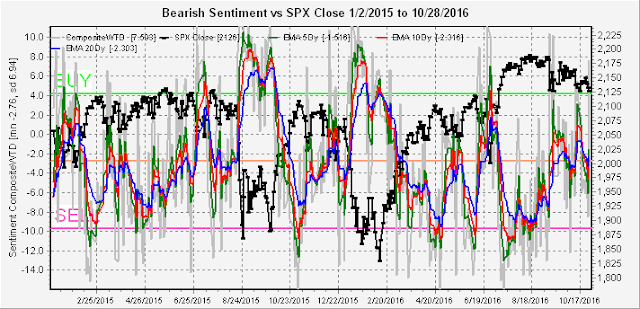

As you will see from today's sentiment update, I apparently had a lot of company during the middle of the week in my siesta as bearish sentiment dropped low enough on the very short term to generate a sell signal. This is the Short Term Indicator (VXX $ Volume and Smart Beta P/C) using 3, 5 and 10 day EMAs (one-half normal).

Looking at the less volatile SPXU/UPRO money flow ETF indicator short term shows bearish levels comparable to the 2016 tops of April, June and August.

Based on this short term view, more downside appears likely with a possible challenge of the SPX 2100 level. It now appears that Hillary's emails may follow her for some time, much like Bill's Monica Lewinsky during the late 1990's, and will lead to uncertainty before the election. It's likely this uncertainty holds the market in check until after the election.

The overall Scoreboard Indicator continues to look eerily similar to the May-July period of 2015

where a breakdown of the trading range of the previous two months was enough to generate one last buy signal before the final market top.

Another indicator which supports this view is the VIX P/C which pushed to new lows last week to match the level of mid-June 2015

Conclusion. Given the above sentiment outlook, I will be looking for long setup before the election, but probably not until election week. Shorting here is probably the lower risk trade now, but potential gains appear to be limited.

Weekly Trade Alert. Changed to siesta with one eye open. Any changes in outlook at @mrktsignals.

No comments:

Post a Comment