Last week I warned of a possible SPX 200+ pt pullback over the next 2-4 weeks with the initial leg down probably reversing to new ST highs over 4000 by the EOM. Wed was certainly a warning with a nearly 100 pt drop from the AM high on weaker the expected news on the economy, but Fri sharp rebound of 3% by the NDX helped to reverse much of the loss. Over the past month I have been buying tech equipment for a future upgrade to Win 11 as prices have been beaten down similar to the stock prices. With MSFT discontinuing support for Win 10 in Oct 2025, I wonder if many corporate IT managers may follow in my footsteps causing a mini-meltup in the NDX in 2024. This would certainly parallel the analogy made several weeks ago to the 1967 era. I can attest to the upgrade in security (mainly UEFI) as I prefer customized lite windows and initially many of the shortcuts that worked in Windows 10 are no longer available.

INT/LT sentiment remains mostly unchanged, while ST sentiment reversed sharply, now supporting a potential move to higher ST prices above SPX 4020 by the EOM.

I. Sentiment Indicators

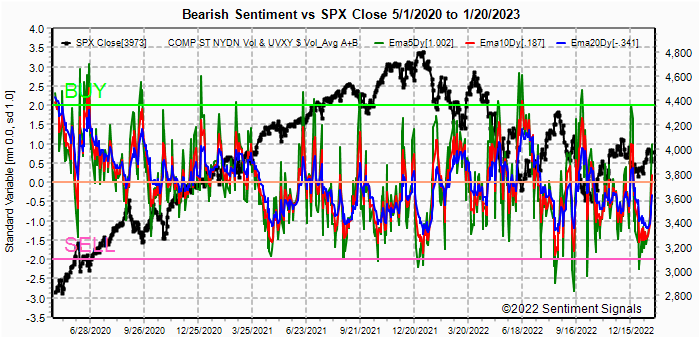

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. 1st is the SPX and ETF put-call indicators (30%), 2nd the SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility ratio of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

Update Alt. In this case the wts for the SPX 2X ETF ratio (SDS/SSO) and SPX puts & calls spread are adj to equal as in the DM/SM section for SPX ETFs.

Update, bearish sentiment remains low, but not extreme. The result may be somewhat like the 2021 topping period.

Update Alt EMA, not much change. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/SPX Trend. Weights are 80%/20%.Update, last weeks extreme low bearish sentiment was expected to produce a 2-4 week pullback and Wed 100 pt SPX drop from the high was a warning.

Update EMA, very ST a sharp uptick in bearish sentiment may lead to more gains. A high around the EOM FOMC at SPX 4030-50 is possible.

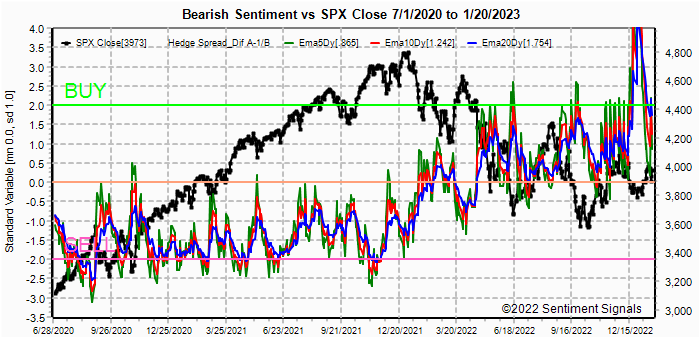

The VIX call & SPXADP ST indicator remains vey low, so the reprieve from last weeks selloff is likely to be short-lived. The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA, the temporary weak Sell has move back to neutral.

Bonds (TNX). Bearish sentiment in bonds remains modestly negative as the 3.5% area continues to show strong support. For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.Update, bearish sentiment has increased somewhat, probably due to the outlook for lower inflation.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update, sentiment continues to hover around the Sell level.

With the sister options Hedge Spread bearish sentiment as a ST/INT indicator (outlook 1-3 mns), the very ST drop in bearish sentiment early in the week was somewhat reversed with the sharp drop Wed. For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the INT term composite (outlook 2 to 4 mns), bearish sentiment continues to slowly improve, mainly due to less bullish options positions.For the NDX combining the hybrid ETF options plus NDX 3X ETF sentiment with the interest rate effect, (outlook 2 to 4 mns) bearish sentiment shows similar extremes between ETF and options as in late 2020 which resulted in a choppy market until options sentiment rose. Note QQQ options are optimal, but are N/A and are included in ETF options.

The sharp rally in the NDX based on good news from NFLX, may

be indicative of a longer term trend as the MSFT upgrades to Windows 11 may spur

investments in that area.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Jan 31. A text overlay is used for extreme OI to improve readability, P/C is not changed. Also, this week includes a look at the GDX for Dec exp. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross.

With Fri close at SPX 3973, options OI for Mon is small with no real put support until 3850 and some call resistance over 3950. So a small pullback to 3950 or lower is likely.

Wed has smaller OI where SPX put support extends up to 3930 with very little call resistance until 4000. A range of 3930-4000 is possible

For Fri stronger OI shows the current level is about neutral, so little net change is possible by EOW.

For Mon/Jan 31/EOM strong OI show little bias between SPX 3900 and 4050, so the 1st day of the FOMC could see some wild swings.

IV. Technical / Other - N/A

Conclusions. Last weeks short pullback was certainly enough to get the bears growling again, and all the talk seems to be of when, not if, the economy enters into a recession. Previously I indicated that a slowdown was expected to about 1% GDP growth as stimulus-lead growth leaks out of the economy, but a recession may not happen. For stocks a trading range from lows of 3750-800 and highs of 4150-200 may be all we see for 2023, with the potential for a tech led blowoff in 2024 to test the SPX ATH.

Weekly Trade Alert. Next week is likely to be somewhat boring with a potential range of SPX 3925-4000. Updates @mrktsignals.

Investment Diary, Indicator Primer, Tech/Other Refs,

update 2021.07.xx Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2022 SentimentSignals.blogspot.com

No comments:

Post a Comment