First let me wish everyone a happy and prosperous New Year.

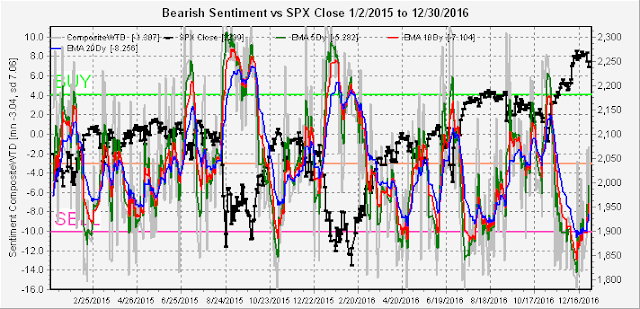

Next I want to outline what I see as the ideal scenario for the first quarter. Sentiment has a major influence on the markets direction, and is often a result of false signals from market actions. For instance, last January was one of the worst in many years, and based on the so called "January effect", many concluded a new bear market was beginning. Instead, the market rallied 25% from the lows by December. As I have pointed out earlier, sentiment is now indicating a down year for 2017, but I am expecting a positive January effect to again give a false signal. This would require an up market the first week and at month end. So after a positive start, a decline of 3-5% by mid-month to about SPX 2200, then a month end rally that may have one or more indexes at ATH high would be ideal.

The biggest potential problem for the first quarter will be strong job reports (~200K) and other economic reports that may cause the Fed to raise rates again in March. The Initial Claims that usually moves inversely with jobs is hovering at the lowest level in 35 years, indicating potential for wage inflation. If true, Feb and March will likely see a rise in bond interest rates and the SPX dropping down to retrace the post-election rally (2080) by the end of March.

Moving on to the sentiment indicators, a nice drop of about SPX 40 points followed the Short Term Indicator (VXX $ volume and Smart Beta P/C) SELL. As a result there was a small rise in bearish sentiment, but not enough to indicate a change in direction.

The overall Indicator Scoreboard has only seen a small rise in bearish sentiment.

Bonds and gold both had a brief but strong rally last week probably due relief of tax loss selling with bond (TNX) sentiment moving back to neutral. The gold stocks (HUI) outlook seems more ominous with short term sentiment dropping well below the mean in a pattern similar to Apr to May 2015.

The NDX remains the most bearish of the indices with sentiment hovering near the lows.

Finally, the banking index BKX with FAZ/FAS has seen a very sharp drop in bearish sentiment as the BKX has rallied 50% in the last 6 months. However, given the long period of accumulation (BUY zone), the index is in a similar position as the HUI in May of 2016 where the initial drop to the SELL zone was meet by a lengthy period of distribution similar to the BKX from March thru July.

Conclusion. Sentiment wise, of all the indices the BKX is probably the least bad and is likely to outperform over the next few months, while the NDX and HIU are the worst. It's hard to say at this time whether the market continues downward as sentiment indicates or presents the "false signal" I outlined above. These two to four week selloffs, followed by 4 to six month rallies are starting to remind me of a 2014 Sci-Fi movie, Edge of Tomorrow with Tom Cruise, where time looped back every time he died.

Weekly Trade Alert. I hope some you were able to short at SPX last week as my entry was meet, but I was too hesitant on the Monday ramp. My New Year's resolution is to work on my trading skills. Same as last week if strong start to year, short on the SPX on a retest of the highs next week 2270-75 with a stop at 2290. Updates @mrktsignals if necessary.

No comments:

Post a Comment