The obvious wildcard is whether Trump has changed his mind that trade wars are easy to win and election losses may also increase pressure to reduce his hard line stance. So far the loss for US equities using the Russell 3000 is 10% or about $3 trillion, while for China the loss is 20% on a market cap of about 7.5T or about $1.5 trillion (correction, China's SSEC down 32% or over $2.5T). With the US GDP at $19T compared to China's 12T, the losses are not as bad compared to GDP, but still worse than China.

The focus is somewhat different this week, looking at longer term sentiment for stocks back to mid 2014. I have also incorporated a long needed adjustment to Std Dec calcs where a 2x period adjustment changes Std Dev by 1/√2. The Dumb Money/Smart Money includes an expanded view for the SPX, while the technical indicator section includes an expanded view of the four year cycle since 2009. Options open int are omitted. The conclusion is also expanded to look at several alternatives.

The overall Indicator Scoreboard (LT 2014.06 to present, 2.5x EMAs) bearish sentiment is on par with the Feb 2018 decline but not at levels that marked major bottoms of the past four years. More volatility or retest aka Mar-Apr 2018 likely.

The LT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four months) bearish sentiment is about the same as Aug 2017, but less than Oct 2014. More volatility likely to reach Feb-Apr levels.

Bond sentiment (TNX) using INT view, the strong BUY resulted in a modest retreat in rates, but with sentiment dropping sharply, rates may not drop below 3%..

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment fell as prices consolidated for most of the week, but then the HUI fell sharply Friday with weak EPS reports causing a slight uptick in bearish sentiment.

II. Dumb Money/Smart Money Indicators

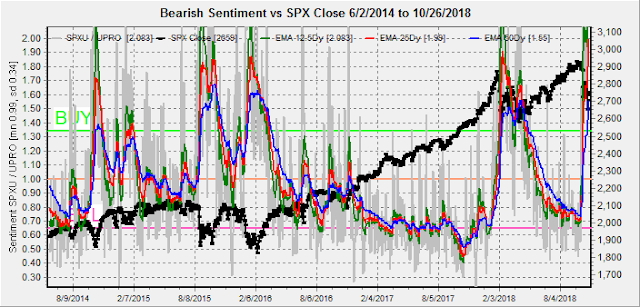

The SPX Long Term/Short Term ETFs (LT 2014.06 to present, 2.5x EMAs) bearish sentiment has continued to be an enigma, although following the Feb 2018 decline bearish sentiment (2x vs 3x) did not pick up until the Mar-Apr retest (immediately prior to the sustained rally).

A closer look at the SPX ETFs may clarify. First the 2x (SDS/SSO) ETFs, where we see that bearish sentiment has risen to just below the levels of the Feb 2018 pullback with the LT EMAs peaking right at the Mar-Apr retest lows.

For the SPX 3x ETFs (SPXU/UPRO) bearish sentiment accekerated more quickly and has already reached the levels of the Feb lows. So the smart money (3x) seem to be more proactive, while the dumb money (2x) is reactive.

Long term neutral, the LT term NDX Long Term/Short Term ETF Indicator has improved, especially compared to the SPX, but the overall pattern shows that much greater extremes are required for major turns.

III. Technical Indicators / Other

Looking back at the SPX using daily charts from the lows of 2009, there has been a repeated pattern of strong rallies into the mid-term election year, followed by a correction to the 400 SMA. In 2014, there was a Sept top followed by a sharp Oct correction, almost identical to 2018, but in 2010 the top was May. Each time there was a rally to a new high the next year followed by a distribution period of several months before an even sharper decline. In EW terms this could be called a completed 5 wave cycle, so possibly that's it, but it would feel more appropriate to see more of a distribution period before a major decline.

Taking a closer look at the mid-term corrections, 2010 differed from 2014 due to the lengthy consolidation period between the 100 and 400 SMAs before a breakout. My feeling is that 2018 is likely to see something similar that could lead to a breakout to the upside if a trade agreement is settled with China by early 2019, but could lead to a breakdown if no settlement is reached

For 2014, the outcome was a sharp V-recovery. This may be possible if Trump quickly reverses course on China but I view this as less likely. Some of the stickier points, like intellectual property and tech spyware are likely to take weeks, if not months to work out, so the 2010 scenario seems more likely.

For 2018, we have already seen our first trip to the 100 SMA and a failure, and I would not be surprised to see any rallies stall out near SPX 2700 until after the election. The election may cause ST volatility, but a Dem win in the House may be positive LT, as this is more likely to force Trump to give up his hard line stance on trade. Any sign of renewing trade talks is likely to push the SPX to 2800+ for an EOY rally, but when Jan begins another round of earnings may result in a retest of the low 2600s. With Congress off for Dec, any trade agreement is not likely until Feb/Mar.

As an update to the Trump rally TLs, now that the lower TL is broken it's possible that a rally back to test occurs. With the current slope the lower TL will be at SPX 2880 in 6 mns.

Conclusions. The composite indicators do not point to an immediate strong rally as was seen after the Oct 2014 selloff. Prices could continue lower, depending on whether the patterns of the last two mid-term elections hold. The best outcome at present seems to be the 2010 scenario where the SPX consolidates between the 100 and 400 SMAs for several months. If the SPX 2x ETF turns more bearish after a possible EOY rally and retest, a larger rally may be possible. Even with a trade agreement the fundamental problems with the economy will persist. A weak rally that fails near SPX 2880 then goes into a distribution pattern for several months could point to a much more serious decline starting the 2nd half of 2019.

Weekly Trade Alert. None. Not expecting much action until after the election. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment