A couple of weeks ago, I changed my preferred scenario to an ending diagonal for the SPX with a target low between 2850-2900 by early Sept before a final high of 3050-100 by mid Nov. Last weeks post indicated that sentiment, especially the hedge ratio and VIX call buying, was hinting at a a pickup in volatility and we saw that in spades with a "sell the new" post FOMC drop of 50 SPX pts in two hours Wed, followed by the predicted rebound in only two hrs back to 3000+. Trumps tweets threatening more China tariffs, however, stopped the rally cold, causing a 100 pt SPX drop over the next two days. Bearish sentiment is now reaching an extreme similar to the June swoon of 2018 before the final rally into Sep-Oct.

I. Sentiment Indicators

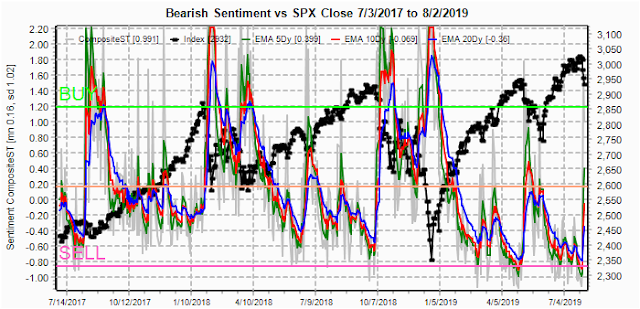

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment saw a sharp rise last week reaching levels similar to June 2018 lows and first leg down in May 2019..

The INT view of the Short Term Indicator (VXX+VXXB $ volume and Smart Beta P/C [ETF Puts/Equity Calls], outlook two to four months) bearish sentiment is lagging the overall composite, so several more weeks of volatility is likely.

Bonds (TNX). Interest rates have continued to decline in spite of sentiment, especially with Trumps threat of renewed China tariffs.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment remains at an extreme, but so far has not caused a price reversal.

II. Dumb Money/Smart Money Indicators

For this week and possibly for the next several months, I am going to replace the DM/SM ETF indicators with other indicators.

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) has also reached a level ST comparable to the June 2018 and May 2019 declines. This may mean that a majority of the correction in price is complete, although the volatility measures indicate a tradeable rally may be weeks away.

And the sister options Hedge Ratio sentiment has also risen sharply, but remains below the levels of JUne 2018 and May 2019, so more volatility is likely.

The INT term SPX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment has also reached levels where a price low may be near, but more time is needed.

The INT term NDX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment has risen comparable to the SPX ETFs.

III. Options Open Interest

Using Wed close, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. This week I will look out thru Apr 30. Also, This week includes a look at the TLT for Aug.

With Fri close at SPX 2932, opt OI is light for M/W. With put support below 2950, Mon should see some strength to over SPX 2950 with first call resistance at 2990.

Wed shows less put support and SPX 2950 is critical, where a move lower could retest the 2915 area, while a move higher could possibly make it to 3000.

For Fri with larger OI, there is strong put support at 2950 and little call resistance until 3000. Likely target is 2975+.

The TLT 20 year bond fund is used as a proxy for interest rates. Currently the TLT is 136.5 with the TNX at 1.86%. For Aug 16, the move over resistance at 133 leaves a wide band where there are few puts and calls between 133 and 140.

IV. Technical / Other

Conclusions. I was somewhat surprised early in the week to see a very muted response to the dismal results of the trade talks in China, where the US walked out after 4 hrs. Trump seems to be getting very frustrated with his "trade talks are easy to win" results. It's possible he takes an all or nothing posture early in 2020 to try force China to capitulate. This could finally send the markets over the edge. I have warned from the very beginning that Trump was severely underestimating China's resolve. It is starting to remind me of the American Revolution of 1776 with "the colony" seeking independence from Britain.

Weekly Trade Alert. Last week I warned of a mid-week swoon followed by a sharp rally, which occurred over a matter of hours, but was trumped by POTUS tweets. The next several weeks are likely to be unpredictable with sharp swings in both directions as the SPX works its way toward a bottom at 2900 or lower. This weeks opt OI indicates a probable up-down-up week with mid-week weakness followed by a rally to 2975+ by EOD Fri. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2019 SentimentSignals.blogspot.com

S&P rallied till 2940 against all odds. Great reading Arthur.

ReplyDeleteThanks