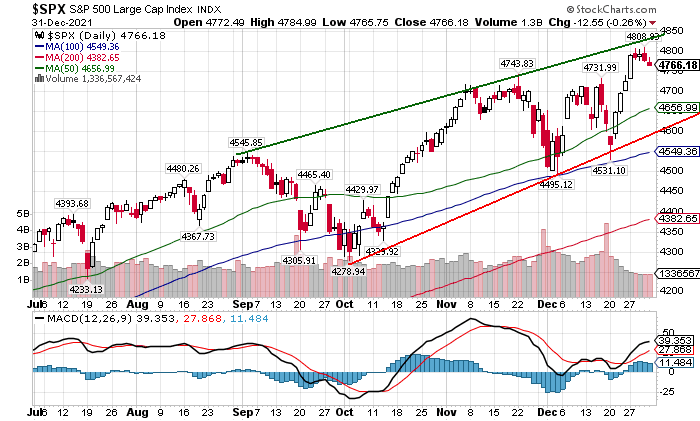

In last weeks conclusions, the outlook was for some consolidation before a move higher to SPX 4750+ in Jan unless an ED was playing out (see Tech/Other). Mon's romp to 4800+ quickly resolved that option, and stocks moved sideways, then lower to close the week. Weakness may spill over into Mon but could move back to ATHs to complete w-c of 5 of the ED by mid-week (options OI).

If the ED continues to be followed, Jan may see strength to start and end, but could see lows in the SPX 4650-4700 mid-late month before a turn around. Tech/Other section also looks at an update of the Composite Put-Call Revised spread, now at new lows.

I. Sentiment Indicators

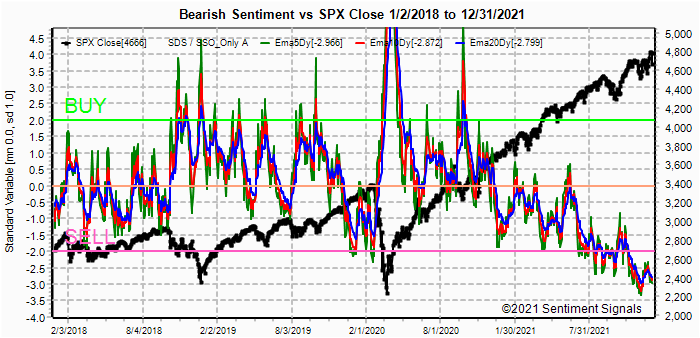

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the VXX $ volume.

The INT/LT Composite bearish sentiment reached new lows last week. It's possible to see lower levels since Dec 2018 SPX lows were +2 SD and Dec 2019 reached -2 SD since Mar 2020 reached +4 SD.

The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the VXX $ Vol/SPX Trend. Weights are 80%/20%.ST Composite sentiment dropped sharply, but may fall to the Sell level before a top.

The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.ST/INT Composite sentiment is somewhat more bearish due to the FOMO component (below) and is nearing the levels seen before the Sept pullback.

Options FOMO sentiment has reached a new extreme and should be considered a strong warning of a pullback nearing. EMAs have declined sharply and resemble the periods before the Sept and late Nov pullbacks. Bonds (TNX). Bearish sentiment in bonds saw a sharp jump last week. This pattern has been seen several times at the EOM recently (possibly following poor auctions) and has typically been followed by lower rates. For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.

Lower rates (TNX) could improve the ST outlook which remains mostly sideways.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Similar to the Jan 2020 decline in SPX, this indicator has been ST positive but has now declined back to the level of the Mar 2020 top.

And the sister options Hedge Spread bearish sentiment as a ST/INT indicator (outlook 1-3 mns) saw a sharp drop early in the week with a move to new highs, but the late week weakness has moved back above neutral and is likely to limit losses ST. Taking a look at the ETF ratio of the INT term SPX INT (2X) ETFs (outlook 2 to 4 mns) as bearish sentiment, it is moving back toward recent lows. The INT term NDX ST 3x ETFs (outlook 2 to 4 mns) bearish sentiment continues to inch its way lower even though the NDX failed to make ATHs last week.III. Options Open Interest

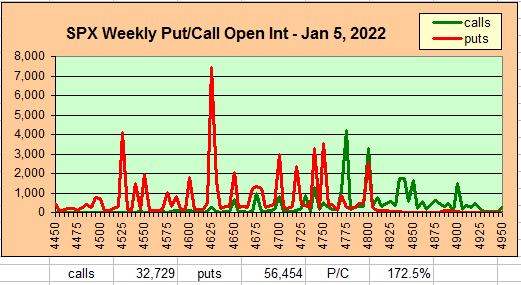

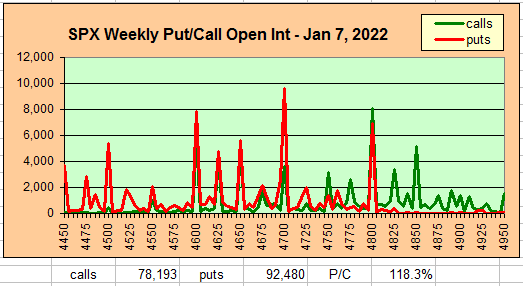

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Jan 7.

With Fri close at SPX 4766, options OI for Mon is small and the P/C is neutral. SPX may decline to 4750 but is likely to rebound to 4775 by the close. SPX 4700, 4725 and 4775 are fully hedged and are unlikely to affect prices.

Wed has larger OI and much larger P/C where SPX has moderate put support at 4750 and strong call resistance at 4775, but a push over that level could move up to the 4830+ level..

For Fri, SPX strong put support drops to 4700 with strong call resistance at 4850. There is call resistance and little net put support down to 4700, so a reversal lower is likely.

IV. Technical / Other

This week I wanted to take a brief look at the Combined Put-Call Revised spread indicator (Equity + ETF + SPX), recently a sharp decrease in ETF bearish FOMO sentiment has pushed this indicator (red) to new lows, a strong ST/INT warning.

The SPX potential ED from what some are calling a wave 4 correction in Oct, the next high should be c of 5 topping near 4820-30, possibly early next week.

Conclusions. Best wishes for the New Year. The surprise so far in 2021 for me has been the tranquility in the bond market in the face of soaring inflation. Expectations seem to lag as they did in the 1980s when inflation fell, and an aging population switching to safer assets may be the reason. As I have mentioned several times, as long as the DJIA div yield (1.58%) remains above the TNX rate (1.51%). this should be supportive of stocks or at least limit the downside.

Weekly Trade Alert. A move in the SPX to the upper bound of the ED (4820-30, 4850 max) should provide an opportunity for a 2-3 week pullback of 3-4% by EOM (4650-700). Updates @mrktsignals.

Investment Diary, Indicator Primer,

update 2021.07.xx Data Mining Indicators - Update, Summer 2021 (in progress),

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2021 SentimentSignals.blogspot.com

Also good wishes Arthur for 2022, always appreciate your great analysis.

ReplyDelete