Last week was not one of my best as I completely overlooked the ending 30+ pt rally in two days in the May topping process. Comparing May to July we saw a 40+ pt rally before the decline started. Many are expecting the decline to continue into next week, but there is a possibility that the rally may continue for another week and then start an even larger decline. While the tech and small caps seem to have lost their luster as "safe havens" in the trade war, the DJIA has been gaining relative strength that could mean continuing easing of trade war concerns. Two weeks ago China and the EU made an agreement to reduce trade tarrifs, and last week we saw the US and the EU reduce trade tensions. China last week increased economic stimulus to bolster a faltering economy amid a sharply declining currency - is it possible they may be willing to wave a small white flag in the trade war?

I. Sentiment Indicators

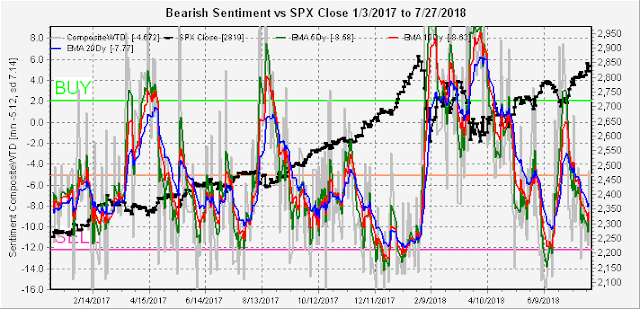

The overall Indicator Scoreboard (INT term, outlook two to four months) continued to fall thru Thur before a bounce on Fri. Does this mean we will have a larger decline than May or will sentiment continue to decline setting up a bigger fall for the markets later?

The ST view of the Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four weeks) has dropped below the level of the May top, and may be setting up a basing period similar to both Jan and June.

Interest rates (TNX) continued to rise last week, pausing just below the 3.0% level while bearish bond sentiment remained close to neutral.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment continued to fall last week even as prices moved lower. Sentiment has now reached the level of Jul of 2017 but as I pointed out last week fundamentals are different this time where we not only have a strong dollar but also rising rates (TNX), not falling rates as in 2017.

II. Dumb Money/Smart Money Indicators

The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 days/hours) as a very ST indicator continues to fall reaching the SELL level both on Tue and Thur. As pointed out last week the low absolute levels may be indicative of relative weakness for the NDX.

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 days/weeks) rebounded sharply on Fri, falling just short of neutral, after a second SELL on Wed. As noted with the ST Indicator, these multiple SELLs and rebounds can be indicative of a mini-meltup as in Jan as over-eager bears pounce on every decline causing the next rally phase.

The INT term SPX Long Term/Short Term ETFs (outlook two to four weeks) continued to fall last week due to strong buying by the dumb money (2x) ETFs reaching a SELL mid-week.

The INT term NDX Long Term/Short Term ETF Indicator (outlook two to four weeks) rose last week due to strong selling by dumb money (2x) ETFs.

NDX 2x ETFs in 2018 have seemed to mark short term tops every time sentiment drops to neutral.

III. Options Open Interest

Last Fri as of Wed close showed call resistance down to SPX 2810 with put support at 2800 which caused me to post on Twitter Wed that Fri would likely see a drop down to 2810.

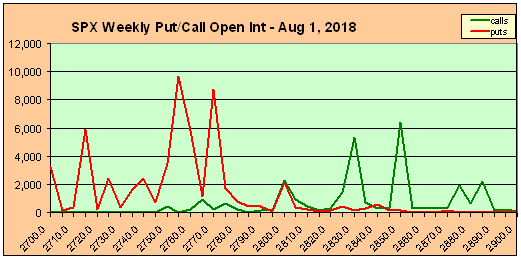

Using Thurs close, remember that further out time frames are more likely to change over time. This week I will look out thru Aug 10. Note last Fri strong down move is likely to increase put support for the week with the Mon data update.

Mon shows put support at SPX 2800 with potential for a push to 2820-30.

For EOM Jul 31, I am going to show both the Wed and Thur updates to show the increase in puts for the Wed SPX 10 pt drop. Wed update,

Thur update, so for Mon data SPX puts at 2800 may have increased enough to hold prices above 2800. Plus Jul 31-Aug 1 are FOMC, so may support prices.

For Wed FOMC, a lot of room to roam between SPX 2770 and 2830 with an expected close at 2800.

For Fri, the huge SPX call open int around 2875 dwarf other open int. This is one thing that makes me wonder if someone is expecting trade concessions from China next week. Note last Fri high open int at 2850 marked the top of the move on Wed. Otherwise 2790-2800 is the expected close unless more puts were added on Fri's down move or are next week.

Following Fri the 10th, is the first really bearish looking chart where SPX 2800+ is strong resistance with little put support below.

IV. Technical/Other

You may want to read Avi Gilberts post from a week ago here where he was looking for an SPX top 2820-72 with chart here. His downside target is 2650-2750 and I would expect something in between. The question is whether one more pop to 2870 is possible.

A short term view (these rarely work) is a H&S on the hourly SPX that does seem to fit the sentiment & options open int. Here a move up to SPX 2830 the next day or two would be followed by a drop to 2800 then a few days consolidation above 2800 before a move lower.

Conclusions. Last week did not go so well other than the Fri pullback. My biggest problem was agreeing with the consensus looking for a pullback to SPX 2750-60 while the May 2018 analog said look for a "pop & drop". The consensus still seems to be looking for a short pullback before a move higher which is why I prefer Avi Gilbert's outlook for a larger degree pullback, likely lasting into mid-late Sept due to uncertainty over the next rate hike. Odds are in that the top is in at SPX 2850 matching the Nov 2015 1% below the previous high, but watch out for potential trade concessions from China that could push prices higher again.

Weekly Trade Alert. Other than the possible H&S on the SPX very ST, my feeling is that last weeks SPX 40 pt drop Thu-Fri has increased put support enough to keep prices above 2800 for most of the week ahead. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment