Markets continued their selloff on Mon following the SPX 80 pt drop Fri afternoon after Trump announced 25% tariffs on Canada & Mexico, and after the 1st hr the SPX was down another 100 pts from the Fri high at 6121 to the Mon low at 5924. However, the BTFDers remained strong and Mexico giving in to Trumps demands followed by Canada on Tue led to a lower high at SPX 6101 Fri before getting knocked down again to 6025 on news of the inflation expt of 4%+ in the UMich sentiment survey. Many of the sentiment indicators have moved to a more neutral stance and the ST Composite has even moved to a weak Buy, so some consolidation (SPX 5975-6075) seems likely. The biggest risk next looks to be the Wed CPI report where options OI is indicating a target of 5975-6000 then a bounce into Fri. The Hedge spread remains between the weak and strong Sells, so volatility is likely to continue.

Other sentiment sources are equally divided with retail investors jumping into the market with near record stock buying going back to the late 1990s and sending volume soaring, while the NAAIIM active manager index has risen to the average of 2024 Q4s level, and the AAII Sentiment survey is showing a 1 year high in bearish sentiment.

Discuss.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. Starting Aug 26, 2023 SPX options are removed due to extreme 0DTE volume distortions. New weights are ETF put-call indicator (30%), SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility spread of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

Update Alt, INT view. Bearish sentiment moved up above the weak Sell, but remains below neutral.

Update Alt EMA. Bearish sentiment moved up above the weak Sell, but remains below neutral.

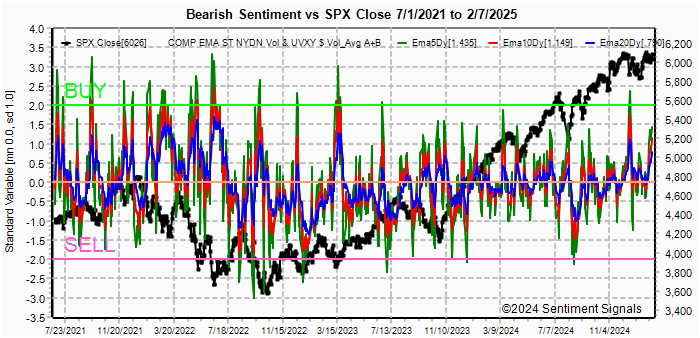

The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/[SPX Trend, SMA only]. Weights are 80%/20%.Update. Bearish sentiment moved up sharply mid-week above a weak Buy.

Update EMA. Bearish sentiment moved up sharply mid-week above a weak Buy. The ST VIX calls and SPXADP indicator bearish sentiment remains near neutral.The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. Bearish sentiment rose modestly but remains on a weak Sell.

Bonds (TNX). Bearish sentiment remains at low extremes as rates (TNX) pulled back tp 4.4% before bouncing with Fri inflation expt. For the INT outlook, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.Update. Bearish sentiment is mostly unchanged with the ETFs near a weak Buy.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Bearish sentiment continued to rise to near neutral.

With the sister options Hedge Spread as a ST/INT indicator (outlook 1-3 mns), bearish sentiment remains in between a weak and strong Sell. A new composite SPX options indicator uses both the volume adj (1/B-A) and P/C equivalent spread (A-B) to compensate for the discrepancy between the two. This replaces the old SPX options indicator for the SPX ETFs + options below and the INT/LT composite. No chart.

For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the

INT term composite (outlook 2 to 4 mns), bearish sentiment has recently seen

a sharp rise due to the lower options volume adjusted for SPX volume. This

is actually due to an increase in shares traded due to the increase in share

purchases by the retail sector. More below.

For the NDX combining the hybrid ETF options plus NDX 3X ETF sentiment with the interest rate effect, (outlook 2 to 4 mns) bearish sentiment shows similar extremes between ETF and options as in late 2020 which resulted in a choppy market until options sentiment rose. Note QQQ options are optimal, but are N/A and are included in ETF options.

Bearish sentiment rose toward a weak Sell.

For the SPX combining the hybrid ETF options plus SPX 2X ETF (outlook 2 to 4 mns) produces an indicator where, in this case, ETF options are a proxy for the SPY options.

Bearish sentiment for SPX rose above a weak Sell.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely to change over time, and that closing prices are more likely to be effected. Delta hedging may occur as reinforcement, negative when put support is broken or positive when call resistance is exceeded. This week I will look out thru Feb 14 & EOM. A text overlay is used for extreme OI to improve readability, P/C is not changed. Also, this week includes a look at the GDX for Dec exp. A new addition is added for OI $ amounts with breakeven pts (BE) where call & put $ amounts cross. Note multiply OI$ by 100 for shares/contract.

With Fri close at SPX 6025, options OI for Mon is moderate with strong P/C support but even for $ P/C due to large quantity of OTM puts around 5900. While everyone seems to be expecting a repeat of the last two Mon, a higher close is likely with BE at 6035.

Wed has small SPX OI with CPI coming out. Here everyone seems to be expecting a drop in CPI. but watch for something like the UMich expectations (higher CPI). Large straddles at 5950 and 6000 give a negative bias and SPX could reach BE at 5975 or lower.

For Fri moderate SPX OI show relatively strong put support and a week with no new tariffs could send prices back to the 6040-50 area.

For Fri 28th EOM strong SPX OI is somewhat interesting with the steepest support/resistance levels converging on the 6000-6100 range with a slightly lower bias toward 6000-25.

IV. Technical / Other

The following uses barcharts.com as a source and discusses S&P futures (ES) as a third

venue of stock sentiment in addition to options and ETFs. The non-commercial/commercial

spread represents a LT bearish sentiment (dumb money/smart money) indicator. As explained in investopedia,

commercial investors (red) are institutions and are smart money, while non-commercials (green) are speculators such as

hedge funds and are dumb money. Here is the current barchart graph

for the S&P 500 (top) and trader positions (1st bot) with positives as net longs and negatives

as net shorts.

Bearish sentiment is represented by the spread and is positive if red > green

(Buy) and negative if green > red (Sell). ES (SPX) sentiment remains

at neutral -0.25 SD, NQ (NDX) bearish sentiment is back to a strong Sell at -2.0 SD, YM (DJIA)

is neutral at -0.25 SD.

Click dropdown list to select from the following options:

Tech / Other History2025

2024

2023

2022

Other Indicators

Conclusions. Time for the superbowl indicator with a win for Philly

bullish and KC bearish, what's one more indicator. Everyone seemed to

forget the volatility during Trump one with the numerous on again off again,

somewhat outlandish proposals by POTUS. The idea of tariffs does not seem

that absurd when you look at the history of the US as the govt was supported

solely by tariffs from 1790-1913 when the Fed Reserve was created and income

taxes were added and after WW2 tariffs were almost eliminated, but income taxes

were raised as high as 60%. Both instances seemed likely to help Europe

recover from WWs, but that was long ago.

Trump Gaza has been discussed for

decades as a means to develop an alt to the Suez canal controlled by the sometimes

unfriendly Egypt and Greenland is the last stop between Russia and CA/US.

BTCers seem to be getting nervous with the recent decline below $100k after

Trump failed to mention BTC as an option for his sovereign wealth fund and

instead proposed Tik Tok.

Weekly Trade Alert. ST sentiment is slightly positive an may help

markets to a positive start for the week, but Wed CPI report is likely to

disappoint and send the SPX back below 6k (target 5975) followed by a

turnaround into Fri. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

Tech/Other Refs,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2025 SentimentSignals.blogspot.com

No comments:

Post a Comment