Another exciting week, especially for the reaction to economic releases. Tuesday's small pullback produced a ST SELL using the ST Indicator (posted on @mrktsignals) and the next day weak Chicago PMI data (later reversed) sent the SPX down to fill the 2405 gap, then ramped up after hours. The late surge anticipated the strong ADP jobs numbers and the SPY surged up to the 242-3 resistance, but by mid-day the bears were dancing shown by the high P/C on CBOE intra day listings so a warning was posted not to short and that SPY 245 might be seen with delta hedging from call writers having to buy futures. Friday's release of the official jobs numbers were only 50% of the ADP numbers, but the markets seemed unfazed and closed on the SPY 244 level. So it looks like the expected July-Sept pullback will occur from higher levels as SPX 2500 is in sight by the end of June.

I. Sentiment Signals

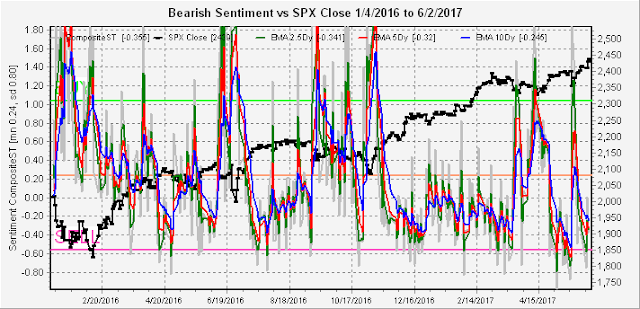

The overall Indicator Scoreboard declined only slightly and, considering that the last INT SELL only produced a two day pullback of 2%, it is unlikely to produce a significant SELL next week.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) using INT EMAs is in much the same situation.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) using S/T EMAs is shows the Tue SELL signal which was only good for 15 SPX pts. A SELL may be produced next week but is unlikely to result in a significant pullback

Bonds (TNX) continued to show strength and are almost at an INT SELL level for the TBT/TLT. Given the weak jobs numbers, it appears the CEOs are delaying investments and hiring until the Trump troubles are cleared up.

Sentiment for gold stocks (HUI) is about as neutral as it gets, juggling the weak USD vs lower inflation expectations from a weaker economy.

II. Options Open Interest

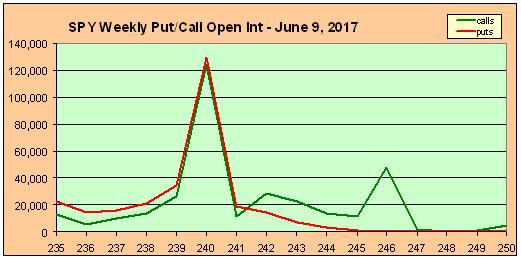

The resistance for the SPY at the 242-3 level did not prove to be as important as expected. I wondered if this might happen given the ease the NDX/QQQ, shown last week, blew thru the 140 level (now 143.5) after failing at that level May 16-17.

Looking at the weeklies for next week, the Wed call resistance (6/7) may prevent a rise over 244-5, but Fri (6/9) resistance rises to 246 so a late week advance is more likely. A pin Fri at 240 is the conventional interpretation but seems unlikely in the current market

The combined Weekly+Monthly is about the same as last week and shows lower resistance at higher prices with possible delta hedging from call writers forcing prices higher. It is possible if a SELL is generated by Wed that a short term pullback as low as SPY 241 could happen by Fri that may coincide with the Comey testimony, but like the QQQ action in mid May this would be a BTFD.

The June EOM/EOQ OI clearly shows that the most significant resistance to higher prices is at the SPY 250 level (SPX 2500), so it seems likely that we move toward that level before a significant correction.

Conclusions. The bears persistence to short every new high is their own undoing. This is easily seen by the high intra day P/Cs and the explosion of VXX volume the last hour of trading. Although still learning to the options open interest, it has helped me to see the markets zones of resistance. Next week, I will take a look at the July and August OI charts that point to lower prices.

Weekly Trade Alert. None really other than the BTFD possibility later this week. I have been posting any sentiment changes one hour before the open when relevant. Updates @mrktsignals.

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2017 SentimentSignals.blogspot.com

No comments:

Post a Comment