In Feb, Trump was telling the US public that Covid-19 was a hoax, referring to it as the Kung flu, and that as soon as the weather warmed up it would die off. Since then, he has constantly downplayed the risk which admittedly is concentrated in the elderly (offering a potential solution to the Social Security funding problem). Members of the GOP have acted like lemmings eschewing the use of protective masks and ignoring the practice of social distancing. And, the result as if by magic POTUS, his staff, and possibly numerous attendees of the recent rallies start dropping like flies a month before the election. Some are saying that it is a hoax in order to garner sympathy from the public or possibly a way to provide an excuse to delay or cancel the election, I call it justice.

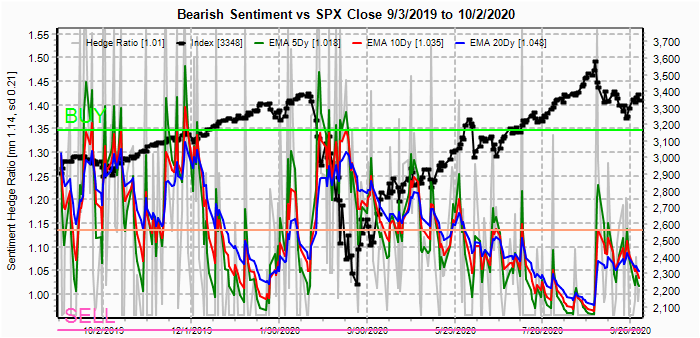

This week I am making some slight changes to the content, changing the timeline from three years to one, in order to more closely pinpoint changes in sentiment as an important top is expected over the next couple of months. Bonds and gold stocks remain the same. Also, a put/call calculation is added to the options OI charts to evaluate overall sentiment.

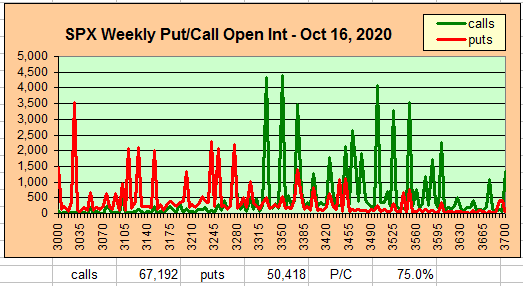

Sentiment is showing the potential for some weakness over the next two weeks. SPX options OI for Oct 16 is showing potential for negative gamma with large call positions staggered between 3325 ad 3375. With strong put support currently around 3250-75 and low P/C a drop below 3300 is possible. Similar to Sept 30, the reaction may be early, and most likely weakness later in the week thru early optn exp week will lead to a rally back to current levels for the exp.

The longer term view from mid-2017 has been used to show the pattern of increasingly lower and higher sentiment levels followed by larger declines and rallies. For the LT, overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment is relatively unchanged for the week as prices gyrated between the SPX 3300 and 3400 levels, selling off overnight after the debate and Trumps covid diagnosis.

The ST view from Sept 2019 also shows little change, but has not yet reached the BUY level seen before the Feb rally that may mean more weakness is likely before a final rally.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C [ETF Puts/Equity Calls], outlook two to four months) bearish sentiment has declined sharply, returning to levels seen prior to the Mar decline.

The VXX $ Vol remains somewhat elevated, indicating a sharp pickup in volatility is not likely.

Bonds (TNX). Bearish sentiment in bonds fell somewhat last week even as bonds remained in a trading range of 0.65-0.7%.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment spiked briefly but remains mainly unchanged as prices continue their gradual slide.

II. Dumb Money/Smart Money Indicators

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) bearish sentiment has followed a similar pattern prior to the Feb top, changing little with the decline to 3200.

And the sister options Hedge Ratio bearish sentiment is similar to the DM/SM options indicator.

The INT term NDX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment remains positive, but similar to the options indicators the reaction the recent selloff was mild, and not likely to cause a sharp rally.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Oct 9. Also, this week includes a look at the GDX for Oct exp.

This week I am adding a new feature to access the overall bearish sentiment by adding the PC below the charts. With Fri close at SPX 3348, options OI for Mon is small and shows a slight positive bias between the range of 3325-75 put support. Likely close is straddle at 3350-60.

Wed has small OI where SPX with similar sentiment to Mon.

For Fri overall P/C is low with strong call resistance at SPX 3380 and strong put support at 3270. May change during the week but 3350 or lower looks likely.

Looking further out to Oct 16 (PM), optn exp Fri has very low P/C and large call positions at 3325 and 3350 that are likely to push prices lower and first real put support is 3250. A decline down to 3270-80 looks likely by exp Fri. Similar setup for Sept 30 saw decline a few days early, so don't be surprised if a decline late this week into exp week sets up a rally back up to 3350 by exp.

For Oct EOM, a sharp increase in overall P/C, as many seem to be expecting a rally into exp week then a decline into the election. A decline to SPX 3270-80 as outlined above is likely to increase puts to support a rally back to or over 3400 by EOM.

For the QQQ (NDX/41, 11k=268), closing at 274 with an 8 pt drop for the day. P/C is high so puts at 270 should show strong support. A modest rally is likely.

For the QQQ optn exp Fri, shows a fairly small range of 270-280 (NDX about 11-11.5k) is likely with 285 max of range.

Using the GDX as a gold miner proxy closing at 39, up slightly for the week as weakness in the $US offset downward pressure of higher rates. Next week strong put support is at 37 and strong call resistance is at 40. Moderate put support up to 39 should keep prices in a tight range, but the low bearish sentiment (P/C) is ominous.

Last week upward pressure in rates were expected and the TLT fell to 162.8 from 165 as the TNX rose to 0.70 from 0.66%.

IV. Technical / Other

Laqst week saw a sharp drop in the SKEW while the VIX term structure remained near 1.2, so I decided to take a look at the data mining comparisons, and the recent decline in the spread is similar to Jan 2020..

Conclusions. Trumps covid diagnosis may be a major wildcard, but barring unexpected news, a decline into exp Fri Oct 16 seems likely, bottoming below SPX 3300 (possibly 3270-80). Depending on sentiment, a rally into the EOM taking the SPX back to 3400 or higher should follow. Last week seemed to be a adjustment to the prospect of a Biden presidency. As pointed out last week, the election surprise may be a Trump loss followed by a short covering rally before a longer term top is seen.

Weekly Trade Alert. A consolidation around the SPX 3350 thru mid-week is likely to be followed by a drop to at least 3300, possibly 3270-80, by early optn exp week. Updates @mrktsignals.

Investment Diary, Indicator Primer,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Hey I’m Martin Reed,if you are ready to get a loan contact.Mr Benjamin via email: 247officedept@gmail.com ,WhatsApp:+1 989-394-3740 I’m giving credit to his Service .They grant me the sum 2,000,000.00 Euro. within 5 working days.Mr Benjamin work with group investors into pure loan and debt financing at the low ROI to pay off your bills or buy a home Or Increase your Business. please I advise everyone out there who are in need of loan and can be reliable, trusted and capable of repaying back at the due time of funds.

ReplyDelete