Sentiment did not get much of a boost last week with the continued volatility which has me concerned that we may be entering a trading range between SPX 2400-50 for several weeks in a rounding top pattern similar to mid-2015. Options open interest continues to show moderate strength for the markets thru mid-Aug.

I. Sentiment Indicators

The overall Indicator Scoreboard showed only slight increase in bearish sentiment. For this week I am again showing the last 18 months with INT EMAs.

Similar action for the Short Term Indicator (VXX $ volume and Smart Beta P/C).

Bearish sentiment for bonds (TNX) fell considerably, however, as the stock volatility increased the demand for a safe haven, almost to the point of giving another SELL.

The gold bugs (HUI) must be smoking too much medical marijuana, showing the most bullishness since the Feb highs as the HUI dropped back to the 180 area that has been support for several months. More in options OI section.

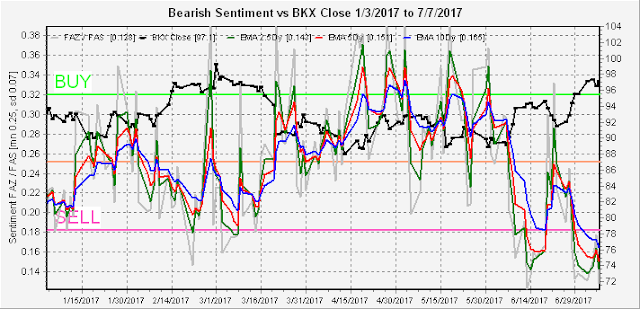

On May 20, I showed a 2017 sentiment chart for the BKX, indicating a ST BUY. Since that time the BKX has rallied 10%, powering the DJIA to new ATH, but this week shows a stronger SELL. With big money center banks reporting EPS on Friday, we may start to see weakness in that sector and the DJIA soon.

II. Options Open Interest

This week I want to look at two weeks forward for the SPY and three months forward for the QQQ and GDX.

The SPY for July 14 shows strong support at 242 and below with a small dip at 241 there is little resistance above, so the bulls are free to roam once over 242.

But the July 21 resistance at 247 and to a lesser extent at 245 will likely provide a difficult wall to overcome.

Many EW analysts have declared confirmed downtrends for the major averages based on the recent action of the tech stocks. Last week I showed that the sentiment measure SQQQ/TQQQ was showing very strong bearish sentiment that could lead to a significant rally, and this week I want to look at the QQQ July-Sept options OI for confirmation. First for July 21 (posted Wed am on Twitter), strong support between 134-136 means that this level is unlikely to be penetrated for a long period of time, and Thur saw a drop to 135.8 followed to a rally Fri to 138. A likely pin or close for the 21st is 139-140 with strong resistance at 140.

For Aug 18, support moves up to 138 with a possible push higher to 141-2.

For Sept 15, we see somewhat of a similar pattern to the SPY two weeks ago, with support at 135 and even stronger support at 130, but little support in between. The lack of call resistance is somewhat odd, but would allow for higher prices as shown by the SPY. Conclusion, new lows ahead.

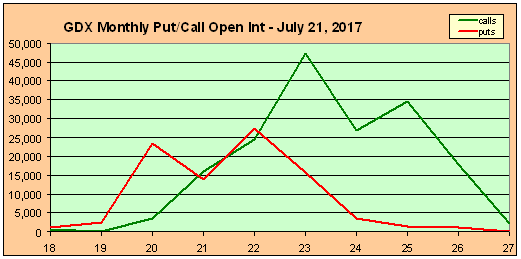

Moving on the the GDX, since the first target of 21 was reached last week, it seemed appropriate to do a followup. July 21 OI shows huge resistance at 22 and 23 with moderate support at 20-22. The likely range seems to be 20.5 to 21.5.

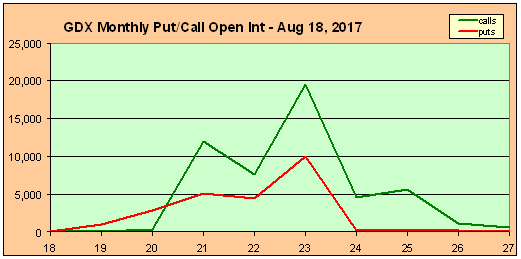

For Aug 18, resistance from calls is likely to overpower support, pushing prices to 20 or lower.

For Sept 15, a strong reversal is still showing as likely with an upside target in the 23-24 range. This matches well with the potential for an event driven stock pullback, but shows a lower upside that before.

III. Technical Indicators

The only item I want to mention here are the SPX gaps from a couple of days ago at 2432 and Friday's 2410 that may need to be filled.

Conclusions. The SPX was up a total of two points last week that pretty much matched my outlook but somewhat lower highs and lows than expected. Next week looks like a "do or die" week for the SPX as options OI point to potential for a move into the 2440s, but sentiment is showing only weak support. Ideally, I would like to see an early pullback to fill the gap at SPX 2410 then a quick move to 2432, but only time will tell.

Weekly Trade Alert. No trades were executed last week as I was holding out for a gap fill on the DJIA just below 21300 to go long. This week an early pullback to SPX 2410 may provide another opportunity. Long SPX 2410, Stop 2400, target 2440+. Updates @mrktsignals.

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2017 SentimentSignals.blogspot.com

No comments:

Post a Comment