Last weeks outlook for a modest pullback before a move back over SPX 6000 fell flat as the Trump party celebrated all week pushing the SPX over 6100 although the Trump and Melania memes fell more than 50%. So far the SPX is performing much as it did in Nov-Dec 2021 where a one month decline was reversed in just a few days to the low 4700s after a test of the 100D SMA, this time filling the post-election gap at 5780. If comparisons continue there could be another test of the 100D SMA before a longer breakout over 6100. On the news front an overlooked item could spell big trouble for the mega cap AI tech sector. The US has been trying to block Chinas AI development by limiting the export of advanced AI chips, notably NVDAs H-100 which runs on propriety CUDA software. However, last week a China tech firm announced a new AI product called DeepSeek-R1 (no J/S) which is competitive performance wise with the most advanced US products, but runs on less advanced chips at about 10% of the cost and power usage by using a more advanced modeling language.

Several of the INT and ST indicators, including Hedge Spread, options FOMO and VIX & SPXADP indicators, are at levels suggesting a ST pullback toward the SPX 5800 is likely over the next few weeks. In the Tech/Other section, an update of LT SKEW and NYSE Adv/Dec volume shows that an INT top is likely in the next several months with the NYSE volume reaching a Sell (100D EMA < 1.5) and SKEW at record highs.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. Starting Aug 26, 2023 SPX options are removed due to extreme 0DTE volume distortions. New weights are ETF put-call indicator (30%), SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility spread of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

Update Alt, INT view. Bearish sentiment fell sharply from below neutral to between the weak and strong Sells with a sharp decline in ETF P/Cs (hedging).

Update INT volatility. Bearish sentiment also nose-dived from above a weak Sell to below. Update Alt EMA. Bearish sentiment fell toward a strong Sell. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/[SPX Trend, SMA only]. Weights are 80%/20%.Update. Bearish sentiment surprisingly remains near neutral, so a few days around 6100 is possible.

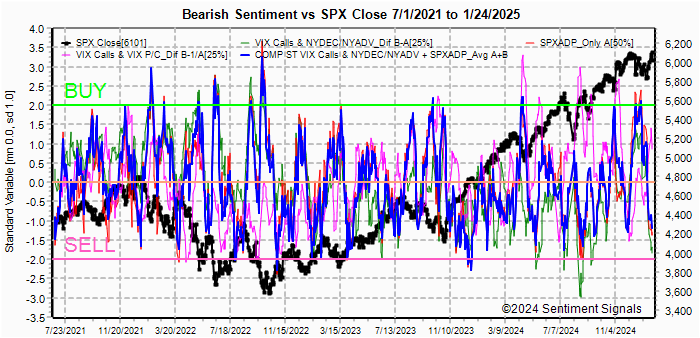

Update EMA. Bearish sentiment is little changed.The ST VIX calls and SPXADP indicator bearish sentiment continues to fall, but still near a weak Buy.

The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. Bearish sentiment fell below a strong Sell with the LT (blu) matching the Nov 2021 level with strong FOMO and weak hedging leading the way.

Update FOMO. Bearish sentiment continues to fall toward a strong Sell. Bonds (TNX). Bearish sentiment remains at low extremes as TNX briefly dropped toward 4.5%. For the INT outlook, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.Update. Bearish sentiment continued to rise with the HUI, ETF sentiment moved over neutral but remains below a weak Buy.

II. Dumb Money/Smart Money Indicators

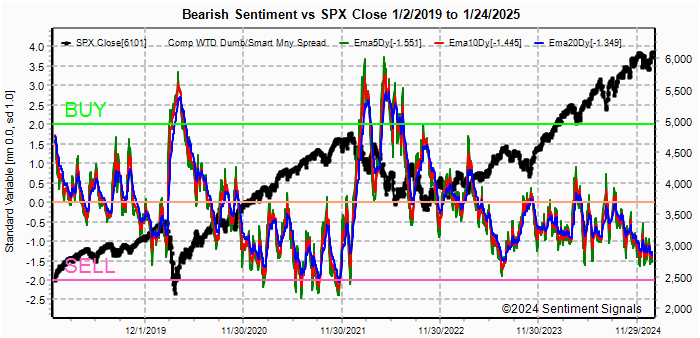

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Bearish sentiment increased slightly.

With the sister options Hedge Spread as a ST/INT indicator (outlook 1-3 mns), bearish sentiment VST (grn) fell sharply from a weak Sell to a strong Sell. A new composite SPX options indicator uses both the volume adj (1/B-A) and P/C equivalent spread (A-B) to compensate for the discrepancy between the two. This replaces the old SPX options indicator for the SPX ETFs + options below and the INT/LT composite. No chart.

For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the

INT term composite (outlook 2 to 4 mns), bearish sentiment fell below neutral.

Bearish sentiment fell sharply from a weak to a strong Sell with the sharp decline in ETF P/Cs (hedging).

For the SPX combining the hybrid ETF options plus SPX 2X ETF (outlook 2 to 4 mns) produces an indicator where, in this case, ETF options are a proxy for the SPY options.

Bearish sentiment for SPX fell from above a weak Sell to near a strong Sell

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Jan 31. A text overlay is used for extreme OI to improve readability, P/C is not changed. Also, this week includes a look at the GDX for Dec exp. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross. Note multiply OI$ by 100 for shares/contract.

With Fri close at SPX 6101, options OI for Mon is moderate with many OTM P&Cs. Over 6100 could push higher but below targets 6080.

Wed has smaller OI where SPX could trade between 6050 and 6100.

For Fri EOM, stronger SPX $OI should create downward pressure toward 6000 (straddle) and 6025 (call resistance). Likely to create downward pressure earlier in week.

For Feb 21 AM strong SPX OI indicates sttrong resistance over 6100 with attraction to large straddle (P&C about 39k) at 6000.

IV. Technical / Other

Oct 2018 topped with SKEW at ATH of 150, 2021 H2 at 160, and now we are at 170. Lead times have varied, but usually several months.

The SPX price performance since the CPI report mid-Jan was impressive, but the volume has lagged and the NYSE Adv/Dec volume 100D EMA (red) crossed below the Sell level at 1.5. Something similar occurred in Nov-Dec 2021 prior to the Jan 2022 top, so an INT top may be closer than originally expected. Watch for a second test of the 100D SMA (SPX 5800-50) and a final burst over 6100 (6250+).

The following uses barcharts.com as a source and discusses S&P futures (ES) as a third venue of stock sentiment in addition to options and ETFs. The non-commercial/commercial spread represents a LT bearish sentiment (dumb money/smart money) indicator. As explained in investopedia, commercial investors (red) are institutions and are smart money, while non-commercials (green) are speculators such as hedge funds and are dumb money. Here is the current barchart graph for the S&P 500 (top) and trader positions (1st bot) with positives as net longs and negatives as net shorts. Bearish sentiment is represented by the spread and is positive if red > green (Buy) and negative if green > red (Sell). ES (SPX) sentiment remains at neutral 0.0 SD, NQ (NDX) bearish sentiment is between a weak and strong Sell at -1.75 SD, YM (DJIA) remains below neutral at -0.5 SD.

Click dropdown list to select from the following options:

Tech / Other History2024

2023

2022

Other Indicators

Conclusions. The stock markets acceleration to the upside last week

created considerable capitulation by the bears. One of the more bullish

outlooks is by an EW analyst Dr. Schure who is

expecting the SPX to reach 6400-500 in Feb, but I remain more cautious and favor

the expanded flat for a couple more months.

Weekly Trade Alert. Below SPX is an important inflection area and

could lead to a drop to SPX 6000-25 by EOM (Fri). Updates @mrktsignals.

Investment Diary,

Indicator Primer,

Tech/Other Refs,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2024 SentimentSignals.blogspot.com

No comments:

Post a Comment