I. Sentiment Indicators

Sentiment overall has seen an increased level of bearishness that is approaching the levels of the sharp May 17-18 decline, also of 50 SPX pts. The question one needs to ask is whether this is the beginning of a larger decline, in which case bearishness can increase much more, or whether this is just more of the same, indicating the possibility of a 50-75 SPX pt rally. My overall conclusion is the later.

The overall Indicator Scoreboard early in the weak fell to the SELL level on Monday for the third time in two months and has shown only a weak bounce, so it is unclear if sentiment is strong enough to power to a new high. For this week I am showing the last 18 months with INT EMAs.

However, since I have been comparing 2017 to 2014 I wanted to compare sentiment as well. Notice that time periods are off by two months since I wanted to show 2014 thru August, but both periods saw low bearishness hitting -14 in Dec of the previous year then followed by BUYs in Apr and three SELLs in the May-June periods. In 2014, however, prices continued to rise as did the level of bearishness until a BUY was signaled with the sharp August selloff.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) also shows only weak support for a rally, but continued volatility next week is likely to push levels higher.

Sentiment for bonds (TNX) moved back to neutral after the recent strong move up in rates so its difficult to gauge a direction at this point.

Sentiment for gold stocks (HUI) fell even as prices declined, probably due to safe haven demand with the volatility in the stock market. Lower prices seem likely.

Finally, just to take a look at a couple of the leveraged ETF ration for SPX and NDX that do show the highest level of bearishness for this year. The SPXU/UPRO $ ratio has risen to the level equal in May 2016 which was followed by an 80 pt SPX rally as well as June 2016 which saw a rally to test recent highs before a larger decline.

The NDX ETF pair SQQQ/TQQQ is even more extreme with ST sentiment at levels last seen before the recent rally that retraced 80% of the original decline. Note that bearish sentiment had been rising for several months before the top.

II. Options Open Interest

This week I am going to take a look at the next two weeks Friday's OI as well as a three month look ahead for the VIX options OI.

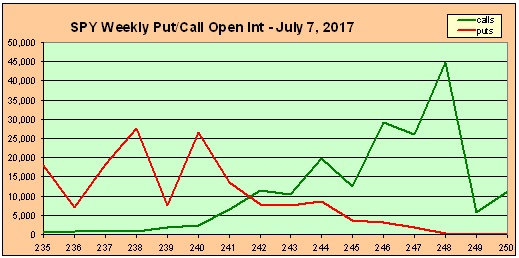

First for Friday July 7, the most likely range seems to be 240.5 to 244 (SPX 2410 to 2445) with 242-3 most likely. Support is strong at 240 and resistance at 246.

For the next week, the support remains strong at 240, but resistance fades away, leaving a clear path to 245 or higher. If the market is to start a new move upwards this is probably the week it happens.

Over the last two years, several times I have mentioned using the VIX P/C as warning sign when it reaches low levels (<.30 EMAs), but the more important factor are jumps in call daily volume to 500k or more (avg 250k). The following chart shows the values for the last two weeks, note after a decline high volume of calls and puts mean dumb money buying calls while smart money buys puts.

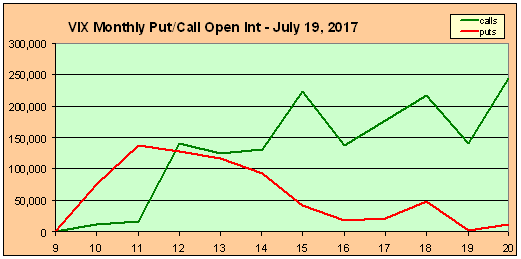

Anyway, this made me decide to look at the VIX options OI with the following data stored from Wed afternoon. If VIX call buyers are smart money hedging their sell programs, the info may be better that that from the SPY. So here goes. Note OI size drops about 50% for each forward month, so forward months may change.

Starting with the July VIX OI, the most likely range is 11 to 14 with strong resistance at 15. When I saw this I started to worry, but little did I know that we would gap down the next day and hit VIX 15 in the afternoon. For some reason these expire on Wed, two days before SPY. Only strong support level at 11 means VIX can drop back down to 10-11.

Looking at August, we see a cup formation that is likely to lock the VIX between 11 and 15 with most likely 12-14. This seems to rule out the strong decline that everyone is looking for at least until the second half of August.

For September it gets down right scary. Here, there is strong support at 14 with very little resistance until 20. Apparently the smart money is expecting something big to the downside between mid-Aug and mid-Sept. For comparison to 2014, the 100 pt SPX drop in Aug produced a VIX of 18 and the 200 pt drop in Oct produced a VIX of 30.

III. Technical Indicators

Today I just want to briefly mention the use of price gaps simply because the market seems to be almost frenetic about filling them. The following two charts are from Friday for the SPX and NDX using hourly charts from Marketwatch.

The SPX has a short term gap from Friday's open at 2420, my preference is a rally to 2440 then a sharp decline to fill next week. This would setup an inverse H&S as well as increase bearish sentiment. The remaining gap is from two weeks ago at 2453, this implies a test of the ATH, but when?

The NDX, however, has already filled its Friday gap but has two gaps at higher levels at 5750 and 5775, but when will they be filled? A large gap also looms at 5400 from April.

Conclusions. Sentiment is not as strong as I would like to support a rally, but the 3X ETFs could support a rally up to 2450 to 2475. I still like the 2014 comparison, updated on Twitter, which points to one more high around July 21. The SPY options OI also shows upside promise after next week, so a sideways consolidation next week between SPX 2420-40 is likely to surprise to the upside. I don't like to depend on EW, but the breakout from the SPX April bull flag could turn into a 5 wave affair with 1=70 pts, 3=90 pts, and 5=70 pts gives 2475. More interesting from a timing perspective is that the VIX options OI supports an extension of time out to late Aug before a 4-5% decline, which leaves plenty of time for an additional rally phase. I am leaning 60/40 up/down at this point.

Weekly Trade Alert. Two potential trades for next week are to short a move to SPX 2440/5 looking to fill the gap at 2420 if not filled first. The second is to go long if 2420 is retested for a longer term trade (two weeks) targeting the 2450-75 level with a stop just below 2405 or even 2410. Updates @mrktsignals.

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2017 SentimentSignals.blogspot.com

Hi Arthur, where do you get your option open interest charts from? What site?

ReplyDelete