Weekly outcomes continue to be swayed by the seemingly unpredictable tariff pollicies by DJT. The previous Fri announcement of aditional tariffs sent foreign markets skidding while US markets were closed. The expected drop last week to SPX 6200 or below was short circuited by Mon change in deadline from July 9 to Aug 1 which helped put a stop to the US markets decline although Mon SPX low was 6201. This does seem to make the Bradley turn date of Aug 13 possibly more important. However, todays (Sat) call for 30%+ tariffs on Mexico and Canada looks like a repeat of last week, so who knows what will happen by Mon. SPX options OI continue to show a likely weak monthly exp targeting SPX 6150-200 or lower. Sentiment is mostly unchanged to slightly more bearish ST. The NDX futures (NQ) did show a moderate decline in bearish sentiment toward a strong Sell.

I. Sentiment Indicators

The INT/LT Composite indicator (outlook 3 to 6+ months) has three separate components. Starting Aug 26, 2023 SPX options are removed due to extreme 0DTE volume distortions. New weights are ETF put-call indicator (30%), SPX 2X ETF INT ratio (40%), and 3rd a volatility indicator (30%) which combines the options volatility spread of the ST SPX (VIX) to the ST VIX (VVIX) with the UVXY $ volume.

Update Alt, INT view. Bearish sentiment rose from near a weak Sell halfway to neutral.

Update Alt EMA. Bearish sentiment rose to neutral. The ST Composite as a ST (1-4 week) indicator includes the NYSE volume ratio indicator (NYDNV/NYUPV & NYDNV/NYDEC) and the UVXY $ Vol/[SPX Trend, SMA only]. Weights are 80%/20%.Update. Bearish sentiment remains positive between neutral and a weak Buy.

Update EMA. Bearish sentiment rose from neutral last week to near a weak Buy.The ST VIX calls and SPXADP indicator bearish sentiment rose back to a weak Sell.

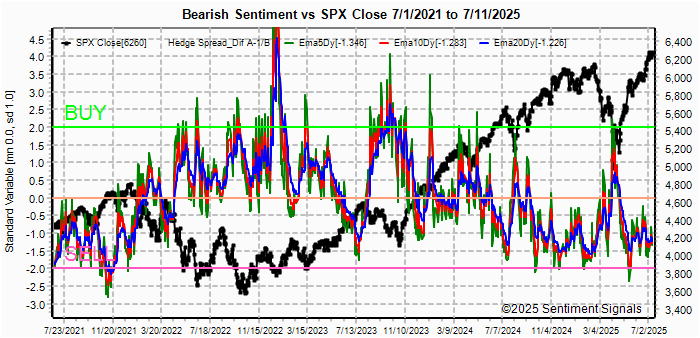

The ST/INT Composite indicator (outlook 1 to 3 months) is based on the Hedge Spread (48%) and includes ST Composite (12%) and three options FOMO indicators using SPX (12%), ETF (12%), and Equity (12%) calls compared to the NY ADV/DEC issues (inverted). FOMO is shown when strong call volume is combined with strong NY ADV/DEC. See Investment Diary addition for full discussion.

Update EMA. Bearish sentiment rose but remains at a weak Sell.

Update FOMO calls. Bearish sentiment is relatively unchanged at a weak Sell. Bonds (TNX). Bearish sentiment remains at low extremes. For the INT outlook, the gold miners (HUI) bearish sentiment is presented in a new format using the data mining software to add the inverse TNX rate to the ETF ratio.

Update. Bearish sentiment fell back to its recent lows from neutral with a 1% gain in HUI last week.

II. Dumb Money/Smart Money Indicators

This is a new hybrid option/ETF Dumb Money/Smart Money Indicator as a INT/LT term (outlook 2-6 mns) bearish sentiment indicator. The use of ETFs increases the duration (term).

Update. Bearish sentiment remains at a weak Sell.

With the sister options Hedge Spread as a ST/INT indicator (outlook 1-3 mns), bearish sentiment remains unchanged at a weak Sell. A new composite SPX options indicator uses both the volume adj (1/B-A) and P/C equivalent spread (A-B) to compensate for the discrepancy between the two. This replaces the old SPX options indicator for the SPX ETFs + options below and the INT/LT composite. No chart.

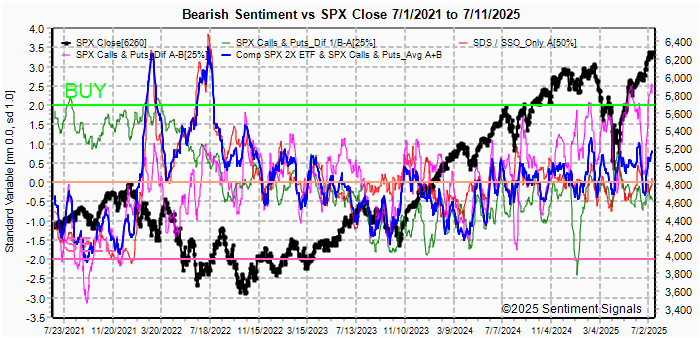

For the SPX, I am switching to hybrid 2X ETFs plus SPX options. Taking a look at the

INT term composite (outlook 2 to 4 mns), bearish sentiment rose slightly

toward a weak Buy.

Bearish sentiment remains at a weak Sell.

For the SPX combining the hybrid ETF options plus SPX 2X ETF (outlook 2 to 4 mns) produces an indicator where, in this case, ETF options are a proxy for the SPY options.

Bearish sentiment for SPX rose slightly, now halfway to neutral.

III. Options Open Interest

Using Thur closing OI, remember that further out time frames are more likely

to change over time, and that closing prices are more likely to be effected.

Delta hedging may occur as reinforcement, negative when put support is broken

or positive when call resistance is exceeded. This week I will look

out thru July 16. A text overlay is used for extreme OI to improve readability,

P/C is not changed. Also, this week includes a look at GDX, TLT & IBIT for Mar exp.

A new addition is added for OI $ amounts with breakeven pts (BE) where

call & put $ amounts cross. Note multiply OI$ by 100 for shares/contract.

With Fri close at SPX 6260, options OI for Mon is small/moderate with P/C

support resistance from 6250-75, then 6225 and 6300.

For Fri AM strong SPX OI still shows a negative bias toward 6150-6200. The straddle at 6000 is now so far OTM that it may have little effect.

For Fri PM moderate/strong SPX OI is also negatively biased toward 6200.

IV. Technical / Other

The following uses barcharts.com as a source and discusses S&P futures (ES) as a third venue of stock sentiment in addition to options and ETFs. The non-commercial/commercial spread represents a LT bearish sentiment (dumb money/smart money) indicator. As explained in investopedia, commercial investors (red) are institutions and are smart money, while non-commercials (green) are speculators such as hedge funds and are dumb money. Here is the current barchart graph for the S&P 500 (top) and trader positions (1st bot) with positives as net longs and negatives as net shorts. Bearish sentiment is represented by the spread and is positive if red > green (Buy) and negative if green > red (Sell). ES (SPX) bearish sentiment is slightly positive at 0.5 SD, NQ (NDX) bearish sentiment increased over weak Sell at -1.75 SD, YM (DJIA) remains near a weak Sell at -0.5 SD.

Click dropdown list to select from the following options:

Tech / Other History2025

2024

2023

2022

Other Indicators

Conclusions. This weeks Phil's Stockworld

sums up most of my thoughts on DJTs tariff policy. Although bigger

picture, I think the purpose is to stop the China juggernaut. Much of the

global growth the last 20 years has come from China, and the US seems to be

willing to slow global growth if it slows China more than the US. Next

weeks CPI/PPI may be the last "good" report for a while. I've noticed that

Kroger and Walmart have raised prices on many items 10% or more. It seems

than rather raise items effected by tariffs by 20-30% or more, they are just

raising the price of everything.

Weekly Trade Alert. Still looking for a pullback to SPX 6150-200

next week. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

Tech/Other Refs,

update 2021.07.xx

Data Mining Indicators - Update, Summer 2021,

update 2020.02.07 Data Mining Indicators,

update 2019.04.27 Stock Buybacks,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2019 by Topic, completed thru EOY 2020.02.04

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2025 SentimentSignals.blogspot.com

No comments:

Post a Comment