Every day I hear more and more analysts predicting a continued rally in the SPX thru 2018 with a price target EOY of 3,000. As a contrarian, this reminds me of Q4 2015 with the SPX at 2,100 when the consensus was an SPX target of 2,400 the first half of 2016, but after the Jan-Feb decline to the 1800's targets dropped to 1300 or lower. More likely scenarios seem to be the melt up-melt down scenario proposed by Ed Yardeni in June, now seeing SPX 3,100 by June 2018, or my preferred scenario of the beginning of a 1970-72 type bear market. The key, as I see it, is the reaction of the bond market to the Fed's reduction of its balance sheet, a once in a lifetime event. More in my long term forecast, due over the next two weeks.

I. Sentiment Indicators

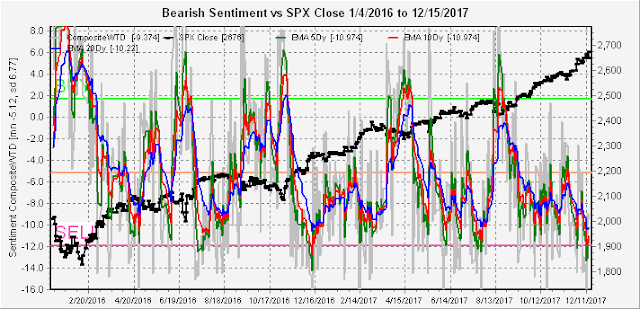

This week, I will only look back two years to look more closely at the Jul-Aug 2016 period which seems most like the current period. The overall Indicator Scoreboard saw a sharp drop in bearish sentiment before a slight uptick on Friday. Sentiment is now at similar levels to the Jul-Aug 2016 and Feb-Mar 2017 tops.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) also saw a sharp drop in bearishnes, but a continued decline in the longer term EMAs is likely before a top.

The NDX sentiment also saw a sharp drop, but remains moderately bullish, and provides the strongest argument for strength in prices possibly thru early Jan.

Bond sentiment (TNX) continued its sharp rise in bearish volume in TBT vs TLT, which is surprising given the small change in TNX outside the drop on lower than expected CPI. To me this looks like smart money positioning ahead of a trend change, rather than retail investors panicking after the fact.

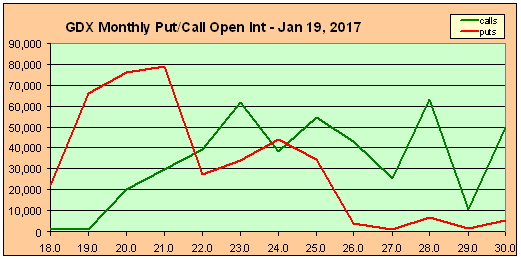

For the gold miners (HUI), bearish sentiment fell sharply with the one day jump in prices with the weak CPI data. As i have pointed out before inflation is not a friend to gold stocks at this time as it simply means higher interest rates. Some gold bugs are now calling for a new bull market, but bearish sentiment is well below the levels of EOY 2016 and does not support a sustained advance.

II. Options Open Interest

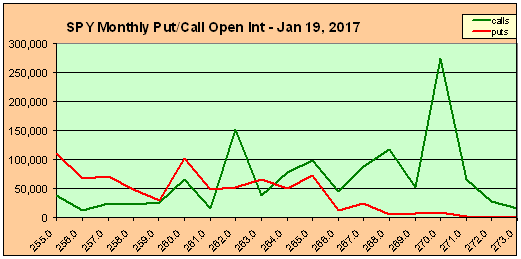

It was no surprise that the high call levels for Dec opt exp provided little resistance to higher prices on the SPY, but the high calls for Dec 29 at 266-7 did act as smart money with a Fri high of 267. This week I want to take a broader look at the SPY, VIX and GDX open int thru Jan 2018.

For the SPY next Wed, at the current 267, there is little put support and call resistance could push down to 265 or delta hedging could push up to 269+.

The VIX shows a very high open int level on Wed at about 50% the Jan monthly and 5-10x the other weeklies with a "most likely" of 12.5, so it's possible someone is expecting a blowoff to SPY 269+ (SPX ~2700) followed by a sharp drop on the tax plan approval.

For Fri, the SPY shows a "most likely" range of 264-5.

For Fri Dec 29, the SPY open int has dropped 50% since last week, so the smart money has covered half their position, indicating that much of the expected gains have been seen. The "most likely" drops to 263.

Looking out to the Jan 2018 monthlies, the SPY has very call resistance at 270 and moderate resistance down to 262 with only weak put support at 260 with a "most likely" range of 261-3.

Looking at the Jan VIX open int, the "most likely" range is 13-14 showing a moderate pickup in volatility is expected.

The GDX looks like it could get a safe haven bid if the stock market falters with a "most likely" range of 22-24.

Conclusions. Last week did not provide any low risk entries with the SPX up 1% for the week, mostly on Fri opt exp. With the tax proposal finalized last Fri, Senate & House approval may be next week. I am not sure how reliable the option open int may be based on the last few weeks, but Wed may provide an important turn date around the SPX 2700 level based on the unusual VIX data. Overall, I expect some type of short term pullback as a "sell the news" with a final rally into early Jan before a larger decline.

Weekly Trade Alert. Next week could see a pickup in volatility if the tax plan is approved . Short at SPX 2700 or better with a target of 2650-60. Updates @mrktsignals.

Investment Diary, update 2017.10.28, Indicator Primer

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2017 SentimentSignals.blogspot.com

No comments:

Post a Comment