The slack, however, was picked up by the DJIA with news of resumption of trade talks with China. It is interesting that the DJIA is the most widely followed index by the public and overseas investors and a new recovery high over 25.8k would probably be considered an "all clear", but with the previous leaders faltering (NDX), this is likely to be a Siren's Song. In Greek mythology, a siren was a mermaid whose calls were used to lure sailors into shipwrecks. The target for a DJIA high could be the gap fill at 26.5k.

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) moved higher with the short term EMAs moving to half way between the SPX May and June lows and the LT EMAs equal to the May lows. Likely result an SPX 70-100 pt rally.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four months) saw an increase in bearish sentiment, but much less than the June lows. Likely result combined with the Indicator Scoreboard is a two to four week rally, but less dynamic that the last two.

Bond sentiment (TNX) remained near the mean last week with little directional bias.

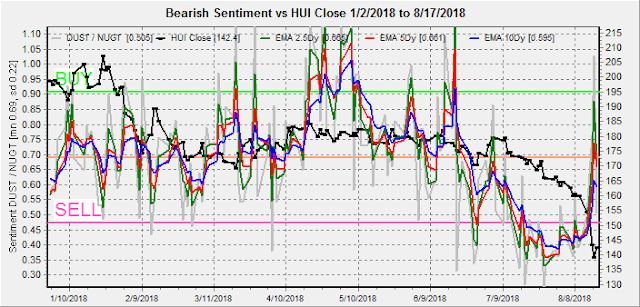

This week I am going to something a little different with the gold miners (HUI) sentiment. Many of the gold bugs are now saying that now is the time to buy (same as all year). They may be right for the very short term, as a spike in bearish sentiment has reached the level of several 10-15 pt rallies (5-10%) in the HUI over 2018.

However, LT back to 2015, bearish sentiment remains extremely low. I fully expect to see a selling climax by the end of the year retesting the 2015 lows, if not lower. If so a basing period extending into mid-2019, similar to late 2015, is likely before an inflation rally into the 2020 elections.

The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 days/hours) as a very ST indicator remains near the bottom of its TL. As I've pointed out the past couple weeks that this would likely lead to underperformance of the NDX (shown below) to SPX due to higher relative buying by the NDX Dumb Money ETFs. Last week saw the NDX down about 2% with the SPX down 0.5%, and without Buffett's continuous buying of AAPL, the NDX would be down more.

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 days/weeks) reached the BUY level a few days early, but remains at relatively high levels, supportive of higher prices.

This week, I am going to look at a ST view of the INT term SPX Long Term/Short Term ETFs (outlook two to four weeks) bearish sentiment . Notably there was almost no reaction by the SPX ETF investors to the pullback that started a week and a half ago, as most of the bearish sentiment was generated by ST speculators using put options and VIX products, while the public (ETFs) remained complacent. This tells me that a bigger correction is on its way after bearish sentiment clears. Looking at the chart below, there have been four SELLs in 2018, starting in Jan, interestingly they have alternated between strong and weak selloffs with the last in July being weak, so the next SELL is likely to be 100+ SPX pts. The SPX 200 SMA should be 2750 by the end of Sept, so that may be the target.

Long term neutral, the INT term NDX Long Term/Short Term ETF Indicator (outlook two to four weeks) has moved nearer to the top of its recent range, so some improvement in the NDX performance is expected.

III. Options Open Interest

Using Thurs close, remember that further out time frames are more likely to change over time. This week I will look out thru Aug 31.

Mon shows moderate call resistance at SPX 2850 and 2870 with put support starting at 2830. A pullback is possible to 2840-45. Open int is relatively light.

Wed the 22nd is interesting since this marks "the longest bull market in history". The setup is the most bullish I've seen in ages with relatively strong put support at 2820, but weak call resistance all the way to 2900. If the SPX makes it over 2855, then 2875-80 should be easy.

Fri shows huge call positions at SPX 2865 and 2875, with little put support until 2800. A move to test the ATH Wed is likely to result in a "pop & drop" down to 2850 or possibly 2830 by Fri.

For Fri Aug 31, has large open int and shows strong resistance at SPX 2850 area, with strong support at 2775. SPX 2800 and 2825 may be critical areas but overlapping puts/calls leave little directional bias.

Conclusions. Last week went as well as could be expected with Wed drop a little stronger than expected. The next several weeks may be the setup for a H&S top with next weeks SPX open int showing the possibility of an ATH retest, and the next several weeks showing 2800-50 a likely range. With the deadline for China trade talk resolution put off to Nov, Sept-Oct may result in a 100+ pt SPX pullback to 2700-50 due to combined negative influence from a Sept Fed rate hike and weaker Oct EPS due to the stronger dollar. If a larger pullback is seen, then a year-end rally to test SPX 3000 may result depending on trade talks, election results, and future tax cuts.

Weekly Trade Alert. With the SPX closing near 2850, a range of about 2825-75 is expected next week with an ATH retest possible on Wed before a small pullback. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment