The first chart I want to discuss is the Composite#1 (P/C,VXX Vol,Skew). The recent decline has moved the indicator from decidedly bearish (low bearish sentiment) to neutral.

In part the lack of movement of the first composite is that SKEW has remained stubbornly high, which has been right as far as overall market direction but is not responsive enough for shorter term trading. So, I am introducing Composite#2, replacing SKEW with the VIX term structure, VXV/VIX. This composite shows moderate bearish sentiment that would support about a 5% rally.

Below I am presenting the chart of the VIX term structure alone since this is the first introduction into my sentiment indicators. There were a couple of questionable signals in early 2015, but it did give a very strong warning of the August crash.

Next, I want to show my SPX etf indicator based on the SPXU/UPRO etfs as discussed Nov 24. As a single indicator, the results are very close to Composite#2 and indicates a slight bearish sentiment similar to the position before the 4-5% rallies in March and July.

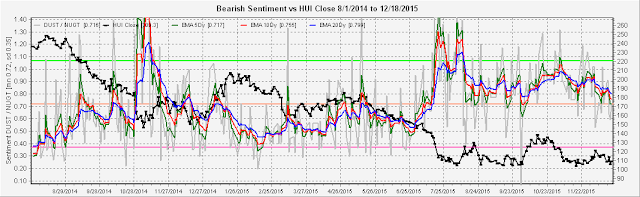

Finally, I want to update the HUI gold miner sentiment indicator using the DUST/NUGT etfs discussed Nov 29. Although long term sentiment is very bullish (high bearish sentiment), remaning over the mean since July, recently sentiment has become less bullish even as prices have continued to fall. Possibly this is due to the anticipation to a year-end rally similar to the low bearish sentiment in the SPX several weeks ago expecting the "Santa rally", and it increases the chances of a final flush in Jan.

In conclusion, sentiment supports a year-end or "January effect" rally for the SPX starting any time, but the overall gains will be limited. My personal targets are a drop down to SPX 1970-75 next week, followed by a rally to 2090-95 or about 120 pts by mid-Jan. After that if sentiment declines to the bearish level again, I expect a decline of about 240 pts to about 1850 by late Feb. SPX 1750 is a real possibility for a final low, but my gut tells me that it will be at a later date. For gold miners, a good bottom is in sight but probably not here yet.

No comments:

Post a Comment