Last week was overall somewhat weaker than expected, but mostly within the target range of SPX 4450-4550. The early bounce to SPX 4500+ (4518) only lasted a day as weak data from China Tue set a negative tone to the market and took prices back to the 4470s. Weakness lasted thru Wed with the expected CPI rally lasting only about an hour, but did hit the target zone of SPX 4520-40 (4527). A disastrous 30 yr T-Bond auction Thur sent the LT bond int rates back to test the prior weeks highs and reversed the SPX 55 pt gain to a 15 pt loss by EOD. Higher PPI data Fri pressured TNX rates on Fri, causing an SPX 15 pt loss for the week. On a positive note the SPX did bounce off its 50 SMA and filled a gap at 4445-50. The question is will the gap at SPX 4550-65 be filled before a larger down leg? The bad news is that bond sentiment (TBT/TLT) is little changed and I am getting the same feeling I had in mid-2021 right before TNX rates rose from 1% to 3%.

Today I want to look at three possible outcomes for the next 3-6 mns. The first (prob 40%) is the contrarian view based on what I see sentiment wise. I do think the will be a fill of the gap at SPX 4550-65, but sentiment is currently too weak and a consolidation is likely to last thru Aug (range 4440-4500) similar to Apr-May. Then Sept with triple witch, FOMC and EOQ the gap is filled. The high risk period is mid-Oct to mid-Dec when inflation pressure and rising rates accelerate and EPS continues to disappoint, pushing the SPX toward the 4100 area (top of A). Second is the crash scenario (30%) for me the reason is rates continue to rise due to higher inflation and new Treasury sales, pressuring Techs with the TNX rising to 5-5.5% by EOY and the NDX filling a large gap around 13.5K and the SPX down about 15%. Avi has a similar view, probably supported by an expected banking crisis. In Avi's case the SPX rises to 4550-65 for Aug optn exp, then down to 3800 by mid-Dec. The third case which I call the traditional view (30%) is a decline into Sept-Oct to about SPX 4300 then a rally into EOY to 4700-4800. Here we have EW's Dr Schure (no J/S,reload) and TA's ExecSpec.

Bond market sentiment is my biggest concern. An interesting article in ZH discussed some interesting divergences between futures (TN) and options (TLT) which agreed with the extreme retail bullishness shown in the TBT/TLT sentiment indicator. Otherwise sentiment is improving for the SPX/NDX but does not indicate a strong turnaround for optn exp week. Due to the possible influence of the Dow Theory a look at DJIA futures (YM) is included in the Tech/Other section. The easiest way to view in COT is to edit url replacing ES with YM and return. An additional link is added to Other links for Marketwatch news releases (note Wed).

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. 1st is the SPX and ETF put-call indicators (40%), 2nd the SPX 2X ETF INT ratio (30%), and 3rd a volatility indicator (30%) which combines the options volatility spread of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume. This week breaks SPX options into volume adj (1/B-A) and traditional spread (A-B).

Update Alt. In this case the wts for the SPX 2X ETF ratio (SDS/SSO) and SPX puts & calls spread are adj to equal as in the DM/SM section for SPX ETFs. Bearish sentiment declined slightly mainly due to SPX options.

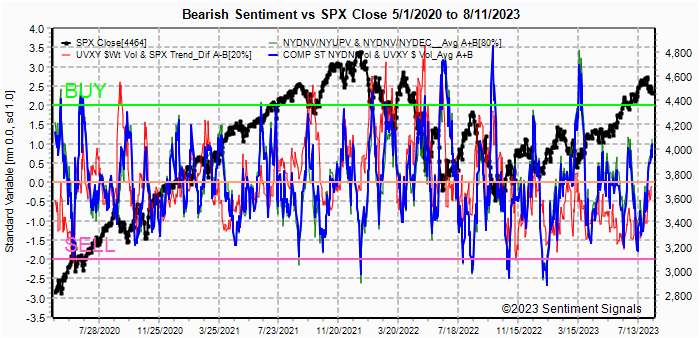

Update Alt EMA. Bearish sentiment remains near the Sell level. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/SPX Trend. Weights are 80%/20%.Update. Bearish sentiment has barely touched the weak Buy level.

Update EMA. Bearish sentiment ST EMAs are just above neutral and suggest more consolidation similar to Apr-May. The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. Bearish sentiment continues to rise now above the weak Sell but still below neutral, the level that supported most rallies in late 2020-21.

Bonds (TNX). Bearish sentiment remains near the Sell level and is the most worrisome for stocks, esp NDX. Rates may continue to rise for the next 3-6 mns. For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.Update. Bearish sentiment fell sharply and seems to continue to follow the mid-2018 analog. Probably the uptick in inflation excites the PM bulls, but the negative interest rate effect should not be ignored. If inflation and TNX rates continue to rise thru EOY, Fed will likely begin increasing ST rates killing PMs.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Bearish sentiment is little changed.

With the sister options Hedge Spread as a ST/INT indicator (outlook 1-3 mns), bearish sentiment rose sharply above the neutral level and may increase enough to support a 2-3% rally in a week or two. A new composite SPX options indicator uses both the volume adj (1/B-A) and P/C equivalent spread (A-B) to compensate for the discrepancy between the two. This replaces the old SPX options indicator for the SPX ETFs + options below and the INT/LT composite. No chart.For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the INT term composite (outlook 2 to 4 mns), bearish sentiment fell slightly due to options extremes (0DTE effect?), while EFT sentiment is neutral.

For the NDX combining the hybrid ETF options plus NDX 3X ETF sentiment with the interest rate effect, (outlook 2 to 4 mns) bearish sentiment shows similar extremes between ETF and options as in late 2020 which resulted in a choppy market until options sentiment rose. Note QQQ options are optimal, but are N/A and are included in ETF options.

Bearish sentiment rose to the weak Sell level on the back of ETF option

sentiment while NDX ETF sentiment is little changed.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Aug 18. A text overlay is used for extreme OI to improve readability, P/C is not changed. Also, this week includes a look at the GDX for Dec exp. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross.

With Fri close at SPX 4464, options OI for Mon is moderate and shows some support for a rally to 4500, but there is little support until 4425.

Wed has somewhat smaller OI where SPX has very strong support at 4455 and 4470. News (see Tech/Other Links) includes housing ind prod, and FOMC notes.

For Fri AM strong SPX OI levels with deep ITM calls skewing $ amounts, most likely target 4450-4500..

For Fri PM moderate SPX OI levels with deep ITM calls skewing $ amounts, most likely target 4450-4525..

IV. Technical / Other

The following uses barcharts.com as a source and discusses S&P futures (ES) as a third venue of stock sentiment in addition to options and ETFs. The non-commercial/commercial spread represents a LT bearish sentiment (dumb money/smart money) indicator. As explained in investopedia, commercial investors (red) are institutions and are smart money, while non-commercials (green) are speculators such as hedge funds and are dumb money. Here is the current barchart graph for the S&P 500 (top) and trader positions (1st bot) with positives as net longs and negatives as net shorts. Bearish sentiment is represented by the spread and is positive if red > green (Buy) and negative if green > red (Sell). ES sentiment is neutral, but lower for the week at < +1 SD, YM (DJIA) is neutral at -0.1 SD, Dow theory may keep DJIA up thru Sept-Oct, watch for Sell at -1 to -2 SD.

Click dropdown list to select from the following options:

Tech / Other History2023

2022

Other Indicators

Conclusions. Bearish sentiment for stocks is rising, but does

not indicate a strong rally next week. .Stocks, esp techs, will continued to be

pressured if rates continue to rise. Athough the SPX found support at its

50 SMA, NDX did not, and may indicate a problem. The DJIA continues to be

the stalwart and seems to bounce strongly every time 35k is tested. If the

DJIA remains strong,losses should be limited, but below the 34.7k level

problems may occur.

Weekly Trade Alert. Not expecting much action next week with the

SPX remaining in the 4440-4500 range unless bonds break down with TNX above

4.25-4.33%. Fri may see a late bounce over SPX 4500 if rates remain calm. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

Tech/Other Refs,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2023 SentimentSignals.blogspot.com

Thanks for the analysis as usual Arthur, always a treat.

ReplyDeleteI'll go with the traditional view this time, a correction to about S&P 4300, then another run up to the old highs of 4800. I was quite surprised how the market took the additional treasury offerings in the last few months; but they were just simply offset by a reduction in the excess liquidity pool of the REPO account. Banks who are in trouble are just simply helped by the Fed's tools, so that also doesn't seem to be an issue anymore that the market cares about. The bullishness from the 4630 high just needs te be reset by a 'normal' correction which is underway. I think it's too early for the real bear case; one of the reasons being the mentioned extreme shorting of Treasuries.