Whipsaws can be fun when you are right with SPX 150+ pts to the downside and 150+ pts to the upside where the target range (3850-90) was beat by five pts. I think I am going to retire for a few weeks and bask in the sub-freezing weather expected to envelop the eastern half of the US.

Is anyone else getting dizzy watching the range of predictions made by some of the more respected EW analysts lately? One of the most widely followed just last Sunday was looking at the decline to SPX 3700 as the start of a larger decline, while Trader Joe in mid-Jan at least got the ST direction right, but was looking for sub 3000 for the SPX in mid-Feb. Another whose forum I follow was talking about the end of supercycle V with the SPX targeting 3 digits after the prior weeks decline, but after a rally back to 25 pts over the prior high is now looking for an additional 25% rally.

From now on I want to standardize the language to differentiate between the normal "put/call ratios" and the std variable approach by using the term "put-call indicator" for the std variable approach. See the Tech/Other section for a look at the ETF put-call indicator with the new Composite Put-Call indicator next week.

I. Sentiment Indicators

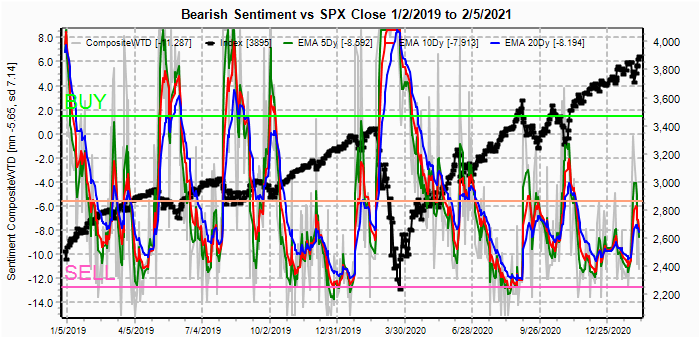

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment saw a minor rise prior to last weeks rally, somewhat similar to the sharp selloff in Sept 2020 that may need a retest before a sustained rally.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C [ETF Puts/Equity Calls], outlook two to four months) bearish sentiment has only rallied very weakly.

Bonds (TNX). Bearish sentiment in bonds remains below neutral and is at about the same level as Jan-Feb 2020, but not likely to prevent higher rates.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment coninues o fade even as prices fade, not a good sign for PM bulls.

II. Dumb Money/Smart Money Indicators

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 mns/weeks) bearish sentiment .

And the sister options Hedge Ratio bearish sentiment .

This week I want to look at an update fo two data mining indicators for the SPX ETFs. First, the SPX ETF term structure (SSO - CPCRevised calls) bearish sentiment. Here, we see a big improvement, but not enough to support a sustained rally. Note this is the old version based on (Equity+SPX+ETF puts)/(Equity+SPX+ETF calls) using contracts so needs to be replaced with new version.

Next, the SPX ETF hedge indicator (SSO - ETF calls) bearish sentiment has reversed sharply with the rapid decline in ETF calls. See Tech/Other for more on ETF calls as a hedge.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Feb 12 plus Feb 19 monthly exp.

With Fri close at SPX 3887, options OI for Mon is very light but has a bearish tilt with call resistance above 3850 and strong resistance at 3900. Note last weeks look at the SPX data mining put-call indicators showed that low vol was bullish, so does it also effect low Oi?

Wed has small OI also, with resistance above SPX 3850 and little put support until below 3700.

For Fri OI is somewhat larger with call resistance starting at SPX 3850 and put support at 3800.

For optn exp Fri Feb 19, also very light OI where a large straddle at SPX 3750 may act as a magnet with small OI pt support below and small call resistance above.

Using the GDX as a gold miner proxy closing at 34.6 is near the bottom of its recent range.

Currently the TLT is 148 with the TNX at 1.17% as int rates rose on the basis of a Dem supported stimulus.

IV. Technical / Other

This week I want to continue the process of developing new Combined Put-Call Indicator by looking at the ETF puts & calls. The standard ETF put/call ratio for the original EMA model is shown below.

Rather than use a chart, I want to look at a table showing the results of the future price regressions. Here we see low correlations for the std P/C for a 10 day SMA. More importantly, looking at calls and puts separately, ETF calls have a higher correlation than the std P/C and combining with puts using the Equity & SPX (1/B - A) calc lowers the fit. So, I decided to use the simple inverse (1/A).

Finally, the results with the inverted ETF calls only, here we see that a sharp rise in ETF calls has been present in several sharp declines in the past, supporting its use in the ETF hedge indicators for the SPX and NDX as shown a week before the recent decline. Currently, the sharp drop in ETF calls is showing a slight bullish tilt.

Conclusions.

Stepping back to gauge the overall sentiment picture, There appears to be little support for a sustained rally at this point, but nothing pointing to an immediate collapse either. The SPX put-call indicator using the data mining format is probably the most bullish and I will include an update with next weeks proposed put-call Composite. Taking a look back at the rounded top of mid-2015, the options OI does agree with the circled area below where a successful retest of the recent lows around 3700 could lead to a multi-month rally into the summer with a range of perhaps SPX 3650-3950.

Weekly Trade Alert. Some type of pullback is likely starting next week. SPX options OI is currently showing possible targets of SPX 3800-50 by this Fri and 3750 in two weeks. Updates @mrktsignals.

Investment Diary, Indicator Primer,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2021 SentimentSignals.blogspot.com

Avi Gilbert has been back and forth with his calls and no matter what, claims he was right. He says Wave 3 up was confirmed like 3 weeks ago and then switched to still waiting on a wave 2. Now he is back to a wave 3. If you followed him you would have lost money but he will claim that he called this all right. I always fade him. Now his wave 3 call is back on I will look to short soon.

ReplyDeleteThey got the entire wavecounts wrong. S%P future CMP 3918. Needs to make one more high above 3928 and then downhill starts. By March 25th SNP will break 3596. If you understand the reason, you will understand the counts as well. Hope this helps.

DeleteSorry, its April 9th though I am expecting it to happen in March but technically, in the worst case scenario, it can extend till April 9th

Delete