Since late Nov, it seems like every week starts strong then fades as the week progresses. The strong rally on high volume for Dec opt exp is reminiscent of the Oct 2014 top, and generally indicates distribution. Higher prices are likely to start the new year, but Jan is likely to be a rocky month. Thanks to loyal readers as page views passed 200k last month. Happy Holidays and a prosperous New Year to all.

I. Sentiment Indicators

Bearish sentiment continued to retreat last week, as the overall Indicator Scoreboard was pushed lower by very low put/call ratios.

Even the Short Term Indicator (VXX $ volume and Smart Beta P/C) has pulled back to the area of recent lows, but still has a ways to go to match the lows of larger tops in 2015.

The NDX sentiment seem to be lagging other indicators which leads me to believe that after a weak first half to Jan, techs will likely power the market back up when earnings season is in full swing late Jan.

Bond sentiment (TNX) proved itself as a smart money indicator last week as rates rose from 2.36% to almost 2.5%. The same behavior with a rounded bottom in sentiment was seen after the Nov election that resulted in much higher rates. It's hard to tell what the effects will be of the reversal of QE, but I expect to see rates of 2.7-2.8% the first quarter and eventually 4%+ the next three years. It has been over 40 years since we have seen a bear market in bonds, but a move to 4% is about a 30% drop in price from the highs for 20 year bonds (TLT).

For the gold miners (HUI), the recent rally has pushed sentiment back to its recent lows so I doubt that prices will push much higher than the 200 level (+ 4-5%).

II. Options Open Interest

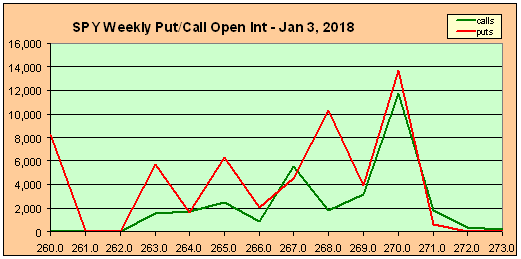

We did not get the pickup in volatility suggested by the VIX options last week as the SPX only rose to 2695 then fell to 2676. This week I want to focus on the SPY, looking at possible turns thru the Jan 19th opt exp (current SPY 267.5, SPX 2683).

The Fri Dec 29 SPY large call open int at 267 may continue to act as support with positive delta hedging with 270 the next resistance level, so probably a small positive bias thru EOY.

Things start to look interesting in Jan, with the Wed put support rising to an important level not seen in a while. It is doubtful that this is smart money as the popular bet is a tax-related selloff to start the year, but is more likely to push the SPY over 270 thru Wed. One popular EW analyst has an ED target of SPX 2720-30, DJIA 25,200+.

By Fri, however, call resistance is likely to push prices lower. As long as 267 holds, delta hedging may prop up prices, otherwise support drops down to 265+.

For Fri Jan 12, there is a modestly positive bias from put support with a "most likely" range of 267-69.

For the monthly opt exp, down is the most likely direction with modest support at 266 and then lower at 262. So the overall outlook is a 4-5% pullback thru Jan opt exp.

Conclusions. The outlook based on the opt open int and supported by sentiment is that Santa may be limping along thru year end, but that the new year is likely to start with a bang, followed by a fairly sharp reversal.

Weekly Trade Alert. Longs may be accumulated in the SPX 2680-90 area with a stop at recent lows (2676) and an early Jan target of SPX 2720-30. Updates @mrktsignals.

Investment Diary, update 2017.10.28, Indicator Primer

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2017 SentimentSignals.blogspot.com

No comments:

Post a Comment