Jan 2018 rose 3% in the first week and 7.5% at the high for the month, but was then down 9% for the year at the Dec lows. Jan 2019 is starting out as much more volatile first dropping 2% into Thur then rallying to up 1% for the year at the Fri close. This year Jan may be a a better indicator as my overall outlook is continued volatility with an upward bias.

Fri rally was partly due to the monthly jobs report that showed a stronger than expected 312k jobs added with an increase of 3.2% annual wage increase, but the unemployment rate actually rose to 3.9%. The unusually warm winter may have much to do with the strong jobs number, especially in construction, as seasonality compares the actual increase to an average. The rise in unemployment may be more important to the Fed, discussed last week, for outlook to changes in fed funds policy and was forecasted Wed in the Twitter update using the St.Louis Fed Initial (Unemployment) Claims report.

The biggest reason for the rally was likely the more dovish stance by the Fed head Powell as he indicated that the "Powell put" may be in play if the markets continue to unravel. This still supports the outlook for a Mar retest as the banksters are likely to play "put up or shut up" going into the Mar FOMC.

Looking forward, the weak pullback in SPX (38% vs 62%) to 2450 may be more immediately bullish, but could point to a rally that lasts only into mid Jan before a retest of the lows by the end of EPS season late Feb if more stocks follow the lead of AAPL. This timing is also closer to the Jun-Sep 2017 time frame indicated by action in bonds and gold stocks shown below.

I. Sentiment Indicators

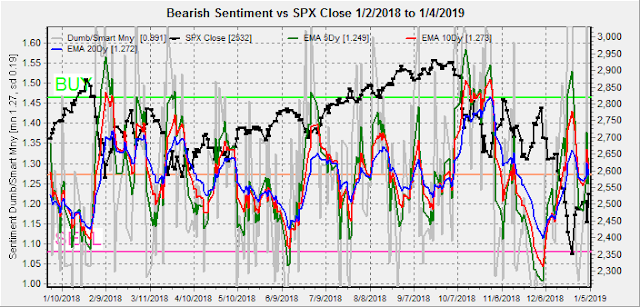

The overall Indicator Scoreboard (INT term, outlook two to four months) bearish sentiment continues near the BUY area similar to the Mar-Apr retest.

The INT view of the Short Term Indicator (VXX+VXXB $ volume and Smart Beta P/C, outlook two to four months) bearish sentiment has dropped from the extreme BUY area, but still higher than in the Mar-Apr retest and may be contributing to the stronger uptrend than expected.

Bond sentiment (TNX) has dropped to the strong SELL area that could be sitting up for a Jun-Sep 2017 type bottom, hinting that once current problems such as govt shutdown and China trade are resolved, a strong rise in rates may follow.

For the INT outlook with LT still negative, the gold miners (HUI) bearish sentiment has seemed to follow a close relationship with bonds while miners prices followed an inverse relationship with rates as the last high in Sep 2017 was the low for TNX rates. If rates do eventually rise strongly, a second bear leg down may follow for the miners.

II. Dumb Money/Smart Money Indicators

The Risk Aversion/Risk Preference Indicator (SPX 2x ETF sentiment/NDX ETF sentiment, outlook 2 to 4 mns/wks) as an INT indicator remains near neutral as the NDX is not expected to outperform as in early 2018 or under perform as in late 2018.

The option-based Dumb Money/Smart Money Indicator as INT term (outlook 2 to 4 mns/weeks) has fallen to neutral about the same level as the early Apr retest period.

The INT term SPX Long Term/Short Term ETFs (outlook two to four mns) bearish sentiment remains near neutral after being on a SELL for much of the second half of 2018 as the smart money (3x ETFs) has shown no interest in buying the current rally.

Smart money not buying it.

Long term neutral, the INT term NDX Long Term/Short Term ETF Indicator (outlook two to four mns) as the long cycle seems to follow prices, the short cycle is not showing any directionality.

III. Options Open Interest

Using Thurs close, remember that further out time frames are more likely to change over time. This week I will look out thru Jan 18, optn exp.

With Fri close at SPX 2532, Mon shows some put support at SPX 2500, but not much else until 2425 and call resistance at 2525 and then 2575. Light open int overall, but easy to see some volatility either way.

Wed is shows strong put support at SPX 2450 and below, 2500 could be a magnet with large puts and calls while there is little (net) resistance above 2525.

Fri, with large open int, looks more bearish with large call resistance at SPX 2510 and 2525 and moderate at 2550. Large put support at 2440 and 2450. A move below 2500 early in the week is likely to stay there, while above 2525 the calls can provide support.

Fri, optn exp, SPX (PM) looks bi-modal, where a move over SPX 2575 is likely to push up to 2600-25 and a move below 2525 should stop at 2500.

Looking at SPY, there is a positive bias due to large puts up to SPY 260 for a 260-92.5 target, but the large call position at 250 is also an inflection pt.

IV. Technical / Other

The $NYUPV/$NYDNV continues to follow a bullish configuration, having already reached the levels of the Mar-Apr retest, may possibly follow the more bullish Aug 2015 pattern.

Currently, the 4 hr SPX appears to be in a LD or ED diagonal while below 2540, and with 2480 as ST support. A break above SPX 2540 is likely to reach 2600-50 by mid Jan, optn exp.

Conclusions. Overall options open int show what you would expect in an event driven market, where positive China trade news etc could drive the SPX to 2600-25 by optn exp, but no news is likely to keep prices around 2500. Normal sentiment measures remain positive, but the SPX ETF indicator is still showing weak buying by the smart money. The APPL warning Wed nite could be a precursor of other companies earnings guidance. If so, the rally may sputter mid Jan (SPX 2600-25) and fade thru earnings season with a retest low late Feb. Bonds (TNX) and the gold miners are showing similar sentiment to mid-2017 that provided a major low for int rates and a major high for gold stocks.

Weekly Trade Alert. A break above SPX 2540 is likely the start of a move to 2600-25, while a break below 2480 could lead to the low 2400s. Updates @mrktsignals.

Investment Diary,

Indicator Primer,

update 2018.03.28 Dumb Money/Smart Money Indicators

Article Index 2018 by Topic

Article Index 2017 by Topic

Article Index 2016 by Topic

Long term forecasts

© 2018 SentimentSignals.blogspot.com

No comments:

Post a Comment