Although not my preferred scenario, the last couple of weeks I have talking about a slow motion melt up as a possibility. Supporting sentiment was shown in the SPX LT/ST ETF ratio where bearish sentiment remained high relative to recent tops, the options Hedge Ratio that showed moderate hedging and the VIX options indicators showing little indication of a pickup in volatility. A pullback of 1-2% was expected before a rally into mid-Dec, but last weeks pullback of just SPX 20 pts from 3095 to 3075 caused a spike in the ST options DM/SM and Hedge Ratio indicators that aborted the pullback.

Otherwise, bearish sentiment seems to be slowly unwinding and could reach the Jan 2018 levels by Dec. If so, given the potential of a plethora of possible unsettling events from Dec-Feb 2020, China's intervention in the HK riots, blowup of US-China trade progress, Brexit, and Deutsche Bank failure, a repeat of 2018 is possible with an initial 10%+ correction followed by a rally into the pre-election period. Trump's supporters would certainly love to see a stock market crash if he loses the election.

The Tech/Other takes a look at the LT NYUPV/NYDNV ratio, the ST VIX options indicators and a paired APPL trade.

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment continues to slowly fall, now matching all but the Jan 2018 and Apr 2019 tops.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C [ETF Puts/Equity Calls], outlook two to four months) bearish sentiment has reached the lowest level of the past two years.

Bonds (TNX). Interest rates fell back from the recent stab at 2.0%, but still seem to be in an uptrend from the Sept lows.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment dropped sharply as the miners continued to move inversely with interest rates.

II. Dumb Money/Smart Money Indicators

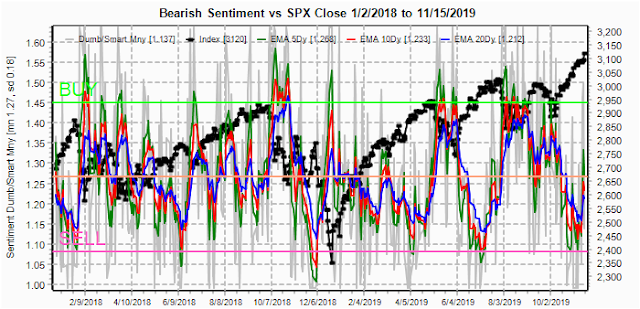

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) saw a fairly large jump in bearish sentiment last week, similar but from a lower level than what was seen at the pullback from the Sept 2018 top.

And the sister options Hedge Ratio sentiment saw an even stronger increase in bearish sentiment matching the level seen before the run to the Oct 2018 top.

The INT term SPX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment continued downward, breaking the pattern of rising bottoms that could spell trouble around the 0.70 level.

The INT term NDX Long Term (2x/DM) ETFs (outlook two to four weeks) bearish sentiment is reaching the levels last seen in Jan 2018, which is one factor making me consider that a repeat of the 2018 volatility could be seen in 2020.

III. Options Open Interest

Using Wed close, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. This week I will look out thru Nov 22. Also, This week includes a look at the TLT for Dec 20 opt exp.

With Fri close at SPX 3120. Last weeks SPX call options resistance was overcome mostly by increased hedging. Next week shows similar sentiment and may not be as effective until hedging subsides. Typically the SPX would be pressured toward 3060, but delta hedging will support prices as ling as 3010 holds. There is little resistance overhead if 3125 is surpassed.

Wed shows SPX put support at 3075 with little call resistance over 3130.

For Fri with larger OI, we have similar support/resistance and any weakness early in the week will likely increase put support ay 3075.

Currently the TLT is 137.76 with the TNX at 1.83%. Two weeks ago the options OI showed that the sharp break of put support at 141 to 138.5 was likely to lead to more weakness toward support at 137. Now 138 should act as a fulcrum with slight negative bias, a small range around 138 seems likely

IV. Technical / Other

The volume indicator, the NYUPV/NYDNV ratio, has provided some interesting insight into INT market trends and now shows that we may be approaching an INT top (circles). The circled areas represent June 2015 and Aug 2018, about 2 months before a sharp decline, but high risk did not occur until the 100 SMA (red) reached the 1.5 line.

The ST VIX put and call indicators relative to CPC Revised were a recent warning of dormant volatility, where low VIX call buying has been a supporter of higher SPX prices and has only recently dropped to neutral.

While the VIX put indicator that is less reliable when not supported by the VIX call indicator (as in Oct where only a trading range resulted from, low sentiment levels) is now moving towards the -1 SD level.

I starting watching the APPL/WDC pair early Oct (no position) as a mega-cap/mid-cap ratio and was surprised at how it correctly predicted the recent AAPL strength. This is not an exact market timing indicator, but the almost exact matching highs and lows for the last 18 months are unusual and the Nov 2018 peak preceded the Dec plunge by a month, while the mid-June peak preceded the Aug selloff by 6 weeks.

Conclusions. A number of indicators show that an INT top is approaching with the most likely time frame being some time in Dec. For stargazers, I also believe there is a major Bradley turn date early Dec. Much of the run up since June has come from AAPL that is up 50% from the June low, adding about 1200 pts to the DJIA, and the ratio compared to WDC indicates that may soon come to an end. One INT indicator to watch is the NYUPV/NYDNV that still needs to fall further to signal an INT top. ST term indicators that have also not indicated an imminent top are the VIX put and call volume. Optons DM/SM and Hedge Ratios are also need to reverse sharply prior to an expected selloff.

SPX options OI may not be as effective this week

Weekly Trade Alert. The SPX was able to power thru the low 3100 option OI resistance as a sign of strength, so don't expect an immediate reversal. We have now reached my LT target of 3100-50 and it looks like that may be marginally exceeded before any sizable pullback. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2019 SentimentSignals.blogspot.com

No comments:

Post a Comment