If I stand on my head, I can almost call last week a good call, but in reality my timing was way off. With only a mild pullback to start the week to SPX 6100 (target 6050-75), a mild rally thru Wed PM pushed the SPX to a new ATH at 6147 (target 6125-50 by EOW). However, WMTs negative EPS outlook Thur AM and a 5% opening drop set a negative tone for the markets and the SPX skidded below 6100 before a late recovery. The SPX continued to drop to about 6075 by mid-AM before a stagflation outlook hit the news with the services PMI (70% of the economy) dropped into contraction (below 50%) for the first time in 2 years, while manufacturing expanded (20% of economy), but the killer was the UMich sentiment outlook where the 5 year inflation outlook jumped to the highest level since 2023. With the close for SPX at 6013, we are now 50% of the way to my mid/late Mar target of SPX 5850 or lower to fill the mid-Jan gap, but I do not expect a straight line decline. SPX options OI and NVDA EPS the 26th could first push the SPX back to 6075 or higher next week.

ST Composite and VIX call indicators remain near neutral with the biggest change in sentiment being a sharp drop in the SPX 2x ETF sentiment (INT/LT) with strong buying in SSO last week. Other INT/LT sentiment indicators remain between a weak and strong Sell. The NAIIM active manager exposure index showed a sharp jump from 76% (below avg) to 91% (above avg) with 100+ a strong Sell.

Discuss.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. Starting Aug 26, 2023 SPX options are removed due to extreme 0DTE volume distortions. New weights are ETF put-call indicator (30%), SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility spread of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

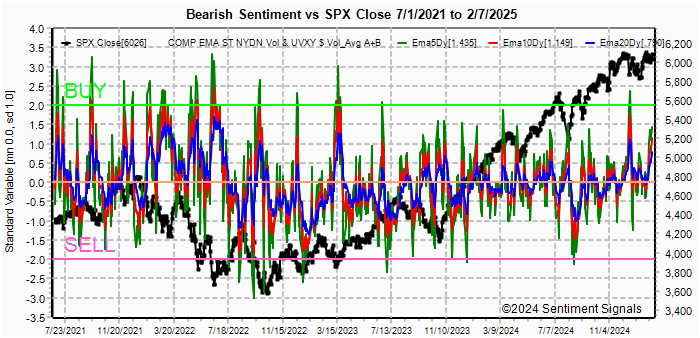

Update Alt, INT view. Bearish sentiment continued to fall to a weak Sell.

Update Alt EMA. Bearish sentiment fell well below the weak Sell on Wed, but bounced back to a weak Sell by EOW. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/[SPX Trend, SMA only]. Weights are 80%/20%.Update. Bearish sentiment fell from a weak Buy but remains positive.

Update EMA. Bearish sentiment fell to neutral mid-week then bounced.The ST VIX calls and SPXADP indicator bearish sentiment fell below neutral, but bounced back.

The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. Bearish sentiment remains below a weak Sell.

Update FOMO calls. Bearish sentiment remains near neutral. Bonds (TNX). Bearish sentiment remains at extreme lows. For the INT outlook, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.

Update. Bearish sentiment declined slightly.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Bearish sentiment is little changed near the weak Sell.

With the sister options Hedge Spread as a ST/INT indicator (outlook 1-3 mns), bearish sentiment improved slightly but remains below a weak Sell. A new composite SPX options indicator uses both the volume adj (1/B-A) and P/C equivalent spread (A-B) to compensate for the discrepancy between the two. This replaces the old SPX options indicator for the SPX ETFs + options below and the INT/LT composite. No chart.

For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the

INT term composite (outlook 2 to 4 mns), bearish sentiment saw a sharp

decline from a combination of options and high SSO volume on Wed.

Bearish sentiment dropped nearer to a strong Sell.

For the SPX combining the hybrid ETF options plus SPX 2X ETF (outlook 2 to 4 mns) produces an indicator where, in this case, ETF options are a proxy for the SPY options.

Bearish sentiment for SPX dropped below a weak Sell.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Feb 28. A text overlay is used for extreme OI to improve readability, P/C is not changed. Also, this week includes a look at GDX, TLT & IBIT for Mar exp. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross. Note multiply OI$ by 100 for shares/contract.

With Fri close at SPX 6013, options OI for Mon is moderate with high P/Cs. Very strong put support around 6000 should provide a good bottom and may launch a rally toward 6050 by EOD.

Wed has smaller OI with SPX having a large put position at 6050 and a move higher could reach 6075+.

For Fri stronger SPX OI has stronger call resistance at 6100/+ with a target of 6075-100 .

Using the GDX as a gold miner proxy closing at 40.8 reached 42+ Thur at the strong call resistance with a most likely range of 37.5-40.5 an extended range of 37-42.

Currently the TLT is 89.6 with the TNX at 4.42%, strong put support at 87.5 and call resistance at 91.5 and BE 89.5 indicate a fairly narrow range (TNX 4.2-4.6%) is likely.

Currently the IBIT is 53.9 with the BTC at $96k, B at 55 (BTC 98k) may limit upside with 54 good support.

IV. Technical / Other

The following uses barcharts.com as a source and discusses S&P futures (ES) as a third

venue of stock sentiment in addition to options and ETFs. The non-commercial/commercial

spread represents a LT bearish sentiment (dumb money/smart money) indicator. As explained in investopedia,

commercial investors (red) are institutions and are smart money, while non-commercials (green) are speculators such as

hedge funds and are dumb money. Here is the current barchart graph

for the S&P 500 (top) and trader positions (1st bot) with positives as net longs and negatives

as net shorts.

Bearish sentiment is represented by the spread and is positive if red > green

(Buy) and negative if green > red (Sell). ES (SPX) sentiment remains

at neutral -0.20 SD, NQ (NDX) bearish sentiment declined to a weak Sell at -1.25 SD, YM (DJIA)

is neutral at -0.15 SD.

Click dropdown list to select from the following options:

Tech / Other History2025

2024

2023

2022

Other Indicators

Conclusions. One month into the Trump 2 Presidency and it already

seems as if the world has been turned upside down, but we probably won't know

until 3 to 6 months what the effects will be. I hoped Trump noticed what

happened to Argentinas crypto token, the Libra, which crashed 94% in 11 hrs on

insider selling; the President who supported its issuance now faces impeachment.

Although Fri seemed like the beginning of the end, the SPX showed similar

behavior in Dec with the Feds hawkish turn and the Jan CPI surprise.

Weekly Trade Alert. Strong SPX put support and HVDA EPS on Wed

should propel at least a 50% retracement next week (SPX 6075-100). Mar

jobs, CPI, and FOMC (7th, 12th and 18-19th) could be impt inflections. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

Tech/Other Refs,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2025 SentimentSignals.blogspot.com