I. What's Up with Bonds

First, I want to briefly explain how the bond market operates. Only about 60% of US bonds are held in the US with the rest mostly China at 20% and Europe at 20%. Due to Trump's weak dollar policy with the USD down 10%, foreign bond holders are down 10%. Add Trumps militaristic attitude toward China, "me first" trade policies, and rejection of Europe's global warming agenda, foreign bondholders are likely to be net sellers.

Within the US about 80% of bonds (excluding Fed) are held by financial institutions (banks, insurance cos, and pension funds) with the remaining 20% mostly in retirement accounts. When QE was implemented, the Fed might announce that it would buy $50 billion in bonds a month for the next 18 months for a total of $900B. But then a funny thing happened as interest rates dropped before the Fed purchases as the financial institutions (FI) would "front run" (buy before) the Fed, this drove up the price of bonds so the FI would make a profit by selling to the Fed. This was OK as one of the Fed's goals was to prop the profitability of the FI after the financial crisis ending in 2009.

Now with the Fed "unwinding" its balance sheet by selling bonds, it appears the FI are now "front running" the Fed's sales of bonds, but unfortunately as we see often in the stock market, selling often begets more selling as panic sets in driving bond prices lower and interest rates higher than is normal. When we add to the pressure from the Fed's unwinding, the pro-growth inflationary policies of Trump, and the negative foreign influences you have the potential for a "perfect storm". At the current rate of increase for the last five weeks for the TNX that works out to 4.0 to 4.5% by mid-year (my forecast for mid-2020) to 6.0 to 6.5% by EOY. For the stock market, this would result in approx a DJIA 5,000 pt drop by mid-year and 10,000 drop by EOY. If it does happen I expect the Fed to suspend QE unwinding and interest rate hikes by mid-year. Longer term this will raise questions about the further use of QE. Fortunately for China the politburo can simply call the FI CEO's and threaten jail time or the firing squad for selling. Check out the Technical Indicator section for how less bond volatility may lead to higher stock prices.

Ii. Sentiment Indicators

The overall Indicator Scoreboard saw a strong bounce relieving the strong SELL, but remains well short of a buy, so only partial retracements of the selloff are expected.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) has reached the moderate BUY level similar to the July 2015 and Sept 2016 selloffs that lead to partial retracements.

Looking more closely at the ST Components, the VXX $ volume has reached a fairly strong BUY level somewhat similar to Sept 2016. The two month retracement period before the early pre-election plunge is consistent with the volatility compression likely with this indicator.

The Smart Beta P/C has only reached the weak BUY level that is also consistent with the Sept 2016 SPX selloff of 80 pts that was followed by a sharp short term retracememt and a two month consolidation before the Nov plunge.

The NDX short term ETFs SQQQ/TQQQ bearish sentiment is now at the highest level seen in the last three years.

Looking at some of the other sectors, the small cap RUT (TZA/TNA) sentiment remains near neutral.

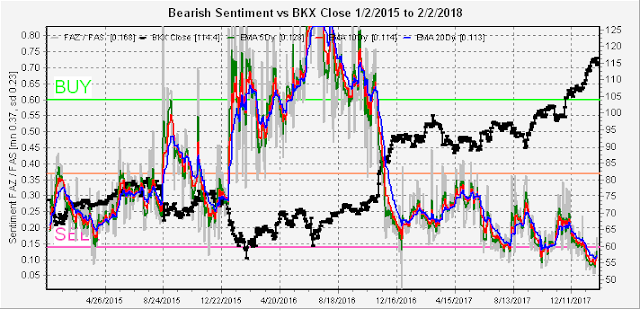

While the banking sector (FAZ/FAS) which has been on fire so far due to higher rates seems to have the most to lose longer term (if higher rates = housing crisis 2).

Bond sentiment (TNX) seems the most perplexing given the sharp run up in rates the last five weeks as bearish sentiment has actually dropped to neutral. This is the epitome of complacency as the public is not worrying about a bond bear market. In mid Dec, one well followed analyst recommended bonds over stocks as he felt the 2.5% yield was "risk-free" compared to stocks. Since then stocks are up 3% (6% two weeks ago) and bonds are down 3%.

The gold miners (HUI) sentiment was virtually unchanged as the HUI dropped sharply, moving inversely with interest rates as expected.

III. Technical Indicators

I am skipping the options open interest section this week in lieu of the special bond and extended technical indicator sections. After posting the long term SKEW chart for the 2008-09 bear market on Sat, Sun I followed up by researching the 2000-02 bear market and found a somewhat less bullish outcome when the SKEW dropped below its uptrend.

The SKEW EMAs were much closer to the current EMAs, and the SPX had rallied 10% in three weeks in a vertical move up between mid-Dec and early Jan following a 20% three month selloff due to the collapse of the LTCM hedge fund. The entire decline occurred over five days following the strongest move up retracing 50% of the advance, sound familiar.

The six months that followed the beginning of the advance saw rising rates and stock prices. It is hard to tell if we will see a similar trend now, but the Fed's stimulus then could be replaced by Trump's tax cuts now. What we saw then were stock declines when rates rose, with stock rallies when rates declined or consolidated. Overall, the next 18 months following Jan 1999 dovetail Avi Gilberts long term outlook.

IV. Other

Last week also saw a VIX Call Indicator BUY as the VIX Call 10 day SMA rose by 54% over the avg number of VIX Calls with the SPX below its 20 day SMA. Friday was actually very interesting with over 3M calls or 10x avg while the puts were over 1M or 6x avg. Both were the highest in my DB back to 7/6/2010. You decide which is the "smart" and which is the "dumb" money.

Conclusions. Last week I was expecting one more push higher before a 3-5% pullback this coming week, but again I ignored the VIX call indicator SELL signal from Jan 13 as last week was week 3. I have been warning that move in the TNX over 2.7% could be trouble for stocks and Mon AM jump over 2.7 seemed to be all that was needed for a selloff. No matter what other indicators may say interest rates (TNX) are likely to be the main driver of stock prices over the short to medium term. Looking at the 1999 analog, stocks can rise while rates are in a long term uptrend, but are likely to fall short term when rates rise. What bothers me most is the rapidity of the current rate rise at .45% in five weeks which is 2% in six months or twice the 1999 amount where rates were twice as high to start. Sentiment points to a strong bounce (possible 62% retrace) with an extended consolidation to compress volatility, but more downside is likely later. TNX over 3% next 2 to 4 weeks could be catastrophic and lead to a repeat of the LTCM type selloff late 1998.

If there are "selling binges" in bonds these may be periodic. With QE, the Fed bought on the 15th and EOM each month which may explain the pickup in volatility mid and late Jan.

Weekly Trade Alert. We may have a few days of chase the rip, but until I get a better idea of what is happening to bonds, it's too hard to call. Updates @mrktsignals.

Investment Diary, update 2017.10.28, Indicator Primer

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2018 SentimentSignals.blogspot.com

Ii. Sentiment Indicators

The overall Indicator Scoreboard saw a strong bounce relieving the strong SELL, but remains well short of a buy, so only partial retracements of the selloff are expected.

The Short Term Indicator (VXX $ volume and Smart Beta P/C) has reached the moderate BUY level similar to the July 2015 and Sept 2016 selloffs that lead to partial retracements.

Looking more closely at the ST Components, the VXX $ volume has reached a fairly strong BUY level somewhat similar to Sept 2016. The two month retracement period before the early pre-election plunge is consistent with the volatility compression likely with this indicator.

The Smart Beta P/C has only reached the weak BUY level that is also consistent with the Sept 2016 SPX selloff of 80 pts that was followed by a sharp short term retracememt and a two month consolidation before the Nov plunge.

The NDX short term ETFs SQQQ/TQQQ bearish sentiment is now at the highest level seen in the last three years.

Looking at some of the other sectors, the small cap RUT (TZA/TNA) sentiment remains near neutral.

While the banking sector (FAZ/FAS) which has been on fire so far due to higher rates seems to have the most to lose longer term (if higher rates = housing crisis 2).

Bond sentiment (TNX) seems the most perplexing given the sharp run up in rates the last five weeks as bearish sentiment has actually dropped to neutral. This is the epitome of complacency as the public is not worrying about a bond bear market. In mid Dec, one well followed analyst recommended bonds over stocks as he felt the 2.5% yield was "risk-free" compared to stocks. Since then stocks are up 3% (6% two weeks ago) and bonds are down 3%.

The gold miners (HUI) sentiment was virtually unchanged as the HUI dropped sharply, moving inversely with interest rates as expected.

III. Technical Indicators

I am skipping the options open interest section this week in lieu of the special bond and extended technical indicator sections. After posting the long term SKEW chart for the 2008-09 bear market on Sat, Sun I followed up by researching the 2000-02 bear market and found a somewhat less bullish outcome when the SKEW dropped below its uptrend.

The SKEW EMAs were much closer to the current EMAs, and the SPX had rallied 10% in three weeks in a vertical move up between mid-Dec and early Jan following a 20% three month selloff due to the collapse of the LTCM hedge fund. The entire decline occurred over five days following the strongest move up retracing 50% of the advance, sound familiar.

The six months that followed the beginning of the advance saw rising rates and stock prices. It is hard to tell if we will see a similar trend now, but the Fed's stimulus then could be replaced by Trump's tax cuts now. What we saw then were stock declines when rates rose, with stock rallies when rates declined or consolidated. Overall, the next 18 months following Jan 1999 dovetail Avi Gilberts long term outlook.

IV. Other

Last week also saw a VIX Call Indicator BUY as the VIX Call 10 day SMA rose by 54% over the avg number of VIX Calls with the SPX below its 20 day SMA. Friday was actually very interesting with over 3M calls or 10x avg while the puts were over 1M or 6x avg. Both were the highest in my DB back to 7/6/2010. You decide which is the "smart" and which is the "dumb" money.

Conclusions. Last week I was expecting one more push higher before a 3-5% pullback this coming week, but again I ignored the VIX call indicator SELL signal from Jan 13 as last week was week 3. I have been warning that move in the TNX over 2.7% could be trouble for stocks and Mon AM jump over 2.7 seemed to be all that was needed for a selloff. No matter what other indicators may say interest rates (TNX) are likely to be the main driver of stock prices over the short to medium term. Looking at the 1999 analog, stocks can rise while rates are in a long term uptrend, but are likely to fall short term when rates rise. What bothers me most is the rapidity of the current rate rise at .45% in five weeks which is 2% in six months or twice the 1999 amount where rates were twice as high to start. Sentiment points to a strong bounce (possible 62% retrace) with an extended consolidation to compress volatility, but more downside is likely later. TNX over 3% next 2 to 4 weeks could be catastrophic and lead to a repeat of the LTCM type selloff late 1998.

If there are "selling binges" in bonds these may be periodic. With QE, the Fed bought on the 15th and EOM each month which may explain the pickup in volatility mid and late Jan.

Weekly Trade Alert. We may have a few days of chase the rip, but until I get a better idea of what is happening to bonds, it's too hard to call. Updates @mrktsignals.

Investment Diary, update 2017.10.28, Indicator Primer

Article Index 2017 by Topic

Article Index 2016 by Topic

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment