Last Friday's selloff was eerily similar to the late Jan 2018 EOM decline which also started with an SPX 50 pt drop. This plus a sell signal from the INT volume indicator NYUPV /NYDNV (see Tech/Other) last week leads me to believe that a top may be (nearly) in about a week earlier than expected. However, with all indicators not on board we may only start with a 4% decline to the SPX 100 SMA around 3200 then a retest of the ATH before a larger decline as in Jun-Jul 2015.

The wildcard, however, is the corona virus breakout in China. In Oct 2014, fears of an avian flu breakout in the USA resulted in a 10% SPX decline in two weeks. This outbreak poses a much larger potential threat. As simulated by a John Hopkins researcher several months ago, a full blown pandemic could result in worldwide deaths of 65 million people over 18 months resulting in a 11% drop in GDP and 20-40% drop in stock markets.

This fits nicely with the LT view of the Safety Trade indicator (see Mon/Twitter, below) which last week I thought was supportive of higher prices, but when looking back over the 2013-2016 period compared to 2017-20 there is evidence of a four year cycle where the late 2018 indicator high only matches the Aug 2015 high and a higher high matching Feb 2016 is needed. This implies an even larger stock market decline than 2018 and lower int rates with the TNX possibly reaching 1%.

I. Sentiment Indicators

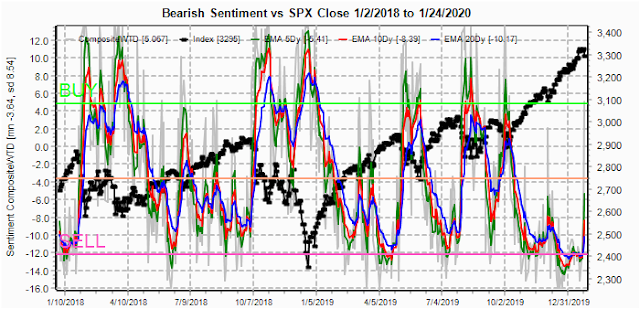

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment has ticked up only slightly.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C [ETF Puts/Equity Calls], outlook two to four months) bearish sentiment has only budged, warning of a significant pickup in volatility ahead.

The next three charts are LT from 2014 using 5X EMAs to show possible 4 tear cycle. Bonds (TNX). Interest rates have now broken below the rising trend and seem to be following the pattern of mid-2016.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment continues to fall as prices are also rising similar to mid-2016.

Finally, the Safety Trade Indicator (SPX/TNX ETFs) from a LT perspective the rise in sentiment during the Oct-Dec 2018 selloff was actually fairly mild and compares to the Aug 2015 rise. This indicates that a lower retest of the SPX lows of 2018 may be required.

II. Dumb Money/Smart Money Indicators

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) has bounced off recent lows, but is not supportive of a rally.

And the sister options Hedge Ratio sentiment has barely moved, indicating a significant increase in hedging is required to support a rally.

The INT term SPX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment has been forming a rounded bottom and is about the same as the Jan 2018 top.

The INT term NDX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment is much like the SPX 2X ETFs and seems to have failed just above the target of 9200-50 at 9272.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Fri large decline has likely increased put support considerably. Delta hedging may occur as negative reinforcement when put support is broken or call resistance is exceeded. This week I will look out thru Jan 31. Also, this week includes a look at the GDX for Feb exp.

With Fri close at SPX 3295, options OI for Mon shows little put support until 3250. The large call OI 3350-70 is probably a bet on a "no" for impeachment by the Senate.

Wed has small OI where SPX already shows moderate put support from 3250-80 as the Mon expected rally was supposed to reverse sharply.

For Fri EOM, large OI shows put support starting at SPX 3275 and call resistance at 3300 with an expected range of 3275-3300.

Using the GDX as a gold miner proxy closing at 29.22,.but faces strong resistance at 30 and 32 with put support ar 27. A move over 30 could accelerate with delta hedging.

Currently the TLT is 142 with the TNX at 1.68% as weak stocks increased demand for bonds.

IV. Technical / Other

Fur several years, I have been watching the $NYUPV/$NYDNV as an INT/LT indicator using the 100 and 200 day SMAs. There seems to be an emerging cycle where a decline in the 100 SMA tends to cross below 1.40 prior to INT tops (red circles) as well as mid-rally corrections (green circles) so far they have been alternating since 2015 with a cross last week that should be an INT top.

Looking more closely at both the 2015 and 2018 top showed a 6-8 week lead time prior to the beginning of a serious decline where both showed increasingly choppy behavior.

2015.

2018

Conclusions. I turned cautiously bearish as the SPX crossed 3240 as I felt that the risk out weighed the rewards with almost 1000 pts gain since last Dec at 2350. There are no clear signals to become aggressively bearish. Although the corona virus may all that is required to start a sharp downturn like the avian flu Oct 2014, I hate to be a trend follower. INT outlook as shown by the volume analysis still shows the potential for a longer topping pattern, but this time may be different.

Weekly Trade Alert. There does seem to be a good possibility of a 4% drop to the 100 SMA at SPX 3200 before an ATH retest similar to 2015. Last Fri SPX P/C jumped to 2.25, the highest since Dec 8 and 18, and both were followed by 50 pt rallies over the next week, but early Oct 2018 the same levels were followed by further declines. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2020 SentimentSignals.blogspot.com

have you considered including GEX and DIX data for your analysis? They seem quite useful as well. Again, thank you for posting the weekly analysis!

ReplyDeleteGreat post again, and you nailed it with a 4% drop!!!

ReplyDeleteAll week the market defended the Monday low so an ATH retest next week is almost certain.

Already look forward to your weekend post.

Yeah... great call Arthur. Market is about to close as I write this and we got very close to that 3200 level. I do expect some kind of rally next week as this looks pretty overdone on the downside right now. Not sure how high but maybe your weekend report can give us some clues.

ReplyDelete