I. Sentiment Indicators

The overall Indicator Scoreboard (outlook two to four months) has moved back to a more positive reading within a positive INT outlook.

The Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four weeks) has, however, moved to a more negative outlook, indicating that the downturn started last week has more to go before an INT upturn. As discussed later, this is likely pointing to a retest of the SPX triangle lows below 2600 over the next several weeks.

Bearish bond sentiment (TNX) saw a sharp spike higher last week as the TNX briefly tested 3.0%, but I have been wondering about the runup in rates over the last few weeks. The runup started right after Trump announced the second round of tariffs with China, so when China did not respond in kind perhaps they sold US bonds instead. Now we have Treasury Secretary Mnuchin scheduled to go to China to discuss trade. Will a solution bring rates back down?

The gold miners (HUI) bearish sentiment continued to climb as gold miners dropped with the rise in rates and the longer sentiment (blue) has the reached the mid-Dec 2017 level which was followed by a 25 pt jump in the HUI.

II. Dumb Money/Smart Money Indicators

This week I want to start with a blow by blow followup of the The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 days/hours). Even though Fri close was at a SELL, I indicated last week that a move up to SPX 2680-85 was likely before a downturn and Mon saw a move up to 2683 before closing at 2670. A hour before the close sentiment looked like this.

Tues AM the SPX again tested the upper range at 2684 before dropping to a low at 2617 and closing at 2635. An hour after the open with the SPX at 2667 the sentiment looked like this.

But by an hour before the close sentiment looked like this, and the result was an end to a sharp one day decline followed by a rally into Fri AM.

The strong open in the NDX on Fri (up 100 pts) again resulted in a strong SELL 20 min after the open as shown below. This time the result was only a 0.5% drop in the SPX (but 2% in the NDX) over the next two hours.

The end of week result is shown below. As sexy as the above reults may seen there is a potential problem with the Risk Aversion Indicator due to cyclicality where the yellow lines represent a possible trend. So the current SELL similar to last Fri may be weaker than it seems.

Here is the Risk Aversion Indicator INT look from early 2017, so we may be doing something similar to May of 2017.

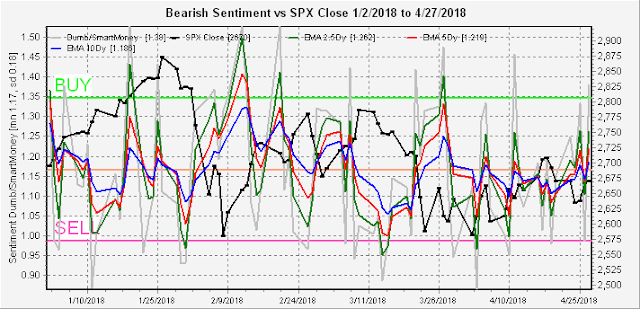

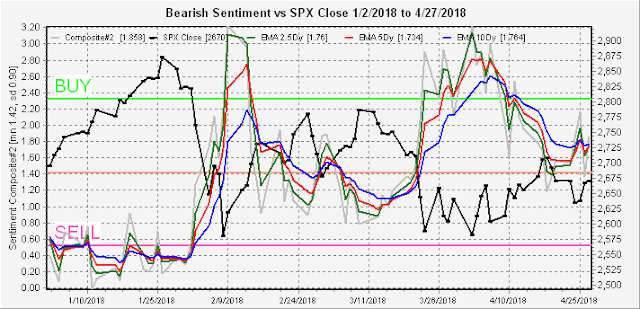

This is why I rely on the regular Dumb Money/Smart Money Indicator as it is more stable on the INT time frame.

Moving on to the short term Dumb Money/Smart Money Indicator (outlook 2 to 4 days/hours) the two weak SELLs near SPX 2700 two weeks ago were followed by two weak BUYs last week. The first BUY at the Wed close was followed by a gap open of SPX 15 pts with a high of +40 pts before a drop into the close. The second was Fri at the close, so we are likely to start the week on a strong note, where a 40 pt up move from SPX 2670 targets the 2710 area.

The DM/SM cyclical component (outlook 2 to 4 days/hours) improved slightly with the pullback last week.

The INT term SPX Long Term/Short Term ETFs (outlook two to four months) improved last week but has not begun the sharp move up seen in Aug 2017 that should proceed an INT rally.

The INT NDX Long Term/Short Term ETF Indicator (outlook two to four months) has moved back to the neutral level seen in Aug 2017 so the lows for the NDX may not be much lower.

III. Technical Indicators/Other

I had been paying so much attention to the new indicators that I forgot to check on the VIX Call Indicator, but on Apr 17 it did increase by 47% of the mean from a recent low where 50% is a SELL. So higher volatility may be expected for three weeks following Apr 17. (Due to Jan drop scale is actually SPX %/3).

The triangle in SPX since January has held up much better than I expected and a near term conclusion may be indicated by sentiment. The DM/SM Indicator weak BUY is indicating a retest of the SPX previous high near 2717 close to the upper trend line over the next few days, while the ST Indicator, VIX Call Indicator, and Risk Aversion Indicator are pointing to a test of the lower TL near 2575 over the next two weeks. The hourly charts also suggest an inverse H&S also pointing to SPX 2717 over the next few days.

IV. Options Open Interest

I did not post an update of the Fri SPX OI, but for those who follow on their own, a large number of calls were added Thur at 2675 that pushed the expected close down to the 2665-70 range (act 2670).

For next week M/W/F all have large positions (10k contracts x 100 sh x 2650 price = $2.65B). Mon Apr 30 EOM, puts dominate below SPX 2660 with not much call resistance until 2725 with puts and calls mostly cancelling each other out at 2675 and 2700, so a move over 2690 is likely to run to 2720. No estimate for expected close.

For Wed May 2 FOMC Day, there's not a lot of put support until SPX 2600 with strong call resistance at 2680, so a move below 2680 could drop to 2600. Expected close 2680.

For Fri May 4 NFP Day, there's strong resistance at SPX 2700 and above, strong support between 2600 and 2650, but little below until 2560. Expected close 2670.

I also wanted to take a look at AAPL since EPS after Tues close may set the tune for NDX short term. Current price $162. AAPL faces a lot af resistance at $165 and higher but little support except at $150, bad news could send the stock reeling while good news may only have a temporary effect.

Finally, a look at GDX which does not look promising. Currently $22.7, there is stiff resistance at $23 but a move over $23-4 could create some serious delta hedging upward pressure.

Weekly Trade Alert. Possible 1-2 day SPX long targeting 2710+ area. Short SPX 2715ish with target next two weeks below 2600. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment