The heyday for the middle class was in the 1970's. Although this is an exaggeration I am going to estimate that roughly 60% of the population in the middle class controlled 50% of the wealth (with 20% poor and 20% rich). But removal of the gold standard and crushing the labor unions led to pumped up asset prices as central bankers began to focus more on "the wealth effect" whereby higher asset prices are supposed encourage consumers to spend more and increase economic growth. Stagnant wages were offset for many years by importing low cost goods from China. The result, however, has been an increased concentration of wealth were 20% of the population controls over 80% of the wealth. The middle class has shrunk to less than 50% and have resorted to borrowing to keep up their standard of living.

To get back to the CBs, I think they are trying to create a soft landing for the "everything bubble shown below. Over the next 5-10 years a 15-20% decline in housing prices and a 30-40% decline in stock prices is probably required to deflate the bubble and bring prices back to a supportable level. This will be accomplished by higher interest rates and monetary tightening. The question is can this be accomplished without another dot-com or housing type crash. Link to article.

I. Sentiment Indicators

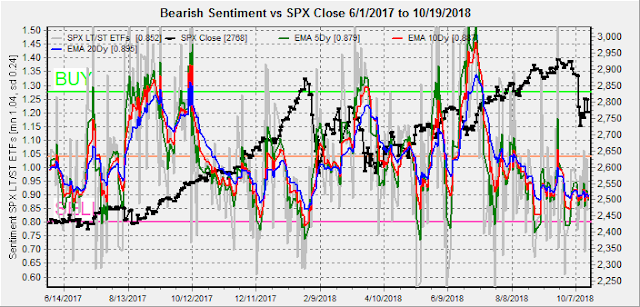

There is little change in overall sentiment this week as bearish sentiment is very high for the SPX, but does not preclude a short but sharp move lower. For the indicators this week the period covered is June 2017 thru current period.

The overall Indicator Scoreboard (INT term, outlook two to four months) has now spiked to a level of the SPX Feb price lows.

I also want to take a look at the LT view of the CPC Revised (combined options less VIX options). The overall trend since 2015 is a gradual reduction in bearish levels which supports a long term bearish outlook for stocks.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four months) has now reached the level of Aug 2017, but note that the Mar retest did not occur until after a significant drop in sentiment. Supports the Aug 2015 flash crash rebound more than the Oct 2014 continuation.

Bond bearish sentiment (TNX) increased sharply last week which still supports the post Feb 2018 leveling off of rates scenario.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment remained near the SELL level as prices consolidated near HUI 155.

II. Dumb Money/Smart Money Indicators

The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 days/wks) as a ST/INT indicator remains near the top of its TL and remains positive for stocks.

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 days/weeks) has actually risen to a slightly higher level than either Aug 2017 and Feb-Mar 2018, indicating strong support for stocks over the next 1-3 months (expt option horizon).

The INT term SPX Long Term/Short Term ETFs (outlook two to four weeks) bearish sentiment remains at low levels as complacency by longer term (2x) ETFs compared to ST (3x) remains high.

The long term NDX Long Term/Short Term ETF Indicator (outlook two to four weeks/ months) remains elevated, but pulled back from the extremes a week ago.

III. Technical / Other

Last week, I mentioned that I preferred the comparison the the flash crash of Aug 2015 for the recent decline to the Oct 2014 washout, and I posted on Twitter Wed that the early weeks SPX bounce could fail at < 50% retrace, then retrace 62% of the bounce to about 2750. Thur provided the drop that may still fill the gap at 2750, but a continuation of the pattern could reach SPX 2850s early Nov. A second leg down may occur late Nov if Trump follows thru on the threat of 25% China tariffs. This still seems to point to a lower top in Jan.

IV. Options Open Interest

Using Thurs close, remember that further out time frames are more likely to change over time. This week I will look out thru Oct 31.

With Fri close at SPX 2768, Mon has huge support at 2700 if the market falls, and secondary support at 2750. Higher prices to 2800 are possible. Light open int overall.

Wed has very large put open int at SPX 2850, but are unlikely to effect prices. More likely is a range of 2775 to 2800.

Fri shows larger open int with large net put support up to SPX 2800. Over 2800 there is little resistance until 2825 and over that 2850 is possible. Most likely is 2800-25.

For the EOM, the outlook is pretty much the same as the 26th as put support should hold the SPX over 2800, but puts and calls net out at higher prices and should not effect SPX price levels.

Conclusions. Last week was supposed to be a trading range so a 1 pt gain made it a good call. The move up was larger than expected, but supported the Aug 2015 flash crash comparison as did the late week retreat. Next week should be pivotal, as follow thru to the downside aligns with Oct 2014, while upside bias with whipsaws likely supports continuation of the flash crash scenario. Longer term, based on the central bank outlook, LT CPC Rev, and SPX ETFS a more protracted bear market with less extreme price drops is looking more likely.

Weekly Trade Alert. Last weeks outlook to take a two week vacation seemed appropriate except for day traders. We could see weakness early to fill the gap at SPX 2750, but there seemed to be a lot of angst Fri with the anniversary of the Oct 1987 crash, so a mild beginning could lead to fireworks by end of week. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment