were about three weeks from the Nov top at 2116, So it is possible on sentiment comparisons that we reach SPX 2100. but it is more likely that a top is reached in the 2050-2080 range. The SPX 2080 target has nice symmetry for a bear market scenario since it is the 78% retracement for wave A down, and if C = A then the next target lower is 1760, my target for a "summer swoon".

Looking at the individual components, two are available intraday (VXV/VIX and TRIN/BPSPX) for those that want to check sentiment readings during market hours. All three components are tracking the Oct 2015 rally very closely, so hopefully will warn of a top when similar readings are reached. When using Stockcharts.com, each variable is preceded by a "$" with the divide "/" replaced by the ":". For example, the VIX term structure VXV/VIX is input as $VXV:$VIX.

For all charts under chart attributes I use dashed lines for daily data and check log scale, under indicators I use Price, $SPX and behind price. For the VIX term structure, I use a 1 year period/daily and under overlays use a 10 day SMA and horizontal lines at 1 and 1.2, where the top is usually when the 10 MA nears 1.2. For the TRIN/BPSPX, I use a 6 month/daily period with a 20 day SMA and this produces a nice sentiment chart with lows at tops and highs at bottoms. For the overbought/oversold indicator (SPXA50R/SPXA150R), I use a 1 year/daily period with a 20 day SMA and horizontal lines at .65 and .95. One last note before saving the chart link, below the chart click Permalink, Reload with link to create the final link.

The amazing thing about these indicators is how closely they are tracking the Oct 2015 rally with each at comparable positions to about 70% completed or about SPX 2080 for a top.

Finally, I want to show updated ETF-based sentiment for the SPX, NDX, RUT and HUI.

Using the SPXU/UPRO to measure sentiment for the SPX, you can see that sentiment is comparable to Oct 2015 when the SPX was at 2010 similar to the Students Trifecta.

Using the SQQQ/TQQQ for the NDX, we can see higher bearish sentiment for the NDX than the SPX, so the NDX is expected to outperform for the remainder of the rally.

Using the TZA/TNA for the RUT, we see that bearish sentiment is below average, indicating weaker expected performance compared to the SPX.

Finally for the HUI using DUST/NUGT, we see that sentiment has reached lower extremes, but is likely to remain in a trading range from 150 to 200 for the next few months similar to the first half of 2015.

Sunday, February 21, 2016

Not Much Change from Last Week

Last week I reported mixed sentiment and this week we have similar results with the SPX advancing from 1865 to 1915. Looking at all sixteen indicators, last weeks score was 6/16 with 9 positive, 4 neutral and 3 negative. This week the score has dropped to 4/16 with 8 positive, 4 neutral and 4 negative as the overbought/oversold indicator(SPXa50r/SPXa150r) moved to a negative.

The big news is for the HUI (DUST/NUGT) as bearish sentiment dropped to a low extreme as the chart below shows It is interesting that Hulberts Digest Newsletter Survey just reported the same results. However, I am less bearish than Hulbert due to the large buildup of high bearish sentiment the last half of 2015. The most likely scenario is a 3 to 6 month trading range, aka the first half of 2014, until volatility subsides in the stock market. Unlike most, I expect a fairly positive second half of the year for stocks after a summer swoon, as Wall Street pulls out all stops to protect the $100 million plus investment in the Clinton campaign to preserve the status quo.

The rest of this post is an update to the Students Trifecta model where I am replacing the BPSPX/CPCE indicator with the original TRIN variable and BPSPX (TRIN/BPSPX). TRIN does not fit well in my model as most use log tranforms so I had to come up with another approach.

Below is the TRIN/BPSPX, here I found that the BPSPX improves the cyclicality.

The revised Students Trifecta ( VXV/VIX, SPXA50R/SPXA150R, and TRIN/BPSPX).

Short term outlook.

Looking for a drift lower into early-mid Mar, possible IHS at SPX 1820-30. Fed announces second rate hike, then pauses until after election plus ECB additional QE. Stocks stage strong rally, SPX 2000+ Apr-May. Then crash down into 1700s in summer swoon, aka 1957, 1969.

The big news is for the HUI (DUST/NUGT) as bearish sentiment dropped to a low extreme as the chart below shows It is interesting that Hulberts Digest Newsletter Survey just reported the same results. However, I am less bearish than Hulbert due to the large buildup of high bearish sentiment the last half of 2015. The most likely scenario is a 3 to 6 month trading range, aka the first half of 2014, until volatility subsides in the stock market. Unlike most, I expect a fairly positive second half of the year for stocks after a summer swoon, as Wall Street pulls out all stops to protect the $100 million plus investment in the Clinton campaign to preserve the status quo.

The rest of this post is an update to the Students Trifecta model where I am replacing the BPSPX/CPCE indicator with the original TRIN variable and BPSPX (TRIN/BPSPX). TRIN does not fit well in my model as most use log tranforms so I had to come up with another approach.

Below is the TRIN/BPSPX, here I found that the BPSPX improves the cyclicality.

The revised Students Trifecta ( VXV/VIX, SPXA50R/SPXA150R, and TRIN/BPSPX).

Short term outlook.

Looking for a drift lower into early-mid Mar, possible IHS at SPX 1820-30. Fed announces second rate hike, then pauses until after election plus ECB additional QE. Stocks stage strong rally, SPX 2000+ Apr-May. Then crash down into 1700s in summer swoon, aka 1957, 1969.

Saturday, February 13, 2016

Despite the Double Bottom on the SPX, Sentiment is Mixed

Today, I am going to do something a little different, which is focus on sentiment components rather than composites. The reason is that some indicators are showing a strong buy (SPX), while others are showing a sell, and when combined I get a neutral signal. For instance, the put/call ratio for the CPC and CPCI (less VIX) are neutral, while the equity P/C is a strong buy and the ETF P/C is a sell. First, I will show the charts for the latter P/C ratios as well as the VIX term structure for the SPX (VXV/VIX) and NDX (VXN/VIX), and try to explain what I think is going on. For the gold bugs, no charts, but sentiment is neutral so no big selloff is expected.

The equity P/C shows extreme bearish sentiment about equal to the Aug 2015 selloff.

The VIX term stucture (SPX) also shows extreme bearish sentiment similar to Jan 2015.

The ETF P/C, however, tells a different story with bearish sentiment below the mean similar to early 2015 and the Nov 2015 top.

The VIX term structure (NDX) is not as reliable as the SPX form, but again the low readings are more consistent with tops than bottoms.

What I decided must be going on is that the average stock, represented by the equity P/C and VIX term structure (SPX), has been a bear market for over a year and sentiment has now reached a bearish extreme indicating a buy. However, the large cap stocks (ETFs), especially the techs (ie, FANGS) that have been holding up the averages still have further downside before a significant rally is expected (ie, 10-15%).

So if you are a stock picker now might be the time to start picking up beaten down stocks (gold miners might be an example of what to expect), otherwise lower lows are expected for the averages. I have using NDX 3800 as a target since mid-Jan and with trend lines from 2009 coming in around SPX 1750 and NDX 3780, a strong rally from those points is expected when/if reached.

The equity P/C shows extreme bearish sentiment about equal to the Aug 2015 selloff.

The VIX term stucture (SPX) also shows extreme bearish sentiment similar to Jan 2015.

The ETF P/C, however, tells a different story with bearish sentiment below the mean similar to early 2015 and the Nov 2015 top.

The VIX term structure (NDX) is not as reliable as the SPX form, but again the low readings are more consistent with tops than bottoms.

What I decided must be going on is that the average stock, represented by the equity P/C and VIX term structure (SPX), has been a bear market for over a year and sentiment has now reached a bearish extreme indicating a buy. However, the large cap stocks (ETFs), especially the techs (ie, FANGS) that have been holding up the averages still have further downside before a significant rally is expected (ie, 10-15%).

So if you are a stock picker now might be the time to start picking up beaten down stocks (gold miners might be an example of what to expect), otherwise lower lows are expected for the averages. I have using NDX 3800 as a target since mid-Jan and with trend lines from 2009 coming in around SPX 1750 and NDX 3780, a strong rally from those points is expected when/if reached.

Saturday, February 6, 2016

Should You be Worried about the Low VIX Put/Call Ratio?

Everyone looks at put/call ratios occasionally, but the CBOE publishes data on other ratios than the widely followed CPC (combined) and CPCI (index). Two of my favorites are the SPX and VIX P/Cs. After the 2007-08 bear market, there was a huge growth in volatility products to hedge risk, and this included puts and calls on the VIX. CBOE includes VIX calls in the calls for both CPC and CPCI, likewise for puts, so to eliminate the distortions, I use modified CPC and SPX for CPCI.

To get back to the main subject, a large volume of calls on the VIX is a bet on increased volatility. Friday for instance the VIX P/C was 0.14 with 700k calls or 30% of the 2.4m reported for the CPC and almost 60% of the calls in the CPCI. The reported CPCI, for instance, was .81, but without the VIX calls the number jumps to 1.80. The SPX P/C was 1.79.

So what does this mean for an investor? Long-term the VIX P/C averages about .50. VIX call buyers tend to be "smart money" investors, such as hedge funds and pension funds, looking for a way to hedge risk.For instance, for the five days from Dec 29, 2015 to Jan 5, 2016 the VIX P/C averaged .25 and the next two weeks the SPX dropped from 2017 to 1812. Before that in mid-Aug 2015, the five day average dropped to .30 before the Aug crash. Friday, Feb 5, the 4-day avg dropped to .2 and the 5-day to .30. What are VIX call buyers afraid of?

The following shows a VIX P/C sentiment chart with the current 5-day EMA at .30.

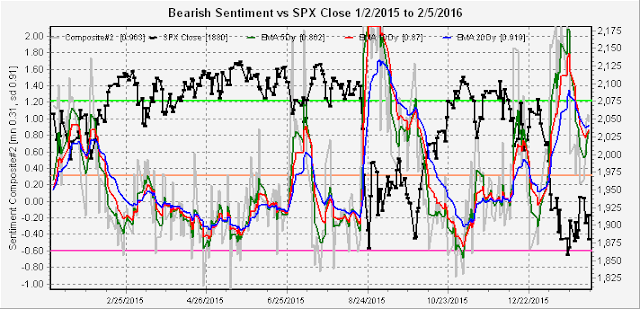

The next two charts show updates for the composites, #1 (P/C, VXX $ Vol, Skew) and #2 (P/C, VXX $ Vol, VXV/VIX).

Composite #1 remained steadfastly bearish (low sentiment) from Sept thru mid-Jan, mostly due to the Skew which remained in the mid-140s, only recently dropping below 120. This composite is now bullish. Composite #2, below, is also bullish, but not as mush so as after the Aug crash and retest.

Overall, sentiment seems to be pointing to some type of short-term washout using the VIX P/C, followed by a sizable rally of several months, but no new highs.

To get back to the main subject, a large volume of calls on the VIX is a bet on increased volatility. Friday for instance the VIX P/C was 0.14 with 700k calls or 30% of the 2.4m reported for the CPC and almost 60% of the calls in the CPCI. The reported CPCI, for instance, was .81, but without the VIX calls the number jumps to 1.80. The SPX P/C was 1.79.

So what does this mean for an investor? Long-term the VIX P/C averages about .50. VIX call buyers tend to be "smart money" investors, such as hedge funds and pension funds, looking for a way to hedge risk.For instance, for the five days from Dec 29, 2015 to Jan 5, 2016 the VIX P/C averaged .25 and the next two weeks the SPX dropped from 2017 to 1812. Before that in mid-Aug 2015, the five day average dropped to .30 before the Aug crash. Friday, Feb 5, the 4-day avg dropped to .2 and the 5-day to .30. What are VIX call buyers afraid of?

The following shows a VIX P/C sentiment chart with the current 5-day EMA at .30.

The next two charts show updates for the composites, #1 (P/C, VXX $ Vol, Skew) and #2 (P/C, VXX $ Vol, VXV/VIX).

Composite #1 remained steadfastly bearish (low sentiment) from Sept thru mid-Jan, mostly due to the Skew which remained in the mid-140s, only recently dropping below 120. This composite is now bullish. Composite #2, below, is also bullish, but not as mush so as after the Aug crash and retest.

Overall, sentiment seems to be pointing to some type of short-term washout using the VIX P/C, followed by a sizable rally of several months, but no new highs.

Subscribe to:

Posts (Atom)