Last week I raised the prospect that there may only be a partial retest of the SPX lows at 2350 and that the low 2700s were likely to be seen first, and now we have the prospect of another "hope" rally as more trade talks are scheduled for the end of Jan. We did get a small pullback of about 2% as bearish sentiment indicated the possibility of an Apr 2018 type pullback and the NDX ETFs were giving a warning signal.

As posted on Twitter Wed, the Hedge Ratio (an options equivalent of a short interest ratio) moved back to the level of the previous Wed before the run over SPX 2600. I am not sure how many are still looking for a 2000-02 or 2008-09 bear market, but in the Technical / Other section this week, I will take a current look at the $SKEW and $NYUPV/$NYDNV that warned of the downturn in Oct (but not a LT bear market) as well as the Hedge Ratio update.

I. Sentiment Indicators

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment remains in a similar pattern to the May-Jun pullback of 2018.

The INT view of the Short Term Indicator (VXX+VXXB $ volume and Smart Beta P/C, outlook two to four months) bearish sentiment also remains in a similar pattern to the May-Jun pullback of 2018.

Bond sentiment (TNX) is still looking like the Jun-Sep 2018 period where a three month consolidation was seen before a sharp runup in rates.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment has been rising, and if the US $ continues to fall based on dovish outlook from the Fed, a rally in HUI is possible similar to Jul-Sep 2018 before a larger decline.

II. Dumb Money/Smart Money Indicators

The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 mns/wks) as a INT indicator continues to show high Risk Preference that may mean a weaker advance.

The option-based Dumb Money/Smart Money Indicator as INT term (outlook 2 to 4 mns/weeks) saw a fairly sharp move up in the Mon/Tue pullback to the SPX low 2600s, but has now moved back to neutral.

The INT term SPX Long Term/Short Term ETFs (outlook two to four weeks) bearish sentiment has finally started to fall below neutral with dumb money (2x) buying while smart money (3x) remains neutral. Continued decline would point to a pullback in weeks ahead.

Long term neutral, the INT term NDX Long Term/Short Term ETF Indicator (outlook two to four weeks) as the long cycle seems to follow prices, the short cycle has moved back down from a brief spike earlier in the week.

III. Options Open Interest

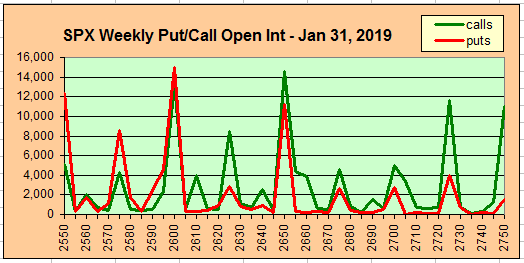

Using Thurs close, remember that further out time frames are more likely to change over time. This week I will look out thru Feb 1.

With Fri close at SPX 2665, Mon. Light open int overall. Put support is likely to keep prices over SPX 2640, and over 2650, call hedging could push prices toward 2700.

Wed is similar with put support at SPX 2640 and over 2650, decling resistance to 2750. Very light open int overall.

Thur, Jan 31, has large open int with SPX 2650 a major inflection point with support below at 2600 and 2625, and above minor resistance at 2675 and 2700 and major at 2725. With China trade talks thru EOM, this shows a "hope" rally potential to 2725+.

Fri, Feb 1 and jobs report, has large open int with SPX 2600 major support with call inflection pts at 2650 and 2700. SPX 2675 seems the most likely close if prices fall below 2700.

IV. Technical / Other

The sharp drop in the $SKEW starting in Oct was a warning of extreme complacency, but over the last month has rallied sharply, very similar to the rally off of the Apr 2018 retest lows. The big difference here is that the $SKEW levels remained high with last weeks pullback, indicating skepticism of the rally, unlike Apr-May 2018 and may limit ST losses.

The current $NYUPV/$NYDNV that also warned of a 10%+ pullback in Oct due to low $NYUPV then saw a huge move up the first two weeks of the rally from the Dec lows, but has since leveled off near the levels of 2015 Q1 and 2018 Q2 that makes me skeptical of some of the more bullish calls for SPX 3000+ in 2019.

The Hedge Ratio is now more closely tracking the options DM/SM indicator with a sharp spike early in the week supporting rally, and a close near neutral, but no indication of a pullback yet.

Conclusions. I should of warned about a pullback to the SPX 50 SMA before a possible move to the 100 SMA at 2720, but last Sat I was in a hurry preparing for the Artic blast. The next week could see the expected move over 2700, but there are few signs yet of any pullback. The SPX ETF DM/SM indicator may provide early warning. Now that Trump seems to have given up on the US/Mexico wall, the big question is whether he will do the same with trying to wall in China. The more I read, the more I think that trade is only a small part of the concern with China as expressed in this article where China is a symptom of the US losing its world dominance.

March still looms as an important inflection in time. If a trade agreement is reached with China that fixes the market and economy problems, would the Fed abort its current dovish outlook? Investors anxiety is likely to be high in Feb.

Weekly Trade Alert. There is a good chance of a tradeable top in SPX between 2720-40 in the next week or two. .Updates @mrktsignals.

Investment Diary,

Indicator Primer,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2019 SentimentSignals.blogspot.com

No comments:

Post a Comment