I. Sentiment Indicators

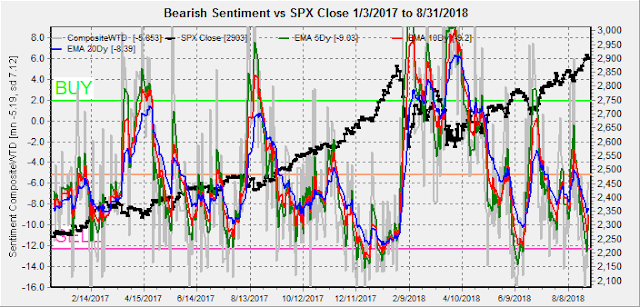

The overall Indicator Scoreboard (INT term, outlook two to four months) saw a sharp plunge in bearish sentiment early last week, but still above the levels seen before the Jan and June tops. More upside is likely.

The INT view of the Short Term Indicator (VXX $ volume and Smart Beta P/C, outlook two to four months) appears to be in a bottoming process that may not go much lower. Inconclusive.

Bond bearish sentiment (TNX) has been on the rise recently and I still think that the big surprise may be the TNX and Fed funds rates meeting at 2.5% if the economy slows. Recent strength in the GDP may be a result of "front running" higher tariff prices by foreign buyers.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment has continued to rise and is likely to support prices for now.

Taking an infrequent look at the small cap RUT INT sentiment using TZA/TNA, bearish sentiment remains low, but not extremely so. Limited gains likely.

II. Dumb Money/Smart Money Indicators

The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 days/hours) as a very ST indicator remains near the bottom of its TL, ahow optimism for techs vs the broad market is high.

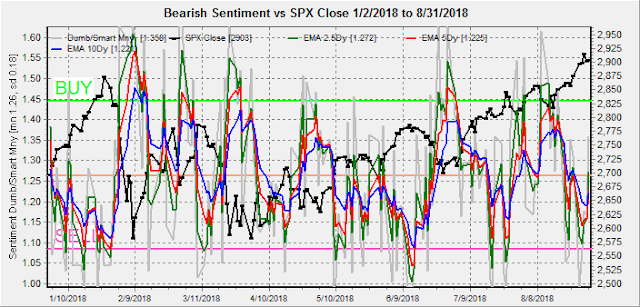

The option-based Dumb Money/Smart Money Indicator as short/INT term (outlook 2 to 4 days/weeks) gave a weak SELL mid-week, but the 1% pullback Thur/Fri may be it. The pattern the last two weeks still resembles that leading to the Jan top with choppy downward action.

The INT term SPX Long Term/Short Term ETFs (outlook two to four weeks) bearish sentiment has been driven lower by strong buying by the dumb money (2x) ETFs, but both indicator and ETFs are still a few weeks from the Jan extremes.

Long term neutral, the INT term NDX Long Term/Short Term ETF Indicator (outlook two to four weeks) remains the difficult to interpret as three upward trends in sentiment occurred since early 2017 with the first two marking tops at the current levels..

III. Options Open Interest / Other

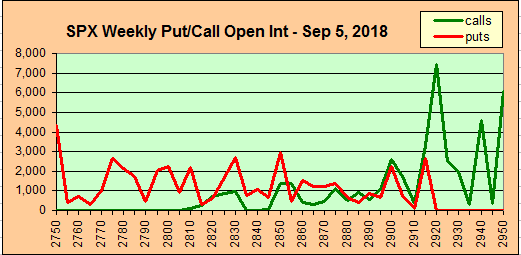

Using Thurs close, remember that further out time frames are more likely to change over time. This week I will look out thru Sept 7.

Last Fri showed a pickup in put support at SPX 2880 making a larger drop unlikely, while the close at 2900+ showed relative strength.

With Fri close at SPX 2902, Tue has very light resistance up to 2925 if the market rallies, while under 2900 the next support level is at 2895. A weak open is likely to rally. Light open int overall.

Wed shows strong call resistance at SPX 2925 with some put support up to 2915.

Fri, a jobs report day, shows larger open int with very strong call resistance from SPX 2925-35 and a positive week is likely going to be capped in that area. There is little put support to 2850, so there is a small probability of a large decline.

Conclusions. If the SPX continues to follow the 2014 analog Sept should be up week 1 to about 2925, down week 2 to about 2885, then up week 3 (opt exp) to 2935. Checking the historical data, mid-Sep 2014 saw a large pickup in VIX call volume near the top, so a similar pickup in volume this year would be a warning. Otherwise, there is still a possibility that the rally may continue until Nov when a possible blowup of the China trade talks and/or election loss by the GOP could derail the Trump agenda.

Weekly Trade Alert. Next week looks to be up with a target of SPX 2920-30 by Fri. Updates @mrktsignals.

Investment Diary, Indicator Primer, update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment